SkyWest Airlines 2005 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2005 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.18

attention and disrupt operations, which may result in increased operating expenses and lower net income. Moreover, we cannot

predict the outcome of any future negotiations relating to union representation or collective bargaining agreements. Agreements

reached in collective bargaining may increase operating expenses and lower operating results and net income. If unionizing

efforts among SkyWest Airlines’ employees are successful, we may be subjected to risks of work interruption or stoppage and/or

incur additional administrative expenses associated with union representation.

If we are unable to reach labor agreements with any current or future unionized work groups, we may be subject to work

interruptions or stoppages, which may adversely affect our ability to conduct our operations and may even allow Delta or United

to terminate their respective code-share agreements.

We may be unable to obtain all of the aircraft, engines, parts or related maintenance and support services we require,

which could have a material adverse impact on our business.

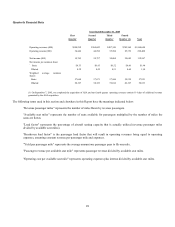

We rely on a limited number of aircraft types, and are dependent on Bombardier as the sole manufacturer of our regional jets.

For the quarter ended December 31, 2005, 62.0% of our available seat miles were flown using CRJ200s, 31.0% of our available

seat miles were flown using CRJ700s, 5.0% of our available seat miles were flown using Brasilia turboprops and 2.0% of our

available seat miles were flown using ATR-72 turboprops. As of December 31, 2005, we had commitments of approximately

$838 million to purchase 15 CRJ700s and 17 CRJ900s and to lease six CRJ200's, together with related flight equipment.

Additionally, we had obtained options to acquire another 70 regional jets that can be delivered in either 70 or 90-seat

configurations. Delivery dates for these aircraft remain subject to final determination as agreed upon by us and our major

partners.

Any significant disruption or delay in the expected delivery schedule of our fleet would adversely affect our business strategy

and overall operations and could have a material adverse impact on our operating results or our financial condition. Certain of

Bombardier’s aerospace workers are represented by unions and have participated in at least one strike in recent history. Any

future prolonged strike at Bombardier or delay in Bombardier’s production schedule as a result of labor matters could disrupt the

delivery of regional jets to us, which could adversely affect our planned fleet growth. We are also dependent on General Electric

as the manufacturer of our aircraft engines. General Electric also provides parts, repair and overhaul services, and other types of

support services on our engines. Our operations could be materially and adversely affected by the failure or inability of

Bombardier or General Electric to provide sufficient parts or related maintenance and support services to us on a timely or

economical basis, or the interruption of our flight operations as a result of unscheduled or unanticipated maintenance

requirements for our aircraft or engines. In addition, the issuance of FAA directives restricting or prohibiting the use of

Bombardier aircraft types we operate would have a material adverse effect on our business and operations.

Maintenance costs will likely increase as the age of our regional jet fleet increases.

Because the average age of our CRJ700s and CRJ200s is approximately 1.4 and 4.2 years, respectively, our regional jet fleet

requires less maintenance now than it will in the future. We have incurred relatively low maintenance expenses on our regional

jet fleet because most of the parts on our regional jet aircraft are under multi-year warranties and a limited number of heavy

airframe checks and engine overhauls have occurred. Our maintenance costs will increase significantly, both on an absolute basis

and as a percentage of our operating expenses, as our fleet ages and these warranties expire. Under our United Express

Agreement, specific amounts are included in the rates for future maintenance on CRJ200 engines used in our United Express

operations. The actual cost of maintenance on CRJ200 engines may vary from the estimated rates.

If we incur problems with any of our third-party service providers, our operations could be adversely affected.

Our reliance upon others to provide essential services on behalf of our operations may limit our ability to control the

efficiency and timeliness of contract services. We have entered into agreements with contractors to provide various facilities and

services required for our operations, including fuel supply and delivery, aircraft maintenance, services and ground facilities, and

expect to enter into additional similar agreements in the future. These agreements are subject to termination after notice. Any

material problems with the efficiency and timeliness of our automated or contract services could have a material adverse effect on

our business, financial condition and results of operations.