Royal Caribbean Cruise Lines 2001 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2001 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

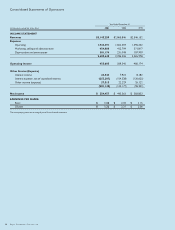

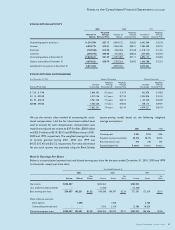

Consolidated Statements of Shareholders’ Equity

Royal Caribbean Cruises Ltd. 41

Accumulated

Other Total

Preferred Common Paid-in Retained Comprehensive Treasury Shareholders’

(in thousands) Stock Stock Capital Earnings Income (Loss) Stock Equity

Balances at January 1, 1999 $ 172,500 $ 1,690 $ 1,361,796 $ 923,691 $ – $(4,919) $2,454,758

Issuance of common stock – 108 487,291 – – – 487,399

Issuance under preferred

stock conversion (300) – 300 – – – –

Issuance under employee related plans – 14 17,260 – – (560) 16,714

Preferred stock dividends – – – (12,506) – – (12,506)

Common stock dividends – – – (69,062) – – (69,062)

Net income – – – 383,853 – – 383,853

Balances at December 31, 1999 172,200 1,812 1,866,647 1,225,976 – (5,479) 3,261,156

Issuance under preferred

stock conversion (172,200) 106 172,094 – – – –

Issuance under employee related plans – 3 4,370 – – (559) 3,814

Preferred stock dividends – – – (3,121) – – (3,121)

Common stock dividends – – – (91,297) – – (91,297)

Net income – – – 445,363 – – 445,363

Balances at December 31, 2000 – 1,921 2,043,111 1,576,921 – (6,038) 3,615,915

Issuance under employee related plans – 2 2,793 – – (560) 2,235

Common stock dividends – – – (99,955) – – (99,955)

Transition adjustment SFAS No. 133 – – – – 7,775 – 7,775

Changes related to cash flow

derivative hedges – – – – (23,843) – (23,843)

Net income – – – 254,457 – – 254,457

Balances at December 31, 2001 $ – $1,923 $2,045,904 $1,731,423 $(16,068) $(6,598) $3,756,584

Comprehensive income is as follows:

Year Ended December 31,

(in thousands) 2001 2000 1999

Net income $254,457 $445,363 $383,853

Transition adjustment SFAS No. 133 7,775 ––

Changes related to cash flow

derivative hedges (23,843) ––

Total comprehensive income $238,389 $445,363 $383,853

The accompanying notes are an integral part of these financial statements.