Royal Caribbean Cruise Lines 2001 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2001 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

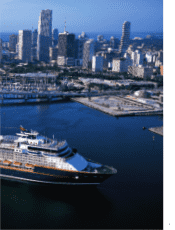

4Royal Caribbean Cruises Ltd.

RICHARD D. FAIN / Chairman and CEO

DEAR SHAREHOLDERS:

We navigated across particularly choppy seas in 2001, and our disappointing financial results reflected this. We had known from

the outset that it would be a challenging year as we launched four new ships in the midst of a softening economy and as we

suffered an unusual spate of ship disruptions due to technical problems. But we were unprepared for the horrific tragedies of

September 11. These attacks affected all of us personally and also led to a drastic decline in air travel and demand for cruises.

This barrage of unforeseen, negative impacts coincided with the peak period of our expansion program – a period of unusu-

ally high operating and financial leverage. While this leverage should soon work for us in a positive way, our margins and

profits are affected in the short term. In 2001, we registered a 43-percent decrease in net profit to $254.5 million, or $1.32 per

share, a steep falloff from record profits in 2000.

The impact of September 11 is still being felt as we enter 2002. We expect yields, which were down 9 percent in 2001, to decline

again. But we are now clearly seeing a recovery in demand with a corresponding abatement of the widespread price discount-

ing of 2001. Looking forward, we are encouraged by the current booking and pricing trends.

We also have taken aggressive steps to control costs and reduce capital expenditures. This has enabled us to reduce our non-

fuel operating and SG&A expenses by 5 percent per berth in 2001 with similar savings expected in 2002. In addition, we have

reduced our planned capital expenditures over the next few years by more than $300 million.

As difficult as this year has been, it also has provided a surprising silver lining. The fact that we have responded so well to the bad

news of 2001 and the resilience that the cruise industry has demonstrated in the face of such market forces are indeed reassuring.

PROMISING FUTURE

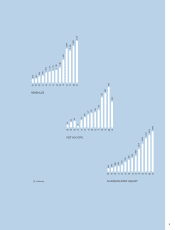

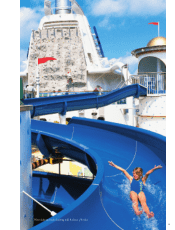

There are a number of reasons to be confident in the future performance of our company. In 2001, we eclipsed records with

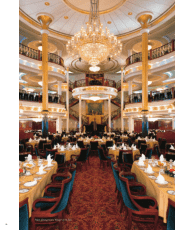

$3.1 billion in revenues and 2.4 million cruise guests. A rapid expansion of Celebrity Cruises, while ill-timed in a recession,

proved to make strategic sense, given the enormous appeal of Millennium and her sister ships. The debut of Royal Celebrity

Tours, complementing our Alaska cruises with escorted land tours, was also a winner. And for the first time, Royal Caribbean

International and Celebrity Cruises topped one million first-time cruisers.

As we started taking bookings in 2002, we saw a significant recovery in pricing. We experienced record booking levels in the “Wave

Period” that began in January, and pricing on new bookings has nearly returned to pre-September 11 levels. I believe these

business trends are proof of the resiliency of the cruise industry and a powerful testament to the fundamental strength of the

business model. The prospects for the future are bright.