Sharp 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 SHARP CORPORATION

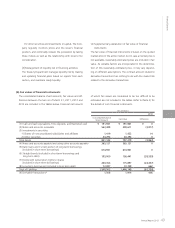

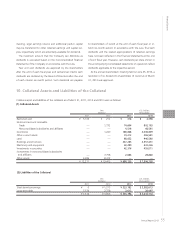

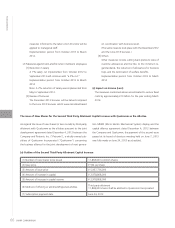

As of March 31, 2013, a part of the above-mentioned collat-

eral assets is pledged as collateral of ¥50,000 million ($537,634

thousand), which was not provided, out of maximum ¥180,000

million ($1,935,484 thousand) of uncommitted credit facility un-

der loan contract of September 27, 2012.

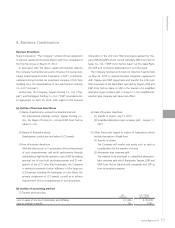

In relation to TFT-LCD business, the Company and some of

its subsidiaries are currently subject to the investigations being

conducted by the Directorate General for Competition of the

European Commission etc., and civil lawsuits seeking monetary

damages resulting from the alleged anticompetitive behavior

have been filed against the Company and some of its subsidiar-

In addition, ¥7,798 million and ¥2,684 million ($28,860 thou-

sand) investments in nonconsolidated subsidiaries and affiliates

for the years ended March 31, 2012 and 2013, respectively, are

pledged as collateral of ¥20,117 and ¥20,393 million ($219,280

thousand) long-term borrowings of affiliates.

ies in North America and Europe. The Company received a cease

and desist order and an administrative surcharge payment order

from the Japan Fair Trade Commission. However, the Company

has submitted a complaint to the Japan Fair Trade Commission,

which is currently pending.

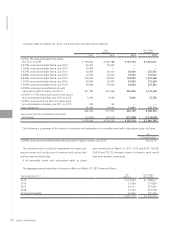

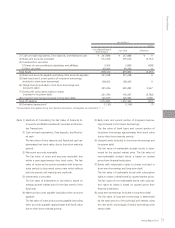

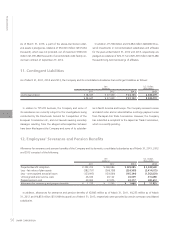

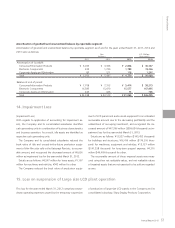

As of March 31, 2011, 2012 and 2013, the Company and its consolidated subsidiaries had contingent liabilities as follows:

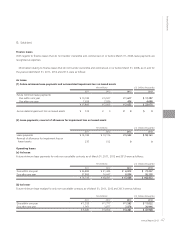

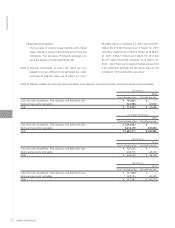

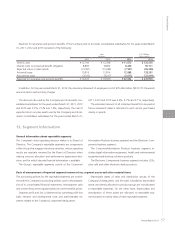

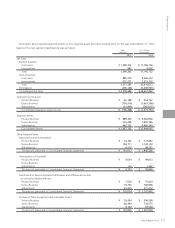

Allowance for severance and pension benefits of the Company and its domestic consolidated subsidiaries as of March 31, 2011, 2012

and 2013 consisted of the following:

In addition, allowances for severance and pension benefits of ¥2,845 million as of March 31, 2011, ¥4,235 million as of March

31, 2012 and ¥4,833 million ($51,968 thousand) as of March 31, 2013, respectively were provided by certain overseas consolidated

subsidiaries.

11. Contingent Liabilities

12. Employees’ Severance and Pension Benefits

Yen

(millions)

U.S. Dollars

(thousands)

2011 2012 2013 2013

Loans guaranteed ¥ 28,647 ¥ 27,349 ¥ 23,103 $ 248,419

¥ 28,647 ¥ 27,349 ¥ 23,103 $ 248,419

Yen

(millions)

U.S. Dollars

(thousands)

2011 2012 2013 2013

Projected benefit obligation ¥ 353,413 ¥ 348,986 ¥ 329,085 $ 3,538,548

Less - fair value of plan assets (282,757) (268,758) (224,509) (2,414,075)

Less - unrecognized actuarial losses (123,995) (129,560) (145,344) (1,562,839)

Unrecognized prior service costs 26,049 23,122 20,059 215,688

Prepaid pension cost 29,063 27,975 22,377 240,613

Allowance for severance and pension benefits ¥ 1,773 ¥ 1,765 ¥ 1,668 $ 17,935

Financial Section