Salesforce.com 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

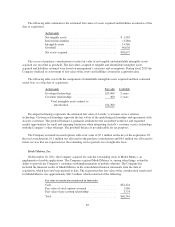

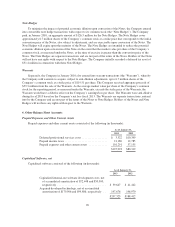

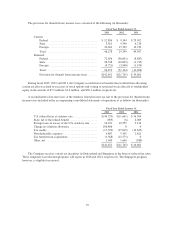

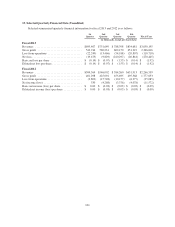

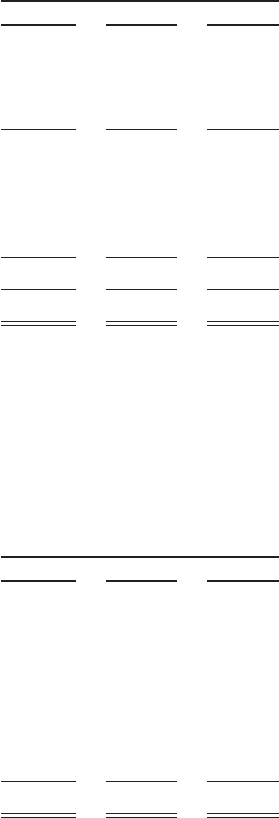

The provision for (benefit from) income taxes consisted of the following (in thousands):

Fiscal Year Ended January 31,

2013 2012 2011

Current:

Federal .................................. $ 12,896 $ 9,344 $ 29,992

State .................................... 3,021 4,346 6,276

Foreign .................................. 30,261 15,709 13,239

Total .................................... 46,178 29,399 49,507

Deferred:

Federal .................................. 72,656 (36,601) (8,687)

State .................................... 28,538 (10,603) (4,745)

Foreign .................................. (4,721) (3,940) (1,474)

Total .................................... 96,473 (51,144) (14,906)

Provision for (benefit from) income taxes ....... $142,651 $(21,745) $ 34,601

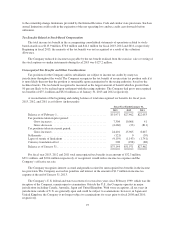

During fiscal 2013, 2012 and 2011, the Company recorded net tax benefits that resulted from allocating

certain tax effects related to exercises of stock options and vesting of restricted stocks directly to stockholders’

equity in the amount of $7.2 million, $1.6 million, and $36.1 million, respectively.

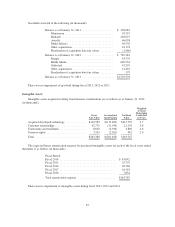

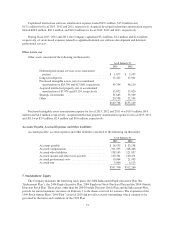

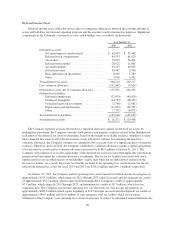

A reconciliation of income taxes at the statutory federal income tax rate to the provision for (benefit from)

income taxes included in the accompanying consolidated statements of operations is as follows (in thousands):

Fiscal Year Ended January 31,

2013 2012 2011

U.S. federal taxes at statutory rate ................. $(44,729) $(11,661) $ 36,504

State, net of the federal benefit ................... (969) (6) 6,069

Foreign taxes in excess of the U.S. statutory rate ..... 16,931 10,555 3,412

Change in valuation allowance ................... 186,806 0 0

Tax credits ................................... (17,670) (15,049) (13,625)

Non-deductible expenses ........................ 4,807 5,345 2,621

Tax benefit from acquisitions .................... (3,568) (12,575) 0

Other, net .................................... 1,043 1,646 (380)

$142,651 $(21,745) $ 34,601

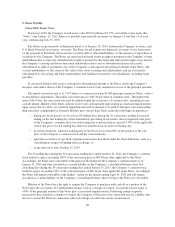

The Company receives certain tax incentives in Switzerland and Singapore in the form of reduced tax rates.

These temporary tax reduction programs will expire in 2016 and 2014, respectively. The Singapore program,

however, is eligible for renewal.

95