SkyWest Airlines 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

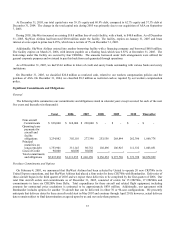

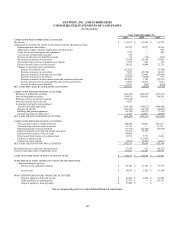

At December 31, 2005, our total capital mix was 39.1% equity and 60.9% debt, compared to 62.7% equity and 37.3% debt at

December 31, 2004. The change in the total capital mix during 2005 was primarily due to our acquisition of ASA on September

7, 2005.

During 2005, SkyWest increased an existing $10.0 million line-of-credit facility, with a bank, to $40.0 million. As of December

31, 2005, SkyWest Airlines had borrowed $30.0 million under the facility. The facility, expires on January 31, 2007 and bears

interest at a rate equal to prime less 0.25%, which was a net rate of 7% on December 31, 2005.

Additionally, SkyWest Airlines entered into another borrowing facility with a financing company and borrowed $60.0 million.

The facility expires on March 21, 2006, with interest payable on a floating basis which was 6.87% at December 31, 2005. The

borrowings under this facility are secured by four CRJ200s. The amounts borrowed under both arrangements were utilized for

general corporate purposes and we intend to pay this back from cash generated through operations.

As of December 31, 2005, we had $34.6 million in letters of credit and surety bonds outstanding with various banks and surety

institutions.

On December 31, 2005, we classified $24.8 million as restricted cash, related to our workers compensation policies and the

purchase of ASA. On December 31, 2004, we classified $9.2 million as restricted cash as required by our workers compensation

policy.

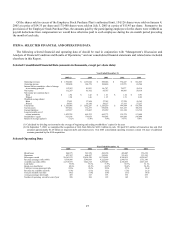

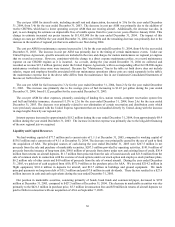

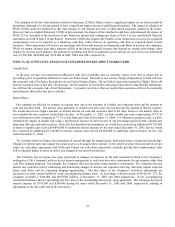

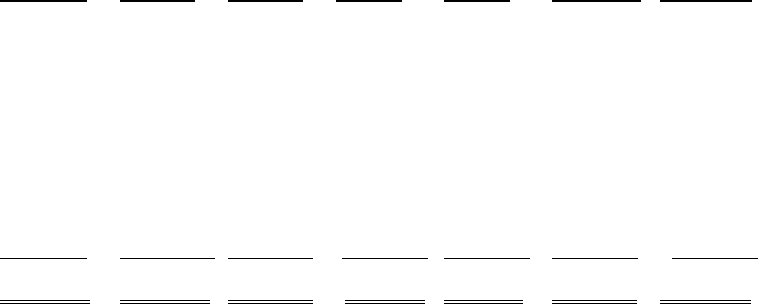

Significant Commitments and Obligations

General

The following table summarizes our commitments and obligations stated in calendar years except as noted for each of the next

five years and thereafter (in thousands):

Total

2006

2007

2008

2009

2010

Thereafter

Firm aircraft

Commitments $ 838,000 $ 618,000 $ 220,000 $ - $ - $ - $ -

Operating lease

payments for

aircraft and

facility

obligations 3,234,082 302,110 277,398 253,556 268,844 262,396 1,869,778

Principal

maturities on

long-term debt 1,753,901 331,145 98,752 102,696 106,925 111,332 1,003,051

Lines of Credit 90,000 60,000 30,000 - - - -

Total commitments

and obligations $5,915,983 $1,311,255 $ 626,150 $ 356,252 $ 375,769 $ 373,728 $ 2,872,829

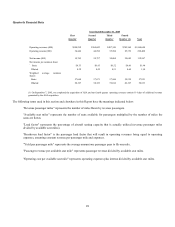

Purchase Commitments and Options

On February 4, 2005, we announced that SkyWest Airlines had been selected by United to operate 20 new CRJ700s in its

United Express operations, and that SkyWest Airlines had placed a firm order for these CRJ700s with Bombardier. Deliveries of

these aircraft began in the third quarter of 2005 and we expect these deliveries to be completed by the first quarter of 2006. Our

total firm aircraft orders and commitments as of December 31, 2005, consisted of orders for 15 CRJ700s, 17 CRJ900s and

commitments to lease six CRJ200's from Delta. Total expenditures for these aircraft and related flight equipment, including

amounts for contractual price escalations is estimated to be approximately $838 million. Additionally, our agreement with

Bombardier includes options for another 70 aircraft that can be delivered in either 70 or 90-seat configurations. We presently

anticipate that delivery dates for these aircraft could start in May 2007 and continue through April 2010; however, actual delivery

dates remain subject to final determination as agreed upon by us and our code-share partners.