SkyWest Airlines 2005 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2005 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.15

Although a plan of reorganization has been confirmed in the United bankruptcy proceedings, which became effective on

February 1, 2006 (subject to pending appeals), and Delta reports that it intends to reorganize and emerge from its bankruptcy

proceedings, there is no assurance that either of United or Delta will ultimately succeed in its reorganization efforts or that either

Delta or United will remain a going concern over the long term. Likewise, even though both Delta and United have assumed our

code-share agreements with bankruptcy court approval, there is no assurance that these agreements will survive the Chapter 11

cases. For example, the Delta reorganization could be converted to a liquidation, or Delta could liquidate some or all of its assets

through one or more transactions with one or more third parties with bankruptcy court approval. In addition, Delta may not be

able to confirm and consummate a successful plan of reorganization that provides for continued performance of its obligations

under its code-share agreements with us. In the event United is not able to perform successfully under the terms of its plan of

reorganization, assumption of our United Express Agreement could be subjected to similar risks.

Other aspects of the Delta and United bankruptcies and reorganizations pose additional risks to our code-share agreements.

Delta may not be able to obtain bankruptcy court approval of various motions necessary for it to administer its bankruptcy case.

As a consequence, Delta may not be able to maintain normal commercial terms with vendors and service providers, including

other code-share partners, that are critical to its operations. Delta also may be unable to reach satisfactory resolutions of disputes

arising out of collective bargaining agreements or to obtain sufficient financing to fund its business while it reorganizes. These

and other factors not identified here could delay the resolution of the Delta bankruptcy and reorganization significantly and could

threaten Delta’s operations. As to United, even though a plan of reorganization has been confirmed in the United bankruptcy

proceedings, the order of confirmation is subject to pending appeals, and there is no assurance that United will be able to operate

successfully under the terms of its confirmed plan.

In light of the importance of our code-share agreements with Delta and United to our business, the termination of these

agreements or the failure of Delta to ultimately emerge from its bankruptcy proceeding could jeopardize our operations. Such

events could leave us unable to operate much of our current aircraft fleet and the additional aircraft we are obligated to purchase.

As a result, they could have a material adverse effect on our operations and financial condition.

Even though United has emerged from bankruptcy proceedings and if Delta is ultimately able to emerge from its bankruptcy

proceedings, their respective financial positions will continue to pose risks for our operations. Serial bankruptcies are not

unprecedented in the commercial airline industry, and Delta and/or United could file for bankruptcy again after emergence from

Chapter 11, in which case our code-share agreements could be subject to termination under the U.S. Bankruptcy Code.

Regardless of whether subsequent bankruptcy filings prove to be necessary, Delta and United have required, and will likely

continue to require, our participation in efforts to reduce costs and improve their respective financial positions. These efforts

could result in lower utilization rates of our aircraft, lower departure rates on the contract flying portion of our business, and more

volatile operating margins. We believe that any of these developments could have a negative effect on many aspects of our

operations and financial performance.

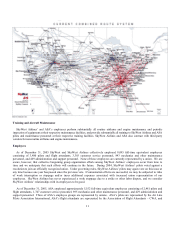

We may not achieve the potential benefits of the ASA acquisition.

Our achievement of the potential benefits of the ASA acquisition will depend, in substantial part, on our ability to

successfully implement our business strategy, including improving the utilization of equipment and facilities, increasing

employee productivity and allocating overhead and administrative expenses over a larger platform. We will be unable to achieve

the potential benefits of the ASA acquisition unless we are able to efficiently integrate the SkyWest Airlines and ASA operating

platforms in a timely manner. The integration of SkyWest Airlines and ASA may be costly, complex and time-consuming, and

the managements of SkyWest Airlines and ASA will have to devote substantial effort to such integration. If we are not able to

successfully achieve these objectives, the potential benefits of the ASA acquisition may not be realized fully or at all, or it may

take longer to realize than expected. In addition, assumptions underlying estimates of expected cost savings and expected

revenues may be inaccurate, or general industry and business conditions may deteriorate. Our combined operations with ASA

may experience increased competition that limits our ability to expand our business. We cannot assure you that the ASA

acquisition will result in combined results of operations and financial condition consistent with our expectations or superior to

what we and ASA could have achieved independently. Nor do we represent to you that any estimates or projections we have

developed or presented in connection with the ASA acquisition can or will be achieved.