Salesforce.com 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

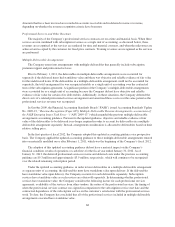

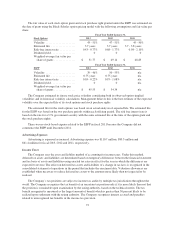

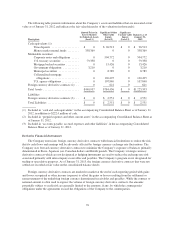

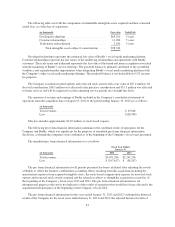

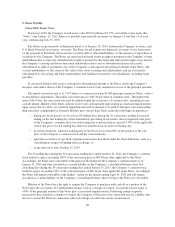

Investment Income

Investment income consists of interest income, realized gains, and realized losses on the Company’s cash,

cash equivalents and marketable securities. The components of investment income are presented below (in

thousands):

Fiscal Year Ended January 31,

2013 2012 2011

Interest income .................................. $17,903 $20,791 $28,273

Realized gains ................................... 5,007 6,542 12,460

Realized losses .................................. (3,348) (4,065) (2,998)

Total investment income ........................... $19,562 $23,268 $37,735

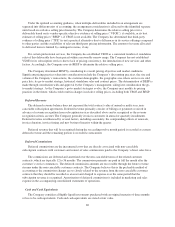

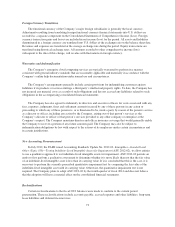

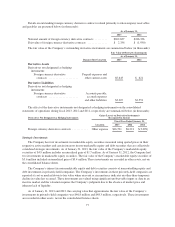

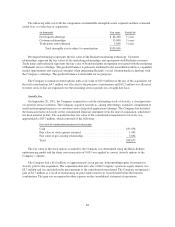

3. Property and Equipment

Property and equipment consisted of the following (in thousands):

As of January 31,

2013 2012

Land .......................................... $248,263 $ 248,263

Building improvements ........................... 49,572 43,868

Computers, equipment and software ................. 328,318 232,460

Furniture and fixtures ............................. 38,275 25,250

Leasehold improvements .......................... 193,181 137,587

857,609 687,428

Less accumulated depreciation and amortization ........ (252,940) (159,482)

$ 604,669 $ 527,946

Depreciation and amortization expense totaled $101.1 million, $69.8 million and $41.4 million during fiscal

2013, 2012 and 2011, respectively.

Computers, equipment and software at January 31, 2013 and 2012 included a total of $136.9 million and

$105.1 million acquired under capital lease agreements, respectively. Accumulated amortization relating to

computers, equipment and software under capital leases totaled $57.8 million and $31.7 million, respectively, at

January 31, 2013 and 2012. Amortization of assets under capital leases is included in depreciation and

amortization expense.

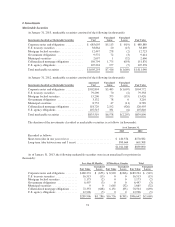

In November 2010, the Company purchased approximately 14 acres of undeveloped real estate in

San Francisco, California, including entitlements and improvements associated with the land. In addition to the

amounts reflected in the table above, the Company recorded $23.3 million related to the perpetual parking rights

and classified such rights as a purchased intangible asset as it represents an intangible right to use the existing

garage. The Company has capitalized pre-construction activities related to the development of the land, including

interest costs and property taxes since the November 2010 purchase. During the first quarter of fiscal 2013, the

Company suspended pre-construction activity. The pre-construction costs capitalized in fiscal 2013 through the

suspension date were $5.7 million. The total carrying value of the land, building improvements and perpetual

parking rights was $321.1 million as of January 31, 2013. The Company continues to evaluate its future needs for

office facilities space and its options for the undeveloped real estate.

There was no impairment of long-lived assets during fiscal 2013, 2012 and 2011.

78