Royal Caribbean Cruise Lines 2001 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2001 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Royal Caribbean Cruises Ltd. 37

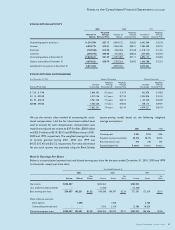

FOREIGN CURRENCY EXCHANGE RATE RISK

Our primary exposure to foreign currency exchange rate risk

relates to our firm commitments under two vessel construction

contracts denominated in euros. We enter into foreign

currency forward contracts to manage this risk and were

substantially hedged as of December 31, 2001. The fair value

of our contracts at December 31, 2001, was an unrealized

loss of $99.3 million which is recorded, along with an offsetting

$99.3 million fair value asset related to our vessel construction

contracts, on our accompanying 2001 balance sheet. A hypo-

thetical 10% strengthening of the U.S. dollar as of December 31,

2001, assuming no changes in comparative interest rates,

would result in an $89.5 million decrease in the fair value of

these contracts. This decrease in fair value would be fully offset

by a decrease in the U.S. dollar value of the related foreign

currency denominated vessel construction contracts.

We are also exposed to foreign currency exchange rate

fluctuations on the U.S. dollar value of our foreign currency

denominated forecasted transactions. To manage this expo-

sure, we take advantage of any natural offsets of our foreign

currency revenues and expenses and enter into foreign currency

forward contracts and/or option contracts for a portion of the

remaining exposure related to these forecasted transactions.

Our principal net foreign currency exposure relates to the

Norwegian kroner and the euro. At December 31, 2001, the

estimated fair value of such contracts was an unrealized gain of

approximately $0.2 million based on quoted market prices for

equivalent instruments with the same remaining maturities. A

hypothetical 10% strengthening of the U.S. dollar as of

December 31, 2001, assuming no changes in comparative

interest rates, would decrease the fair value of these contracts

by approximately $6.2 million. This decrease in fair value would

be fully offset by a decrease in the U.S. dollar value of the

forecasted transactions being hedged.

BUNKER FUEL PRICE RISK

Our exposure to market risk for changes in bunker fuel prices

relates to the consumption of fuel on our vessels. Bunker fuel

cost, as a percentage of our revenues, was approximately

3.7% in 2001, 3.3% in 2000 and 2.1% in 1999. We use fuel swap

agreements to mitigate the financial impact of fluctuations in

bunker fuel prices. As of December 31, 2001, we had fuel swap

agreements to pay fixed prices for bunker fuel with an aggre-

gate notional amount of $85.2 million, maturing through 2003.

The fair value of these contracts at December 31, 2001 was an

unrealized loss of $7.8 million. We estimate that a hypothetical

10% increase in our weighted-average bunker fuel price as of

December 31, 2001 would increase our 2002 projected bunker

fuel cost by approximately $16.3 million. This increase would

be partially offset by a $7.5 million increase in the fair value of

our fuel swap agreements.