SkyWest Airlines 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

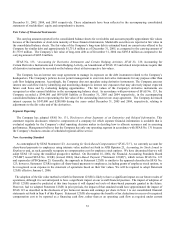

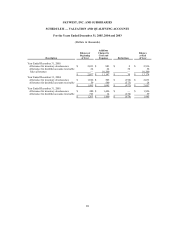

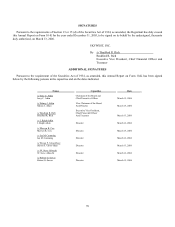

The following table summarizes information about stock options outstanding at December 31, 2005:

Options Outstanding Options Exercisable

Range of

Exercise

Prices

Number

Outstanding

Weighted Average

Remaining

Contractual Life

Weighted Average

Exercise Price

Number

Exercisable

Weighted Average

Exercise Price

$10 to $15 1,463,176 6.1 years $ 11.18 415,000 $ 12.67

$16 to $21 3,412,440 8.1 years 18.24 525,000 20.13

$22 to $27 1,425,386 5.8 years 26.10 1,425,386 26.10

$10 to $27 6,301,002 7.1 years 18.38 2,365,386 22.42

(7) Retirement Plan and Employee Stock Purchase Plan

SkyWest Retirement Plan

The Company sponsors the SkyWest, Inc. Employees’ Retirement Plan (the “SkyWest Plan”). Employees who have completed

90 days of service and are 18 years of age are eligible for participation in the SkyWest Plan. Employees may elect to make

contributions to the SkyWest Plan. The Company matches 100% of such contributions up to 2%, 4% or 6% of the individual

participant’s compensation, based upon length of service. Additionally, a discretionary contribution may be made by the

Company. The Company’s combined contributions to the SkyWest Plan were $10.5 million, $9.7 million and $7.8 million for the

years ended December 31, 2005, 2004 and 2003, respectively.

ASA Retirement Plan

ASA sponsors the Atlantic Southeast Airlines, Inc. Investment Savings Plan (“ASA Plan”). Employees who have completed

90 days of service and are 18 years of age are eligible for participation in the ASA Plan. Employees may elect to make

contributions to the ASA Plan however, ASA limits the amount of company match of up to 6% of their compensation.

Additionally, ASA matches the individual participant’s contributions from 20% to 75%, based on length of service. Since ASA

makes company matching contributions on an annual basis, no contributions were made for the period from date of acquisition

through December 31, 2005. Additionally, participants are 100% vested in their elective deferrals and rollover amounts and from

10% to 100% in company matching contributions based on length of service.

Employee Stock Purchase Plan

In February 1996, the Company’s Board of Directors approved the SkyWest, Inc. 1995 Employee Stock Purchase Plan (the

“Stock Purchase Plan”). All employees who have completed 90 days of employment are eligible to participate, except employees

who own five percent or more of the Company’s common stock. The Stock Purchase Plan enables employees to purchase shares

of the Company’s common stock at a 15% discount, through payroll deductions. Employees can contribute up to 15% of their

base pay, not to exceed $21,250 each calendar year, for the purchase of shares. Shares are purchased semi-annually at the lower

of the beginning or the end of the period price. Employees can terminate their participation in the Stock Purchase Plan at anytime

upon written notice.

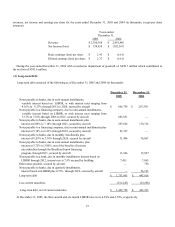

The following table summarizes purchases made under the Employee Stock Purchase Plan:

Year Ended December 31,

2005 2004 2003

Number of share purchased 175,480 343,136 324,680

Average price of shares purchased $ 15.45 $ 14.57 $ 13.24

During the year ended December 31, 2005, the Company discovered that it had issued 329,606 more shares of common stock

than originally authorized to certain of its employees participating in its Employee Stock Purchase Plan. Of the shares sold in

excess of the Employee Stock Purchase Plan’s authorized limit, 154,126 shares were sold on January 4, 2005 at a price of $14.35

per share and 175,480 shares were sold on July 5, 2005 at a price of $15.45 per share. Because the shares that exceed the original

authorized shares were not deemed to be qualified under the Stock Purchase Plan, the intrinsic value of these share on the

purchase date was recorded as compensation expense.