Royal Caribbean Cruise Lines 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

34 Royal Caribbean Cruises Ltd.

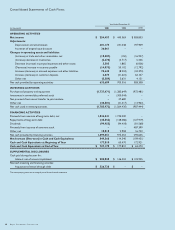

Capitalized interest decreased to $37.0 million in 2001 from

$44.2 million in 2000 due to a lower average level of invest-

ment in ships under construction and lower interest rates.

Capitalized interest increased to $44.2 million in 2000 from

$34.6 million in 1999 due to an increase in expenditures related

to ships under construction.

During 2001, we received net cash proceeds of $1.8 billion

from the issuance of Senior Notes, Liquid Yield Option™

Notes, Zero Coupon Convertible Notes, term loans, and

drawings on our revolving credit facility. We also incurred addi-

tional debt of $0.3 billion related to the acquisition of a vessel.

During 2000, we received net proceeds of $1.2 billion from the

issuance of term loans, and drawings on our revolving credit

facility. These funds were used for ship deliveries and general

corporate purposes, including capital expenditures. (See

Note 6 – Long-Term Debt.)

The Liquid Yield Option™ Notes and the Zero Coupon

Convertible Notes are zero coupon bonds with yields to matu-

rity of 4.875% and 4.75%, respectively, due 2021. Each Liquid

Yield Option™ Note and Zero Coupon Convertible Note was

issued at a price of $381.63 and $391.06, respectively, and will

have a principal amount at maturity of $1,000. The Liquid Yield

Option™ Notes and Zero Coupon Convertible Notes are

convertible at the option of the holder into 17.7 million and

13.8 million shares of common stock, respectively, if the

market price of our common stock reaches certain levels.

These conditions were not met at December 31, 2001 for the

Liquid Yield Option™ Notes or the Zero Coupon Convertible

Notes and therefore, the shares issuable upon conversion are

not included in the earnings per share calculation.

We may redeem the Liquid Yield Option™ Notes beginning on

February 2, 2005, and the Zero Coupon Convertible Notes

beginning on May 18, 2006, at their accreted values for cash as

a whole at any time, or from time to time in part. Holders may

require us to purchase any outstanding Liquid Yield Option™

Notes at their accreted value on February 2, 2005 and

February 2, 2011 and any outstanding Zero Coupon

Convertible Notes at their accreted value on May 18, 2004,

May 18, 2009, and May 18, 2014. We may choose to pay the

purchase price in cash or common stock or a combination

thereof. In addition, we have a three-year, $345.8 million unse-

cured variable rate term loan facility available to us should the

holders of the Zero Coupon Convertible Notes require us to

purchase their notes on May 18, 2004.

In July 2000, we invested approximately $300 million in

convertible preferred stock issued by First Choice Holidays PLC.

Independently, we entered into a joint venture with First

Choice Holidays PLC to launch a new cruise brand, Island

Cruises. As part of the transaction, ownership of Viking

Serenade was transferred to the new joint venture at a valua-

tion of $95.4 million. The contribution of Viking Serenade

represents our 50% investment in the joint venture, as well as

$47.7 million in proceeds used towards the purchase price of

the convertible preferred stock.

We made principal payments totaling approximately $45.6 mil-

lion, $128.1 million and $127.9 million under various term loans

and capital leases during 2001, 2000 and 1999, respectively.

During 2001, 2000 and 1999, we paid quarterly cash dividends

on our common stock totaling $100.0 million, $91.3 million and

$69.1 million, respectively. In April 2000, we redeemed all

outstanding shares of our convertible preferred stock and

dividends ceased to accrue. We paid quarterly cash dividends

on our convertible preferred stock totaling $3.1 million and

$12.5 million in 2000 and 1999, respectively.

In 1999, we issued 10,825,000 shares of common stock.

The net proceeds were approximately $487.4 million.

(See Note 7 – Shareholders’ Equity.)

FUTURE COMMITMENTS

We currently have six ships on order for an additional capacity

of 14,562 berths. The aggregate contract price of the six ships,

which excludes capitalized interest and other ancillary costs, is

approximately $2.6 billion, of which we have deposited

$316.5 million as of December 31, 2001. Additional deposits

are due prior to the dates of delivery of $127.0 million in 2002

and $5.2 million in 2003. We anticipate that overall capital

expenditures will be approximately $1.1 billion, $1.1 billion and

$1.0 billion for 2002, 2003 and 2004, respectively. Two of the

ships on order, with an aggregate capacity of 4,200 berths, are

committed to the joint venture with P&O Princess. The aggregate

contract price of these two ships, excluding capitalized interest

and other ancillary costs, is approximately $0.8 billion and is

included in our projected capital costs above.