Salesforce.com 2013 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company assumed unvested options with a fair value of $2.2 million. Of the total consideration,

$0.5 million was allocated to the purchase consideration and $1.7 million was allocated to future services and

will be expensed over the remaining service periods on a straight-line basis.

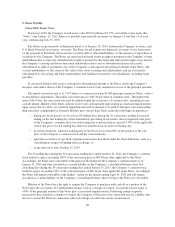

Buddy Media, Inc.

On August 13, 2012, the Company acquired the outstanding stock of Buddy Media, Inc. (“Buddy”), a social

media marketing platform. The Company acquired Buddy for the assembled workforce, expected synergies and

expanded market opportunities when integrating Buddy’s social media marketing platform with the Company’s

current offerings. The acquisition date fair value of the consideration transferred for Buddy was approximately

$735.8 million, which consisted of the following:

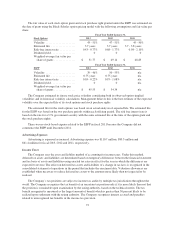

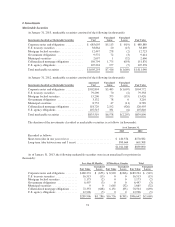

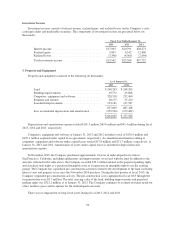

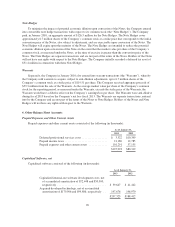

Fair value of consideration transferred (in thousands, except share data)

Cash ............................................ $497,500

Common stock (1,392,774 shares) ..................... 202,161

Fair value of stock options and restricted stock awards

assumed ....................................... 36,092

Total ............................................ $735,753

The value of the share consideration for the Company’s common stock was based on the closing price of

$145.15 on the day of the acquisition. The fair value of the stock options and restricted stock awards assumed by

the Company was determined using the Black-Scholes option pricing model. The share conversion ratio of 0.146

was applied to convert Buddy’s options and restricted stock awards to the Company’s options and restricted

stock awards.

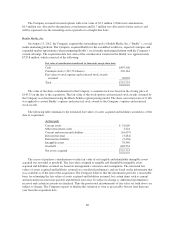

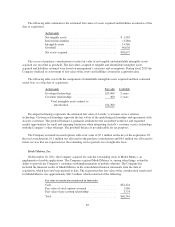

The following table summarizes the estimated fair values of assets acquired and liabilities assumed as of the

date of acquisition:

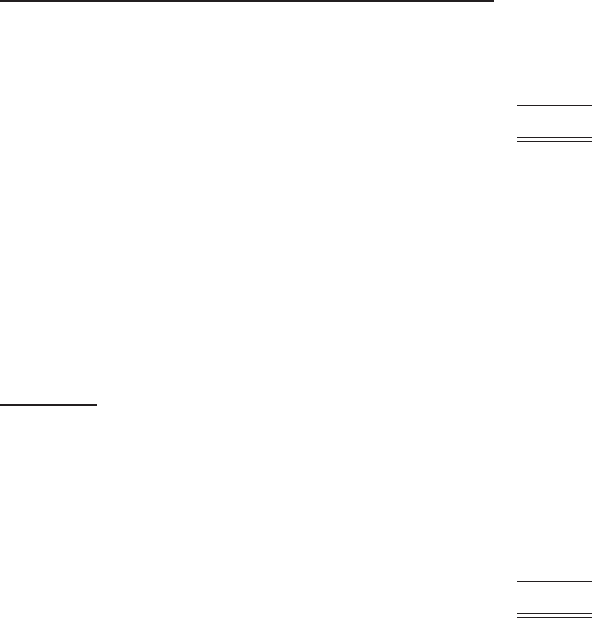

(in thousands)

Current assets ..................................... $ 35,609

Other noncurrent assets ............................. 3,424

Current and noncurrent liabilities ...................... (16,437)

Deferred revenue .................................. (3,281)

Deferred tax liability ............................... (2,436)

Intangible assets ................................... 78,340

Goodwill ......................................... 640,534

Net assets acquired ................................. $735,753

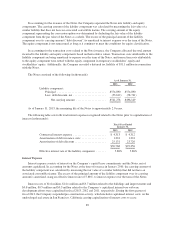

The excess of purchase consideration over the fair value of net tangible and identifiable intangible assets

acquired was recorded as goodwill. The fair values assigned to tangible and identifiable intangible assets

acquired and liabilities assumed are based on management’s estimates and assumptions. The estimated fair

values of assets acquired and liabilities assumed are considered preliminary and are based on the information that

was available as of the date of the acquisition. The Company believes that the information provides a reasonable

basis for estimating the fair values of assets acquired and liabilities assumed, but certain items such as current

and noncurrent income taxes payable and deferred taxes may be subject to change as additional information is

received and certain tax returns are finalized. Thus the provisional measurements of fair value set forth above are

subject to change. The Company expects to finalize the valuation as soon as practicable, but not later than one-

year from the acquisition date.

80