SkyWest Airlines 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.30

Historically, multiple contractual relationships have enabled us to reduce reliance on any single major airline code and to

enhance and stabilize operating results through a mix of our controlled or “pro-rate” flying and contract flying. On contract

routes, the major airline partner controls scheduling, ticketing, pricing and seat inventories and we are compensated by the major

airline partner at contracted rates based on the completed block hours, flight departures and other operating measures. On pro-

rate flights, we control scheduling, ticketing, pricing and seat inventories and receive a pro-rated portion of passenger fares. Since

August 1, 2003, substantially all of our flights have been contract flights. For the year ended December 31, 2005, essentially all

of our Brasilia turboprops flown for Delta were flown under pro-rate arrangements while approximately 92% of our Brasilia

turboprops flown in the United system were flown under contractual arrangements, with the remaining nine percent flown under

pro-rate arrangements.

In September 2005, Delta filed for reorganization under Chapter 11 of the U.S. Bankruptcy Code. Prior to the date of Delta’s

bankruptcy filing, each of SkyWest Airlines and ASA entered into an amended Delta Connection Agreement which provides for a

15-year term, subject to certain termination and extension rights. Delta received all necessary approvals from the U.S.

Bankruptcy Court and the Delta Connection Agreements were assumed by Delta on October 6, 2005. Under the terms of its Delta

Connection Agreement, SkyWest Airlines is compensated primarily on a fee-per-completed-block hour and departure basis, is

reimbursed for fuel and other direct costs, and is paid a margin based on completed block hours. Under its Delta Connection

Agreement, ASA is compensated primarily on a fee-per-completed-block-hour basis, is directly reimbursed for fuel and other

costs, and is paid a margin based on performance incentives. Notwithstanding the assumption by Delta of the Delta Connection

Agreements, Delta’s bankruptcy filing could still lead to many other unforeseen expenses, risks and uncertainties for SkyWest

Airlines, ASA or both.

Although Delta has reported that it intends to reorganize and emerge from its ongoing Chapter 11 bankruptcy proceeding, it

could convert its reorganization proceeding to a liquidation proceeding under the U.S. Bankruptcy Code or liquidate some or all

of its assets through one or more transactions with third parties. Such events could jeopardize our Delta Connection operations,

leave us unable to efficiently utilize the additional aircraft which we are currently obligated to purchase, or result in other

outcomes which could have a material adverse effect on our operating results or financial condition.

Although a plan of reorganization has been confirmed in United’s bankruptcy proceedings, which became effective on

February 1, 2006 (subject to pending appeals), there is no assurance that United’s plan will ultimately succeed. Among other

uncertainties, United’s order of confirmation is subject to pending appeals. There is no assurance that United will be able to

operate successfully under the terms of its plan. In the event United is not able to perform successfully under the terms of its

plan, our United Express operations could be jeopardized, which could have a material adverse effect on our operating results or

financial condition.

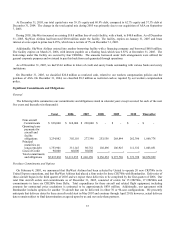

On February 4, 2005, we announced that SkyWest had been selected by United to operate 20 new CRJ700s in its United

Express operations, and that SkyWest had placed a firm order for these CRJ700s with Bombardier. Deliveries of these aircraft

began in the third quarter of 2005 and we expect these deliveries to be completed by the first quarter of 2006. Our total firm

aircraft orders and commitments, as of December 31, 2005, consisted of orders for 15 CRJ700s, 17 CRJ900s and commitments to

lease six CRJ200's from Delta. Total expenditures for these aircraft and related flight equipment, including amounts for

contractual price escalations is estimated to be approximately $838 million through April 2007. Additionally, our agreement with

Bombardier includes options for another 70 aircraft that can be delivered in either 70 or 90-seat configurations. We presently

anticipate that delivery dates for these aircraft could start in January 2007 and continue through April 2010; however, actual

delivery dates remain subject to final determination as agreed upon by us and our code-share partners.

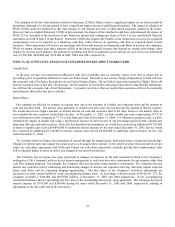

Critical Accounting Policies

Our significant accounting policies are summarized in Note 1 to our consolidated financial statements for the year ended

December 31, 2005, included in Item 8 of this Report. Critical accounting policies are those policies that are most important to the

preparation of our consolidated financial statements and require management’s subjective and complex judgments due to the need to

make estimates about the effect of matters that are inherently uncertain. Our critical accounting policies relate to revenue recognition,

aircraft maintenance, aircraft leases and impairment of long-lived assets and intangibles as discussed below. The application of these

accounting policies involves the exercise of judgment and the use of assumptions as to future uncertainties and, as a result, actual

results will differ, and could differ materially from such estimates.