Sharp 2013 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2013 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 SHARP CORPORATION

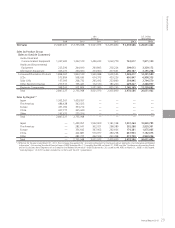

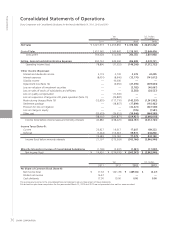

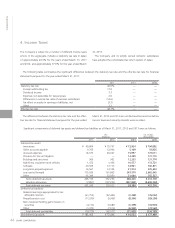

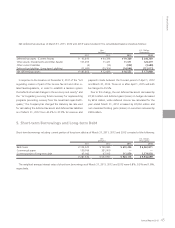

Consolidated Statements of Operations

Sharp Corporation and Consolidated Subsidiaries for the Years Ended March 31, 2011, 2012 and 2013

Yen

(millions)

U.S. Dollars

(thousands)

2011 2012 2013 2013

Net Sales ¥ 3,021,973 ¥ 2,455,850 ¥ 2,478,586 $ 26,651,462

Cost of Sales 2,452,345 2,043,842 2,218,003 23,849,494

Gross profit 569,628 412,008 260,583 2,801,968

Selling, General and Administrative Expenses 490,732 449,560 406,849 4,374,721

Operating income (loss) 78,896 (37,552) (146,266) (1,572,753)

Other Income (Expenses):

Interest and dividends income 3,119 2,730 2,278 24,495

Interest expenses (8,001) (8,646) (13,170) (141,613)

Subsidy income — 10,000 — —

Impairment loss (Note 14) — (6,656) (47,396) (509,634)

Loss on valuation of investment securities — — (3,782) (40,667)

Loss on sales of stocks of subsidiaries and affiliates — — (3,583) (38,527)

Loss on quality compensation — (11,500) — —

Loss on suspension of large size LCD plant operation (Note 15) — (25,887) — —

Restructuring charges (Note 16) (12,655) (117,110) (143,397) (1,541,903)

Settlement package — (18,857) (17,899) (192,462)

Provision for loss on litigation — — (32,321) (347,538)

Loss on charge in equity — — (705) (7,581)

Other, net (20,479) (24,951) (59,946) (644,580)

(38,016) (200,877) (319,921) (3,440,010)

Income (loss) before income taxes and minority interests 40,880 (238,429) (466,187) (5,012,763)

Income Taxes (Note 4):

Current 26,927 19,617 17,607 189,323

Deferred (7,244) 115,523 59,972 644,860

19,683 135,140 77,579 834,183

Income (loss) before minority interests 21,197 (373,569) (543,766) (5,846,946)

Minority Interests in Income of Consolidated Subsidiaries (1,796) (2,507) (1,581) (17,000)

Net income (loss) ¥ 19,401 ¥ (376,076) ¥ (545,347) $ (5,863,946)

Yen U.S. Dollars

2011 2012 2013 2013

Per Share of Common Stock (Note 9):

Net income (loss) ¥ 17.63 ¥ (341.78) ¥ (489.83) $ (5.27)

Diluted net income 16.47 — — —

Cash dividends 17.00 10.00 0.00 0.00

The accompanying notes to the consolidated financial statements are an integral part of these statements.

Diluted net loss per share computation for the years ended March 31, 2012 and 2013 are not presented since net loss were recorded.

Financial Section