Salesforce.com 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

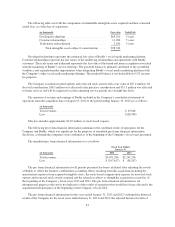

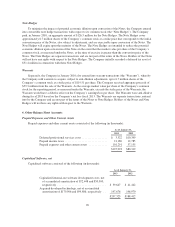

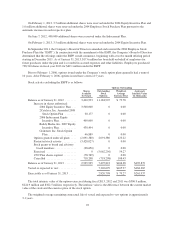

Capitalized internal-use software amortization expense totaled $22.1 million, $15.8 million and

$13.1 million for fiscal 2013, 2012 and 2011, respectively. Acquired developed technology amortization expense

totaled $80.0 million, $62.1 million, and $16.9 million for fiscal 2013, 2012 and 2011, respectively.

During fiscal 2013, 2012 and 2011, the Company capitalized $3.4 million, $2.4 million and $2.6 million

respectively, of stock-based expenses related to capitalized internal-use software development and deferred

professional services.

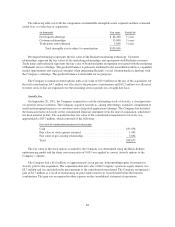

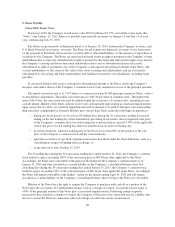

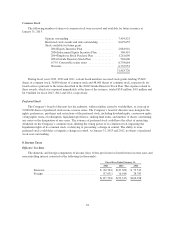

Other Assets, net

Other assets consisted of the following (in thousands):

As of January 31,

2013 2012

Deferred professional services costs, noncurrent

portion ...................................... $ 1,077 $ 3,935

Long-term deposits .............................. 13,422 13,941

Purchased intangible assets, net of accumulated

amortization of $28,790 and $17,868, respectively . . . 49,354 46,110

Acquired intellectual property, net of accumulated

amortization of $7,074 and $3,139, respectively ..... 13,872 15,020

Strategic investments ............................ 51,685 53,949

Other ......................................... 20,338 22,194

$149,748 $155,149

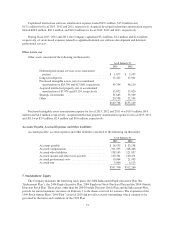

Purchased intangible assets amortization expense for fiscal 2013, 2012 and 2011 was $10.9 million, $8.0

million and $4.2 million, respectively. Acquired intellectual property amortization expense for fiscal 2013, 2012

and 2011 was $3.9 million, $2.4 million and $0.6 million, respectively.

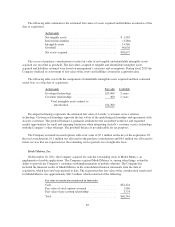

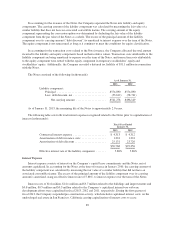

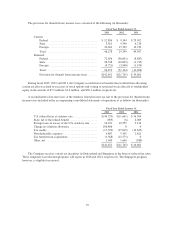

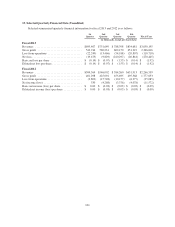

Accounts Payable, Accrued Expenses and Other Liabilities

Accounts payable, accrued expenses and other liabilities consisted of the following (in thousands):

As of January 31,

2013 2012

Accounts payable ............................... $ 14,535 $ 33,258

Accrued compensation ........................... 311,595 228,466

Accrued other liabilities .......................... 138,165 121,957

Accrued income and other taxes payable ............. 120,341 100,471

Accrued professional costs ........................ 10,064 21,993

Accrued rent ................................... 3,006 6,115

$597,706 $512,260

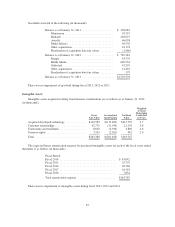

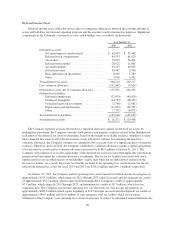

7. Stockholders’ Equity

The Company maintains the following stock plans: the 2006 Inducement Equity Incentive Plan (the

“Inducement Plan”), the 2004 Equity Incentive Plan, 2004 Employee Stock Purchase Plan and the 2004 Outside

Directors Stock Plan. These plans, other than the 2004 Outside Directors Stock Plan and the Inducement Plan,

provide for annual automatic increases on February 1 to the shares reserved for issuance. The expiration of the

1999 Stock Option Plan (“1999 Plan”) in fiscal 2010 did not affect awards outstanding, which continue to be

governed by the terms and conditions of the 1999 Plan.

91