Royal Caribbean Cruise Lines 2001 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2001 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

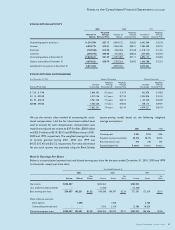

Notes to the Consolidated Financial Statements (continued)

Royal Caribbean Cruises Ltd. 43

Unrealized gains and losses on fair value hedges are recorded

on the balance sheet as offsets to the changes in fair value of

related hedged assets, liabilities and firm commitments.

Realized gains and losses on foreign currency forward

contracts that hedge foreign currency denominated firm

commitments related to vessels under construction are

included in the cost basis of the vessels. Realized gains and

losses on all other fair value hedges are recognized in earnings

as offsets to the related hedged items. For derivative instru-

ments that qualify as cash flow hedges, the effective portions of

changes in fair value of the derivatives are deferred and

recorded as a component of other comprehensive income

until the hedged transactions occur and are recognized in earn-

ings. All other portions of changes in the fair value of cash flow

hedges are recognized in earnings immediately.

Our risk-management policies and objectives for holding

hedging instruments have not changed with the adoption of

Statement of Financial Accounting Standards No. 133. The

implementation of Statement of Financial Accounting Standards

No. 133 did not have a material impact on our results of

operations or financial position at adoption or during the

twelve months ended December 31, 2001.

FOREIGN CURRENCY TRANSACTIONS

The majority of our transactions are settled in U.S. dollars.

Gains or losses resulting from transactions denominated in

other currencies and remeasurements of other currencies are

recognized in income currently.

EARNINGS PER SHARE

Basic earnings per share is computed by dividing net income,

after deducting preferred stock dividends accumulated during

the period, by the weighted-average number of shares of

common stock outstanding during each period. Diluted earnings

per share is computed by dividing net income by the weighted-

average number of shares of common stock, common stock

equivalents and other potentially dilutive securities outstanding

during each period.

STOCK-BASED COMPENSATION

We account for stock-based compensation using the intrinsic

value method and disclose certain fair market value information

with respect to our stock-based compensation activity. (See

Note 7– Shareholders’ Equity.)

SEGMENT REPORTING

We operate two cruise brands, Royal Caribbean International and

Celebrity Cruises. The brands have been aggregated as a single

operating segment based on the similarity of their economic

characteristics as well as product and services provided.

Information by geographic area is shown in the table below.

Revenues are attributed to geographic areas based on the

source of the guest.

2001 2000 1999

Revenues:

United States 81% 82% 83%

All Other Countries 19% 18% 17%

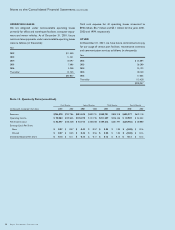

NEW ACCOUNTING PRONOUNCEMENTS

In June 2001, the Financial Accounting Standards Board

issued Statement of Financial Accounting Standards No. 142,

“Goodwill and Other Intangible Assets,” which addresses how

goodwill should be accounted for after having been initially

recognized in the financial statements. Statement of Financial

Accounting Standards No. 142 is effective for fiscal years

beginning after December 15, 2001. Upon adoption of

Financial Accounting Standards No. 142, we will cease to

amortize goodwill; goodwill amortization was $10.4 million in

2001. In addition, we are required to perform an initial

impairment review of our goodwill upon adoption and an

annual impairment review thereafter. We currently do not

expect to record an impairment charge upon completion of

the impairment review.

In August 2001, the Financial Accounting Standards Board

issued Statement of Financial Accounting Standards No. 144,

“Accounting for the Impairment or Disposal of Long-Lived

Assets.” Statement of Financial Accounting Standards No. 144

supersedes Statement of Financial Accounting Standards

No. 121, “Accounting for the Impairment of Long-Lived Assets

and for Long-Lived Assets to be Disposed Of,” and requires

(i) the recognition and measurement of the impairment of

long-lived assets to be held and used and (ii) the measurement

of long-lived assets to be held for sale. Statement of Financial

Accounting Standards No. 144 is effective for fiscal years

beginning after December 15, 2001. We do not expect the

adoption of Statement of Financial Accounting Standards

No. 144 to have a material effect on our results of operations

or financial position.

Note 3. Proposed Dual-Listed Company Merger

with P&O Princess

On November 19, 2001, we entered into an agreement with

P&O Princess Cruises plc (P&O Princess), providing for the

combination of Royal Caribbean and P&O Princess as a

merger of equals under a dual-listed company structure. If the

dual-listed company merger is completed, it would involve a

combination of the two companies through a number of

contracts and certain amendments to our Articles of

Incorporation and By-Laws and to P&O Princess’ Articles and

Memorandum of Association. The two companies would retain