Salesforce.com 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

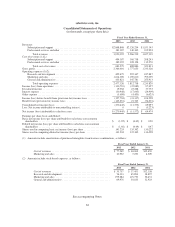

Our cash, cash equivalents and marketable securities are comprised primarily of corporate notes and other

obligations, U.S. treasury securities, U.S. agency obligations, government obligations, collateralized mortgage

obligations, mortgage backed securities, time deposits, money market mutual funds and municipal securities.

As of January 31, 2013, we have a total of $60.8 million in letters of credit outstanding in favor of certain

landlords for office space. To date, no amounts have been drawn against the letters of credit, which renew

annually and mature at various dates through December 2030.

We do not have any special purpose entities, and other than operating leases for office space and computer

equipment, we do not engage in off-balance sheet financing arrangements. Additionally, we currently do not

have a bank line of credit.

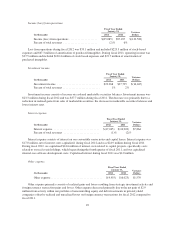

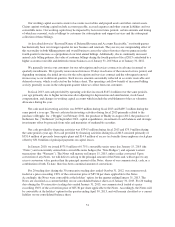

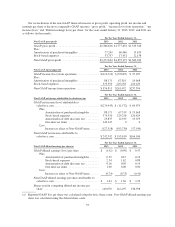

Our principal commitments consist of obligations under leases for office space and co-location facilities for

data center capacity and our development and test data center, and computer equipment and furniture and

fixtures. At January 31, 2013, the future non-cancelable minimum payments under these commitments were as

follows (in thousands):

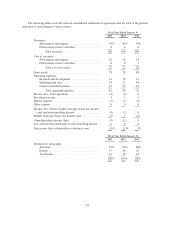

(In thousands)

Contractual Obligations

Payments Due by Period

Total

Less than

1 Year 1-3 Years 3-5 Years

More than

5 Years

Capital lease obligations ...................... $ 66,853 $ 31,694 $ 22,400 $ 12,759 $ 0

Operating lease obligations:

Facilities space ......................... 1,505,059 108,301 233,378 250,428 912,952

Computer equipment and furniture and

fixtures .............................. 81,356 43,046 38,310 0 0

Convertible Senior Notes, including interest ...... 583,626 4,313 579,313 0 0

Contractual commitments ..................... 7,072 3,472 3,600 0 0

Total ..................................... $2,243,966 $190,826 $877,001 $263,187 $912,952

The majority of our operating lease agreements provide us with the option to renew. Our future operating

lease obligations would change if we exercised these options and if we entered into additional operating lease

agreements as we expand our operations.

Purchase orders are not included in the table above. Our purchase orders represent authorizations to purchase

rather than binding agreements. The contractual commitment amounts in the table above are associated with

agreements that are enforceable and legally binding and that specify all significant terms, including: fixed or minimum

services to be used; fixed, minimum or variable price provisions; and the approximate timing of the transaction.

Obligations under contracts that we can cancel without a significant penalty are not included in the table above.

During fiscal 2014 and future fiscal years, we expect to make additional investments in our infrastructure to

scale our operations and increase productivity. We plan to upgrade and/or replace various internal systems to

scale with the overall growth of the Company. Additionally, we expect capital expenditures to be higher in

absolute dollars in fiscal 2014 than in fiscal 2013 as a result of continued office build-outs, other leasehold

improvements and data center investments.

In the future, we may enter into arrangements to acquire or invest in complementary businesses or joint

ventures, services and technologies, and intellectual property rights. We may be required to seek additional

equity or debt financing. Additional funds may not be available on terms favorable to us or at all.

We believe our existing cash, cash equivalents and short-term marketable securities and cash provided by

operating activities will be sufficient to meet our working capital and capital expenditure needs over the next

12 months.

52