Royal Caribbean Cruise Lines 2001 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2001 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

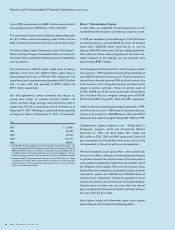

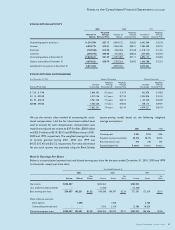

Notes to the Consolidated Financial Statements (continued)

48 Royal Caribbean Cruises Ltd.

Note 9. Retirement Plans

We maintain a defined contribution pension plan covering all of

our full-time shoreside employees who have completed the

minimum period of continuous service. Annual contributions to

the plan are based on fixed percentages of participants’ salaries

and years of service, not to exceed certain maximums. Pension

cost was $8.3 million, $7.3 million and $7.2 million for the

years 2001, 2000 and 1999, respectively.

Effective January 1, 2000, we instituted a defined benefit pension

plan to cover all of our shipboard employees not covered under

another pension plan through their collective bargaining agree-

ment. Benefits to eligible employees are accrued based on the

employee’s years of service. Pension expense was approximately

$3.2 million and $1.9 million in 2001 and 2000, respectively.

Note 10. Income Taxes

We and the majority of our subsidiaries are not subject to U.S.

corporate income tax on income generated from the interna-

tional operation of ships pursuant to Section 883 of the Internal

Revenue Code, provided that we meet certain tests related to

country of incorporation and composition of shareholders. We

believe that we and a majority of our subsidiaries meet these

tests. Income tax expense related to our remaining subsidiaries

is not significant.

Note 11. Financial Instruments

The estimated fair values of our financial instruments are

as follows (in thousands):

2001 2000

Cash and Cash Equivalents $ 727,178 $ 177,810

Long-Term Debt

(including current portion

of long-term debt) (5,031,858) (3,332,475)

Foreign Currency Forward

Contracts (losses) (99,110) (5,624)

Interest Rate Swap Agreements

in a net receivable position 35,668 24,583

Fuel Swap Agreements

in a net (payable) receivable position (7,799) 10,666

The reported fair values are based on a variety of factors and

assumptions. Accordingly, the fair values may not represent

actual values of the financial instruments that could have been

realized as of December 31, 2001 or 2000 or that will be

realized in the future and do not include expenses that could be

incurred in an actual sale or settlement. The following methods

were used to estimate the fair values of our financial instruments,

none of which are held for trading or speculative purposes:

CASH AND CASH EQUIVALENTS

The carrying amounts of cash and cash equivalents approximate

their fair values due to the short maturity of these instruments.

LONG-TERM DEBT

The fair values of our Senior Notes, Senior Debentures, Liquid

Yield Option™ Notes and Zero Coupon Convertible Notes

were estimated by obtaining quoted market prices. The fair

values of all other debt were estimated using discounted cash

flow analyses based on market rates available to us for similar

debt with the same remaining maturities.

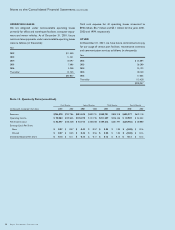

FOREIGN CURRENCY CONTRACTS

The fair values of our foreign currency forward contracts were

estimated using current market prices for similar instruments.

Our exposure to market risk for fluctuations in foreign currency

exchange rates relates to our firm commitments on vessel con-

struction contracts and forecasted transactions. We use foreign

currency forward contracts to mitigate the impact of fluctuations

in foreign currency exchange rates. As of December 31, 2001,

we had foreign currency forward contracts in a notional amount

of $1.1 billion maturing through 2003. Our foreign currency for-

ward contracts related to firm commitments on vessels under

construction had aggregate unrealized losses of approximately

$99.3 million at December 31, 2001.

INTEREST RATE SWAP AGREEMENTS

The fair values of our interest rate swap agreements were

estimated based on quoted market prices for similar or

identical financial instruments to those we hold. Our exposure

to market risk for changes in interest rates relates to our long-

term debt obligations. Market risk associated with our long-term

fixed rate debt is the potential increase in fair value resulting from

a decrease in interest rates. Market risk associated with our vari-

able rate debt is the potential increase in interest expense from

an increase in interest rates. We enter into interest rate swap

agreements to modify our exposure to interest rate movements

and to manage our interest expense. As of December 31, 2001,

we had interest rate swap agreements in effect, which exchanged

fixed interest rates for floating interest rates in a notional amount

of $525.0 million, maturing in 2006 through 2011.

FUEL SWAP AGREEMENTS

The fair values of our fuel swap agreements were estimated

based on quoted market prices for similar or identical financial

instruments to those we hold. Our exposure to market risk for

changes in bunker fuel prices relates to the forecasted

consumption of fuel on our vessels. We use fuel swap agree-

ments to mitigate the impact of fluctuations in bunker fuel

prices. As of December 31, 2001, we had fuel swap agreements

to pay fixed prices for bunker fuel with an aggregate notional

amount of $85.2 million, maturing through 2003.