Salesforce.com 2013 Annual Report Download - page 92

Download and view the complete annual report

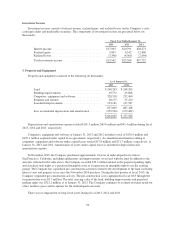

Please find page 92 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.5. Notes Payable

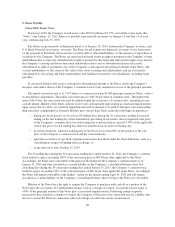

Convertible Senior Notes

In January 2010, the Company issued at par value $575.0 million of 0.75% convertible senior notes (the

“Notes”) due January 15, 2015. Interest is payable semi-annually in arrears on January 15 and July 15 of each

year, commencing July 15, 2010.

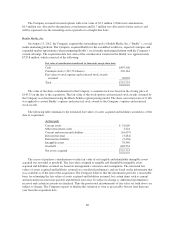

The Notes are governed by an Indenture dated as of January 19, 2010, between the Company, as issuer, and

U.S. Bank National Association, as trustee. The Notes do not contain any financial covenants or any restrictions

on the payment of dividends, the incurrence of senior debt or other indebtedness, or the issuance or repurchase of

securities by the Company. The Notes are unsecured and rank senior in right of payment to the Company’s future

indebtedness that is expressly subordinated in right of payment to the Notes and rank equal in right of payment to

the Company’s existing and future unsecured indebtedness that is not so subordinated and are effectively

subordinated in right of payment to any of the Company’s cash equal to the principal amount of the Notes, and

secured indebtedness to the extent of the value of the assets securing such indebtedness and are structurally

subordinated to all existing and future indebtedness and liabilities incurred by our subsidiaries, including trade

payables.

If converted, holders will receive cash equal to the principal amount of the Notes, and at the Company’s

election, cash and/or shares of the Company’s common stock for any amounts in excess of the principal amounts.

The initial conversion rate is 11.7147 shares of common stock per $1,000 principal amount of Notes, subject

to anti-dilution adjustments. The initial conversion price is $85.36 per share of common stock. Throughout the

term of the Notes, the conversion rate may be adjusted upon the occurrence of certain events, including for any

cash dividends. Holders of the Notes will not receive any cash payment representing accrued and unpaid interest

upon conversion of a Note. Accrued but unpaid interest will be deemed to be paid in full upon conversion rather

than cancelled, extinguished or forfeited. Holders may convert their Notes under the following circumstances:

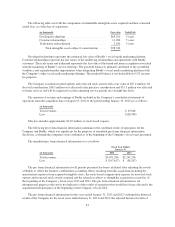

• during any fiscal quarter, if, for at least 20 trading days during the 30 consecutive trading day period

ending on the last trading day of the immediately preceding fiscal quarter, the last reported sales price

of the Company’s common stock for such trading day is greater than or equal to 130% of the applicable

conversion price on such trading day share of common stock on such last trading day;

• in certain situations, when the trading price of the Notes is less than 98% of the product of the sale

price of the Company’s common stock and the conversion rate;

• upon the occurrence of specified corporate transactions described under the Notes Indenture, such as a

consolidation, merger or binding share exchange; or

• at any time on or after October 15, 2014.

For 20 trading days during the 30 consecutive trading days ended October 31, 2012, the Company’s common

stock traded at a price exceeding 130% of the conversion price of $85.36 per share applicable to the Notes.

Accordingly, the Notes were convertible at the option of the holder for the Company’s common shares as of

January 31, 2013 and were classified as a current liability on the Company’s consolidated balance sheet. For

20 trading days during the 30 consecutive trading days ended January 31, 2013, the Company’s common stock

traded at a price exceeding 130% of the conversion price of $85.36 per share applicable to the Notes. Accordingly,

the Notes will remain convertible at the holders’ option for the quarter ending April 30, 2013 and will remain

classified as a current liability on the Company’s consolidated balance sheet so long as the Notes are convertible.

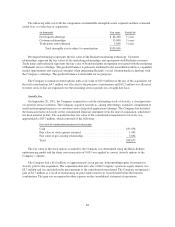

Holders of the Notes have the right to require the Company to purchase with cash all or a portion of the

Notes upon the occurrence of a fundamental change, such as a change of control, at a purchase price equal to

100% of the principal amount of the Notes plus accrued and unpaid interest. Following certain corporate

transactions that constitute a change of control, the Company will increase the conversion rate for a holder who

elects to convert the Notes in connection with such change of control in certain circumstances.

88