Salesforce.com 2013 Annual Report Download - page 74

Download and view the complete annual report

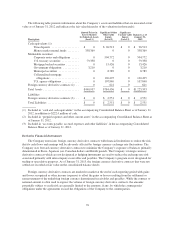

Please find page 74 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Marketable Securities

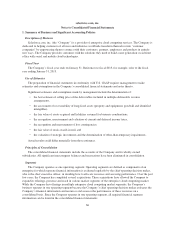

Management determines the appropriate classification of marketable securities at the time of purchase and

reevaluates such determination at each balance sheet date. Securities are classified as available for sale and are

carried at fair value, with the change in unrealized gains and losses, net of tax, reported as a separate component

on the Consolidated Statements of Comprehensive Income (Loss). Fair value is determined based on quoted

market rates when observable or utilizing data points that are observable, such as quoted prices, interest rates and

yield curves. Declines in fair value judged to be other-than-temporary on securities available for sale are included

as a component of investment income. In order to determine whether a decline in value is other-than-temporary,

the Company evaluates, among other factors: the duration and extent to which the fair value has been less than

the carrying value and its intent and ability to retain the investment for a period of time sufficient to allow for any

anticipated recovery in fair value. The cost of securities sold is based on the specific-identification method.

Interest on securities classified as available for sale is also included as a component of investment income.

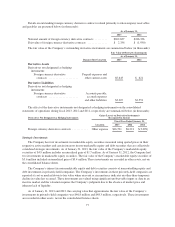

Fair Value Measurement

The Company measures its cash equivalents, marketable securities and foreign currency derivative contracts

at fair value.

The Company reports its financial and non-financial assets and liabilities that are re-measured and reported

at fair value at each reporting period.

The additional disclosures regarding the Company’s fair value measurements are included in Note 2.

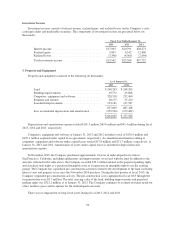

Property and Equipment

Property and equipment are stated at cost. Depreciation is calculated on a straight-line basis over the

estimated useful lives of those assets as follows:

Computer, equipment and

software .................... 3to7years

Furniture and fixtures ............ 5years

Leasehold improvements ......... Shorter of the lease term or 10 years

Building improvements .......... Amortized over the estimated

useful lives of the respective assets

when they are ready for their

intended use.

When assets are retired or otherwise disposed of, the cost and accumulated depreciation and amortization

are removed from their respective accounts and any loss on such retirement is reflected in operating expenses.

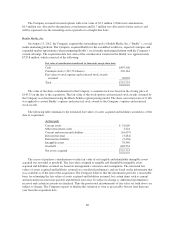

Capitalized Internal-Use Software Costs

The Company capitalizes costs related to its enterprise cloud computing services and certain projects for

internal use incurred during the application development stage. Costs related to preliminary project activities and

post implementation activities are expensed as incurred. Internal-use software is amortized on a straight line basis

over its estimated useful life. Management evaluates the useful lives of these assets on an annual basis and tests

for impairment whenever events or changes in circumstances occur that could impact the recoverability of these

assets.

Goodwill, Intangible Assets, Long-Lived Assets and Impairment Assessments

The Company evaluates and tests the recoverability of its goodwill for impairment at least annually during

the fourth quarter or more often if and when circumstances indicate that goodwill may not be recoverable.

70