Salesforce.com 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

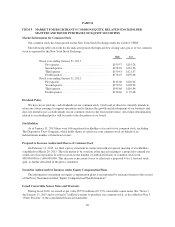

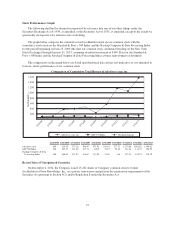

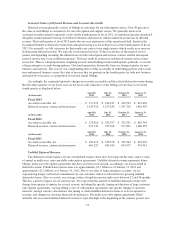

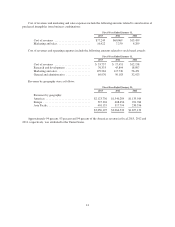

Seasonal Nature of Deferred Revenue and Accounts Receivable

Deferred revenue primarily consists of billings to customers for our subscription service. Over 90 percent of

the value of our billings to customers is for our subscription and support service. We generally invoice our

customers in either annual or quarterly cycles. In the fourth quarter of fiscal 2012, we introduced greater operational

discipline around annual invoicing, for both new business and renewals which resulted in an increase in deferred

revenue. The fourth quarter of fiscal 2013 marks the one year anniversary of this operational shift, therefore the

incremental benefit to deferred revenue from annual invoicing was lower than it was in the fourth quarter of fiscal

2012. Occasionally, we bill customers for their multi-year contract on a single invoice which results in an increase

in noncurrent deferred revenue. We typically issue renewal invoices 30 days in advance of the renewal service

period, and depending on timing, the initial invoice for the subscription and services contract and the subsequent

renewal invoice may occur in different quarters. This may result in an increase in deferred revenue and accounts

receivable. There is a disproportionate weighting towards annual billings in the fourth quarter, primarily as a result

of large enterprise account buying patterns. Our fourth quarter has historically been our strongest quarter for new

business and renewals. The year on year compounding effect of this seasonality in both billing patterns and overall

new and renewal business causes the value of invoices that we generate in the fourth quarter for both new business

and renewals to increase as a proportion of our total annual billings.

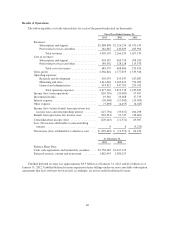

Accordingly, the sequential quarterly changes in accounts receivable and the related deferred revenue during

the first three quarters of our fiscal year are not necessarily indicative of the billing activity that occurs in the

fourth quarter as displayed below:

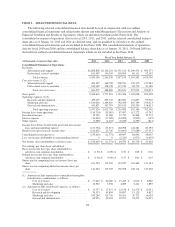

(in thousands)

April 30,

2012

July 31,

2012

October 31,

2012

January 31,

2013

Fiscal 2013

Accounts receivable, net ................. $ 371,395 $ 446,917 $ 418,590 $ 872,634

Deferred revenue, current and noncurrent .... 1,334,716 1,337,184 1,291,703 1,862,995

(in thousands)

April 30,

2011

July 31,

2011

October 31,

2011

January 31,

2012

Fiscal 2012

Accounts receivable, net ................. $ 270,816 $ 342,397 $ 312,331 $ 683,745

Deferred revenue, current and noncurrent .... 915,133 935,266 917,821 1,380,295

(in thousands)

April 30,

2010

July 31,

2010

October 31,

2010

January 31,

2011

Fiscal 2011

Accounts receivable, net ................. $ 183,612 $ 228,550 $ 258,764 $ 426,943

Deferred revenue, current and noncurrent .... 664,529 683,019 694,557 934,941

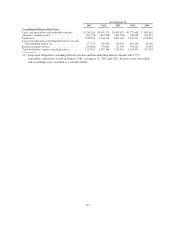

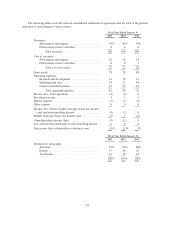

Unbilled Deferred Revenue

The deferred revenue balance on our consolidated balance sheet does not represent the total contract value

of annual or multi-year, non-cancelable subscription agreements. Unbilled deferred revenue represents future

billings under our subscription agreements that have not been invoiced and, accordingly, are not recorded in

deferred revenue. Unbilled deferred revenue was approximately $3.5 billion as of January 31, 2013 and

approximately $2.2 billion as of January 31, 2012. Due to our sales to large enterprise accounts, we are

experiencing longer contractual commitments by our customers which is reflected in our growing unbilled

deferred revenue. Also as a result, our average contract length has grown and is now between 12 and 36 months.

This has a positive impact on our renewal rate. We expect that the amount of unbilled deferred revenue will

change from quarter to quarter for several reasons, including the specific timing and duration of large customer

subscription agreements, varying billing cycles of subscription agreements, the specific timing of customer

renewals, foreign currency fluctuations, the timing of when unbilled deferred revenue is to be recognized as

revenue, and changes in customer financial circumstances. For multi-year subscription agreements billed

annually, the associated unbilled deferred revenue is typically high at the beginning of the contract period, zero

33