Sharp 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 SHARP CORPORATION

Financial Section

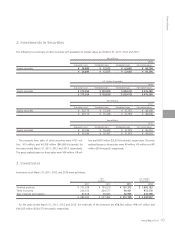

(a) Qualitative information on financial instruments

(1) Policies for financial instruments

The Company and its consolidated subsidiaries obtain neces-

sary funds mainly through bank loans and issuing bonds ac-

cording to its capital investment plan for its main business of

manufacturing and distributing electronics equipment and

electronic components.

Short-term operating funds are obtained through bank

loans.

Transactions involving such financial instruments are con-

ducted with creditworthy financial institutions. The Company

utilizes derivative transactions for minimizing risk and not for

speculative or dealing purposes.

(2) Description and risks of financial instruments

Notes and accounts receivable are exposed to customer credit

risk. Some notes and accounts receivable are denominated in

foreign currencies because the Company has business rela-

tions globally and therefore are exposed to foreign currency

risk. Notes and accounts payable (excluding other accounts

payable) are payable within one year. Some notes and ac-

counts payable arising from the import of raw materials are

denominated in foreign currencies and therefore are exposed

to foreign currency risk. The Company offsets foreign currency

denominated notes and accounts receivable with notes and

accounts payable, and uses forward exchange contracts to

hedge foreign currency risk exposure.

Other securities are held for the long term to construct bet-

ter business alliances and relations with Company customers

and suppliers. Other securities are exposed to market price

fluctuation risk. Long-term borrowings (included in long-term

debt) and bonds (included in short-term borrowings and long-

term debt) are mainly in preparation for capital investments.

The longest redemption date for bonds is six and a half years

after March 31, 2013.

Derivative transactions consist primarily of forward ex-

change contracts, and currency swap contracts are used to

hedge foreign currency risk exposure. Interest swap contracts

are used to hedge interest rate risk exposure. For hedging

instruments, hedged items, hedging policies and assessment

methods of effectiveness of hedging instruments, please see

Note 1.

(3) Risk management of financial instruments

[1] Management of credit risk

For notes and accounts receivable, the Company periodi-

cally reviews the status of its key customers, monitoring

their respective payment deadlines and remaining out-

standing balances.

The Company strives to recognize and reduce irrecover-

able risks, due to deteriorating financial conditions or other

factors at an early stage. The Company’s consolidated sub-

sidiaries also follow the same monitoring and administra-

tion process.

[2] Management of market risk

The Company decides basic policy for derivative transac-

tions at the Foreign Exchange Administration Committee

meeting which is held monthly and the Finance Adminis-

tration Committee meeting which is required by the Com-

pany’s internal procedure.

The Treasury Department of Corporate Accounting and

Control Group executes transactions and reports the result

of such transactions to the Accounting Department of Cor-

porate Accounting and Control Group on a daily basis. The

Accounting Department has set up a specialized section

for transaction results and position management and re-

ports the result of transactions to the General manager of

Corporate Accounting and Control Group on a daily basis.

In addition, the Treasury Department reports the result

of transactions to the Foreign Exchange Administration

Committee and the Finance Administration Committee on

a periodic basis. Its consolidated subsidiaries also manage

forward foreign exchange transactions in accordance with

the rules established by the Company and report the con-

tent of such transactions to the Company on a monthly

basis. For interest swap contracts and currency swap con-

tracts, its consolidated subsidiaries execute transactions

after the Company approves.

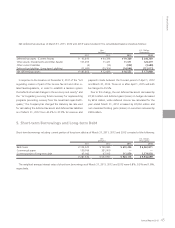

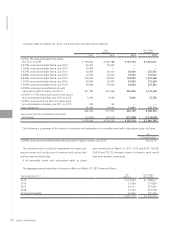

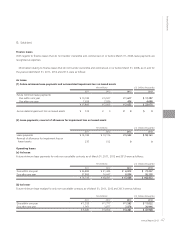

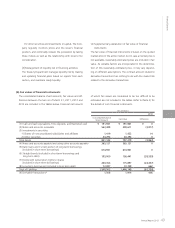

7. Financial Instruments