Salesforce.com 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.dollars as we invest in our infrastructure and we incur additional employee related costs, professional fees and

insurance costs related to the growth of our business and international expansion. We expect general and

administrative costs as a percentage of total revenues to either remain flat or decrease for the next several

quarters.

Stock-Based Expenses. Our cost of revenues and operating expenses include stock-based expenses related to

equity plans for employees and non-employee directors. We recognize our stock-based compensation as an

expense in the statement of operations based on their fair values and vesting periods. These charges have been

significant in the past and we expect that they will increase as our stock price increases, as we hire more

employees and seek to retain existing employees.

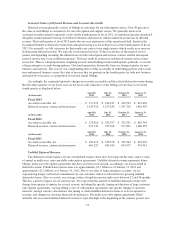

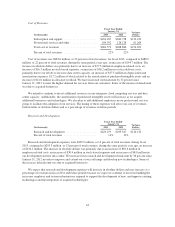

For fiscal 2013, we recognized stock-based expense of $379.4 million. As of January 31, 2013, the

aggregate stock compensation remaining to be amortized to costs and expenses was $1.2 billion. We expect this

stock compensation balance to be amortized as follows: $491.0 million during fiscal 2014; $394.2 million during

fiscal 2015; $249.8 million during fiscal 2016; and $92.5 million during fiscal 2017. The expected amortization

reflects only outstanding stock awards as of January 31, 2013 and assumes no forfeiture activity. We expect to

continue to issue stock-based awards to our employees in future periods.

Amortization of Purchased Intangibles from Business Combinations. Our cost of revenues and operating

expenses include amortization of acquisition-related intangible assets, such as the amortization of the cost

associated with an acquired company’s research and development efforts, trade names, customer lists and

customer relationships. We expect this expense to increase as we acquire more companies.

Critical Accounting Estimates

Our consolidated financial statements are prepared in accordance with accounting principles generally

accepted in the United States. The preparation of these consolidated financial statements requires us to make

estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, costs and expenses,

and related disclosures. On an ongoing basis, we evaluate our estimates and assumptions. Our actual results may

differ from these estimates under different assumptions or conditions.

We believe that of our significant accounting policies, which are described in Note 1 to our consolidated

financial statements, the following accounting policies involve a greater degree of judgment and complexity.

Accordingly, these are the policies we believe are the most critical to aid in fully understanding and evaluating

our consolidated financial condition and results of operations.

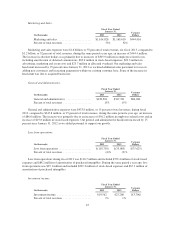

Revenue Recognition. We derive our revenues from two sources: (1) subscription revenues, which are

comprised of subscription fees from customers accessing our enterprise cloud computing services and from

customers purchasing additional support beyond the standard support that is included in the basic subscription

fee; and (2) related professional services such as process mapping, project management, implementation services

and other revenue. “Other revenue” consists primarily of training fees.

We commence revenue recognition when all of the following conditions are satisfied:

• There is persuasive evidence of an arrangement;

• The service has been or is being provided to the customer;

• The collection of the fees is reasonably assured; and

• The amount of fees to be paid by the customer is fixed or determinable.

Our subscription service arrangements are non-cancelable and do not contain refund-type provisions.

35