Sharp 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 SHARP CORPORATION

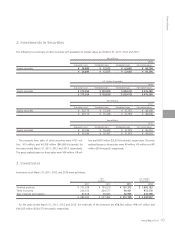

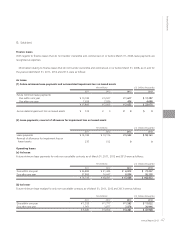

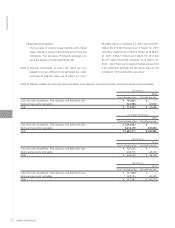

Long-term debt as of March 31, 2011, 2012 and 2013 consisted of the following:

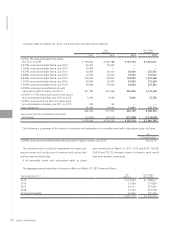

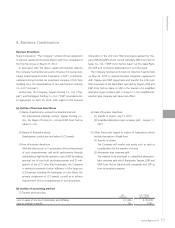

The following is a summary of the terms for conversion and redemption of convertible bonds with subscription rights to shares:

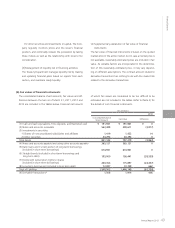

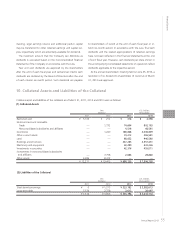

The aggregate annual maturities of long-term debt as of March 31, 2013 were as follows:

Yen

(millions)

U.S. Dollars

(thousands)

2011 2012 2013 2013

0.0%-9.1% loans principally from banks,

due 2011 to 2034 ¥ 149,554 ¥ 126,188 ¥ 137,774 $ 1,481,441

0.970% unsecured straight bonds, due 2012 20,000 20,000 — —

1.165% unsecured straight bonds, due 2012 10,000 — — —

1.423% unsecured straight bonds, due 2014 30,000 30,000 30,000 322,581

2.068% unsecured straight bonds, due 2019 10,000 10,000 10,000 107,527

0.846% unsecured straight bonds, due 2014 100,000 100,000 100,000 1,075,269

1.141% unsecured straight bonds, due 2016 20,000 20,000 20,000 215,054

1.604% unsecured straight bonds, due 2019 30,000 30,000 30,000 322,581

0.000% unsecured convertible bonds with

subscription rights to shares, due 2013 201,783 201,068 200,354 2,154,344

0.250%-1.177% unsecured Euroyen notes issued

by a consolidated subsidiary, due 2012 to 2013 5,046 6,996 5,000 53,763

0.500% unsecured Pound discount notes issued

by a consolidated subsidiary, due 2011 to 2012 290 130 — —

Lease obligations 26,289 32,690 31,041 333,774

602,962 577,072 564,169 6,066,334

Less-Current portion included in short-term

borrowings (43,042) (47,912) (313,859) (3,374,828)

¥ 559,920 ¥ 529,160 ¥ 250,310 $ 2,691,506

Years ending March 31 Yen

(millions)

U.S. Dollars

(thousands)

2015 ¥ 110,560 $ 1,188,817

2016 21,560 231,828

2017 34,171 367,430

2018 21,574 231,978

2019 and thereafter 62,445 671,452

¥ 250,310 $ 2,691,505

Yen

Conversion price

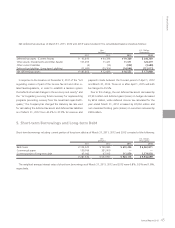

0.000% unsecured convertible bonds with subscription rights to shares, due 2013 ¥2,522.90

The conversion price is subject to adjustment for certain sub-

sequent events such as the issue of common stock at less than

market value and stock splits.

If all convertible bonds with subscription rights to shares

were converted as of March 31, 2011, 2012 and 2013, 79,018,

79,018 and 79,272 thousand shares of common stock would

have been issuable, respectively.

Financial Section