SkyWest Airlines 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

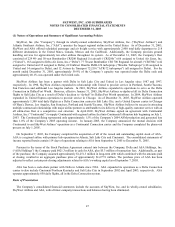

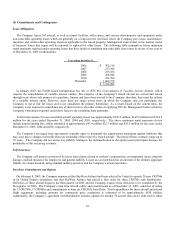

Property and Equipment

Property and equipment are stated at cost and depreciated over their useful lives to their estimated residual values using the

straight-line method as follows:

Depreciable Residual

Assets Life Value

Aircraft and rotable spares 10-18 years 0-30%

Ground equipment 5-7 years 0%

Office equipment 5-7 years 0%

Leasehold improvements 15 years 0%

Buildings 20-39.5 years 0%

Impairment of Long Lived and Intangible Assets

As of December 31, 2005, we had approximately $2.6 billion of property and equipment and related assets. Additionally, as of

December 31, 2005, we had approximately $33.0 million in intangible assets. In accounting for these long-lived and intangible

assets, we make estimates about the expected useful lives of the assets, the expected residual values of certain of these assets, and

the potential for impairment based on the fair value of the assets and the cash flows they generate. We recorded an intangible

asset of approximately $33.0 million relating to the acquisition of ASA. The intangible is being amortized over fifteen years

under the strait-line method. As of December 31, 2005, we had recorded $718,000 in amortization expense. Factors indicating

potential impairment include, but are not limited to, significant decreases in the market value of the long-lived assets, a significant

change in the condition of the long-lived assets and operating cash flow losses associated with the use of the long-lived assets.

On a periodic basis, we evaluate whether the book value of our aircraft is impaired in accordance with SFAS No. 144,

“Accounting for the Impairment or Disposal of Long-Lived Assets.” Based on the results of the evaluations, our management

concluded no impairment was necessary as of December 31, 2005. However, there is inherent risk in estimating the future cash

flows used in the impairment test. If cash flows do not materialize as estimated, there is a risk the impairment charges recognized

to date may be inaccurate, or further impairment charges may be necessary in the future.

Reclassifications

Certain reclassifications have been made to the December 31, 2004 and 2003 consolidated financial statements to conform to

the current year presentation.

Capitalized Interest

Interest is capitalized on aircraft purchase deposits and long-term construction projects and is depreciated over the estimated

useful life of the asset. During the years ended December 31, 2005, 2004 and 2003, the Company capitalized interest costs of

approximately $2,833,000, $3,397,000, and $5,084,000, respectively.

Maintenance

The Company operates under an FAA-approved continuous inspection and maintenance program. The Company uses the

direct expense method of accounting for its regional jet engine overhauls where the expense is recorded when the overhaul event

occurs. In 2004, the Company entered into an engine services agreement with a third party vendor to provide long-term engine

services covering the scheduled and unscheduled repairs for engines certain of its CRJ700 regional jet aircraft. Under the terms

of the agreement, the Company pays a set dollar amount per engine hour flown on a monthly basis and the third party vendor will

assume the responsibility to repair the engines at no additional cost to the Company, subject to certain specified exclusions.

Maintenance costs under these contracts are recognized when a contractual obligation exists. The Company uses the “deferral

method” of accounting for its Brasilia turboprop engine overhauls where the overhaul costs are capitalized and depreciated over

the estimated useful life of the engine. The costs of maintenance for airframe and avionics components, landing gear and normal

recurring maintenance are expensed as incurred. For leased aircraft, the Company is subject to lease return provisions that require

a minimum portion of the “life” of an overhaul be remaining on the engine at the lease return date. For Brasilia turboprop engine