SkyWest Airlines 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

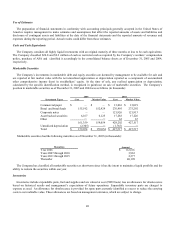

54

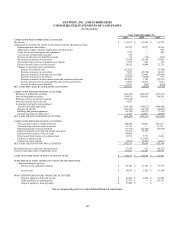

literature. This requirement will reduce net operating cash flows and increase net financing cash flows in periods after adoption.

While we cannot estimate what those amounts will be in the future (primarily because they depend on, among other things, when

employees exercise stock options), the amount of operating cash flows recognized in prior periods for such excess tax deductions

were $7,509,000, $442,000 and $129,000 in 2005, 2004, and 2003, respectively.

(2) Acquisition of ASA

On September 7, 2005, the Company completed the acquisition of all of the issued and outstanding capital stock of ASA.

ASA is a regional airline with primary hub operations in Atlanta, Salt Lake City and Cincinnati. The consolidated statements of

income reported herein contain 114 days of operations relating to ASA from September 8, 2005 to December 31, 2005.

Pursuant to the terms of the Stock Purchase Agreement entered into between the Company, Delta and ASA Holdings, Inc.

(“ASA Holdings”) the Company paid $421.3 million in cash for ASA, plus $5.3 million of transaction fees. Additionally, as part

of the purchase, the Company assumed approximately $1,251.3 million in long-term debt which combined with the amounts paid

at closing, resulted in an aggregate purchase price of approximately $1,677.9 million. The purchase price of ASA has been

adjusted to reflect certain post-closing adjustments related to ASA’s working capital as of September 7, 2005.

In connection with the acquisition of ASA, SkyWest Airlines and Delta entered into an Amended and Restated Delta

Connection Agreement and ASA and Delta entered into a Second Amended and Restated Delta Connection Agreement whereby

SkyWest Airlines and ASA agreed to provide regional airline service in the Delta flight system (See Note 1). Among

other provisions, the Delta Connection Agreements provide for the transfer of certain ownership and lease rights among SkyWest

Airlines, ASA, Delta and Comair Inc., a wholly-owned subsidiary of Delta ("Comair"). Prior to December 31, 2005, SkyWest

Airlines, ASA, Delta and/or Comair, as applicable, terminated two master sublease agreements with respect to ten Bombardier

CRJ200s and transferred to Delta ten CRJ200s financed in part by an affiliate of Bombardier, and ASA and Delta entered into a

sublease agreement whereby ASA is subleasing the ten CRJ200s from Delta.

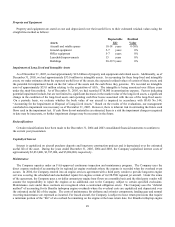

The acquisition value of ASA was accounted for using the purchase method of accounting. Accordingly, the aggregate

purchase price was assigned to the assets acquired and liabilities assumed based on fair market values at the respective purchase

date. The following table reflects the allocation of the aggregate purchase (including the attribution of ASA liabilities to the

purchase price, since those liabilities remained the obligation of ASA post-closing) to the aggregate assets acquired and liabilities

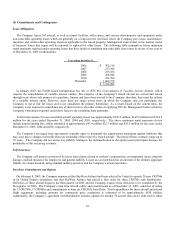

assumed (in thousands):

Current assets, net $ 154,057

Property, plant and equipment 1,548,854

Intangible assets 33,762

Other non-current assets 31,937

Current liabilities (312,748)

Long-term liabilities (1,029,299)

Total consideration $ 426,563

Less cash acquired (54,651)

Net cash paid $ 371,912

The Company is currently in the process of completing the final purchase price allocation based on the results of a valuation

performed by a third party valuation advisor and any final purchase adjustment are not expected to be material to the consolidated

financial statements. The intangible assets value of $33.8 million represents the value assigned to the Delta Connection

Agreement between ASA and Delta, which was signed in conjunction with the acquisition of ASA and is based on the valuation

performed by the third-party valuation advisor and will be amortized over the 15-year life of the contract.

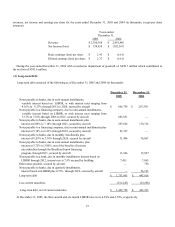

The following table illustrates the pro forma effects of the acquisition of ASA and sets forth the unaudited pro forma combined