Sharp 2013 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2013 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

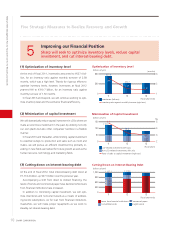

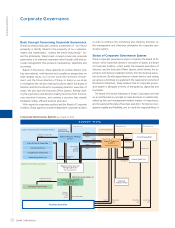

Optimization of Inventory Level

0

300

600

1

2

3

(billions of yen) (months)

11 12 13

(Fiscal year-ends)

527.4

310.7

2.58

1.50 1.40

Inventories (left axis)

Inventory ratio against monthly turnover (right axis)

Minimization of Capital Investment

0

50

100

150

2

3

4

5

(billions of yen) (%)

11 12 13

(Fiscal years)

118.8

82.4

4.8

3.3 3.0

LCD-related investments (left axis)

Non-LCD-related investments (left axis)

Ratio of sales to capital investment (right axis)

Cutting Down on Interest-Bearing Debt

0

300

600

900

1,200

(billions of yen)

11 12 13

(Fiscal year-ends)

Loans from financial institutions Commercial paper

Convertible bonds Straight bonds

1,127.1 1,174.4

10 SHARP CORPORATION

Medium-Term Management Plan for Fiscal 2013-2015: For Recovery and Growth

5Improving our Financial Position

Sharp will seek to optimize inventory levels, reduce capital

investment, and cut interest-bearing debt.

(1) Optimization of inventory level

At the end of fiscal 2011, inventories amounted to ¥527.4 bil-

lion, for an inventory ratio against monthly turnover of 2.58

months, which was a high level. Thanks for rigorous efforts to

optimize inventory levels, however, inventories at fiscal 2012

year-end fell to ¥310.7 billion, for an inventory ratio against

monthly turnover of 1.50 months.

In fiscal 2013 and beyond, we will continue working to opti-

mize inventory level and thus enhance financial efficiency.

(2) Minimization of capital investment

We will dramatically reduce capital investment in LCDs where we

made an enormous investment in the past, by utilizing not only

our own plants but also other companies’ facilities in a flexible

manner.

In fiscal 2013 and thereafter, while limiting capital investment

to essential outlays to production and sales such as mold and

masks, we will pursue an efficient investment by primarily in-

vesting in new fields earmarked for future growth as well as the

human resource, technology, and marketing fields.

(3) Cutting down on interest-bearing debt

At the end of fiscal 2012, total interest-bearing debt stood at

¥1,174.4 billion, up ¥47.3 billion over the previous year.

Accompanying a shift from direct to indirect financing, the

levels of bonds and commercial paper have declined while loans

from financial institutions have increased.

In addition to minimizing capital investment, we will opti-

mize inventories and noncurrent assets as a means of address-

ing bonds redemptions. As for loan from financial institutions,

meanwhile, we will make proper repayments as we work to

steadily cut interest-bearing debt.

Five Strategic Measures to Realize Recovery and Growth