Sharp 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 SHARP CORPORATION

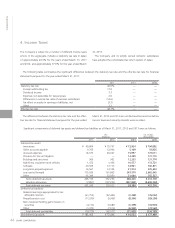

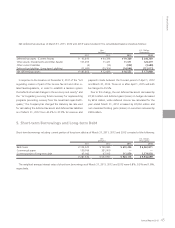

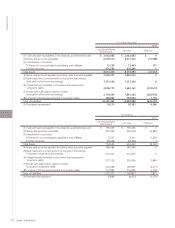

vide an allowance for severance and pension benefits based on

the estimated amounts of projected benefit obligation and the

fair value of plan assets at the balance sheet date. Projected ben-

efit obligation and expenses for severance and pension benefits

are determined based on the amounts actuarially calculated us-

ing certain assumptions.

Prior service costs are amortized using the straight-line meth-

od over the average of the estimated remaining service years

(16 years) commencing with the current period. Actuarial gains

and losses are primarily amortized using the straight-line method

over the average of the estimated remaining service years (16

years) commencing with the following period.

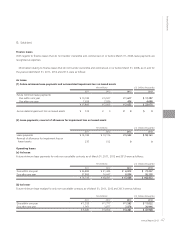

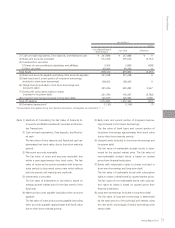

(l) Research and development expenses

Research and development expenses are charged to income as

incurred. The research and development expenses charged to

income amounted to ¥173,983 million, ¥154,798 million and

¥137,936 million ($1,483,183 thousand) for the years ended

March 31, 2011, 2012 and 2013 respectively.

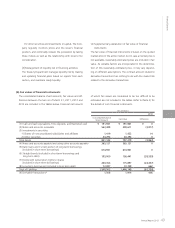

(m) Derivative financial instruments

The Company and some of its consolidated subsidiaries use

derivative financial instruments, including foreign exchange

forward contracts in order to hedge the risk of fluctuations in

foreign currency exchange rates associated with assets and li-

abilities denominated in foreign currencies.

All derivative financial instruments are stated at fair value and

recorded on the balance sheets. The deferred method is used

for recognizing gains or losses on hedging instruments and the

hedged items. When foreign exchange forward contracts meet

certain conditions, the hedged items are stated at the forward

exchange contract rates.

Derivative financial instruments are used based on internal

policies and procedures on risk control. The risks of fluctuations

in foreign currency exchange rates have been assumed to be

completely hedged over the period of hedging contracts as the

major conditions of the hedging instruments and the hedged

items are consistent. Accordingly, an evaluation of the effective-

ness of the hedging contracts is not required.

The credit risk of such derivatives is assessed as being low be-

cause the counter-parties of these transactions have good credit

ratings with financial institutions.

(n) Method and Period for Amortization of Goodwill

Goodwill for which the effective term is possible to be estimated

is amortized evenly over the estimated terms, while the other is

amortized evenly over 5 years. However, if the amount is minor,

the entire amount is amortized during the period of occurrence.

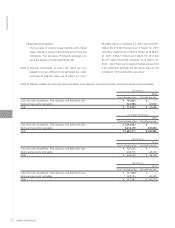

(o) Changes in accounting policies that are difficult to

distinguish from changes in accounting estimates

In accordance with the amendment of the Corporation Tax Law,

effective from the year ended March 31, 2013, the Company

and its domestic consolidated subsidiaries have changed the de-

preciation method for plant and equipment acquired on or after

April 1, 2012.

This change had an immaterial impact on financial statements.

(p) Reclassifications

Certain account balances in the financial statements and ac-

companying footnotes for the years ended March 31, 2011 and

2012 have been reclassified to made to conform to the presen-

tation for the fiscal year ended March 31, 2013.

Financial Section