Royal Caribbean Cruise Lines 2001 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2001 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

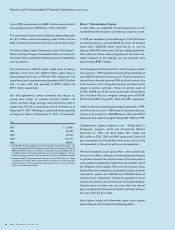

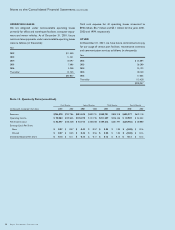

Notes to the Consolidated Financial Statements (continued)

Royal Caribbean Cruises Ltd. 49

Our exposure under foreign currency contracts, interest rate

and fuel swap agreements is limited to the cost of replacing the

contracts in the event of non-performance by the counter-

parties to the contracts, all of which are currently our lending

banks. To minimize this risk, we select counterparties with

credit risks acceptable to us and we limit our exposure to

any individual counterparty. Furthermore, all foreign

currency forward contracts are denominated in primary

currencies.

Note 12. Commitments and Contingencies

CAPITAL EXPENDITURES

As of December 31, 2001, we have six ships on order. Three

are Radiance-class vessels scheduled for delivery in the third

quarter of 2002, fourth quarter of 2003 and second quarter of

2004. Two are Voyager-class vessels with delivery scheduled in

the first quarters of 2003 and 2004. One is a Millennium-class

vessel scheduled for delivery in the second quarter of 2002.

The aggregate contract price of the six ships, which excludes

capitalized interest and other ancillary costs, is approximately

$2.6 billion, of which we have deposited $316.5 million as of

December 31, 2001. Additional deposits are due prior to the

dates of delivery of $127.0 million in 2002 and $5.2 million in

2003. We anticipate that overall capital expenditures will be

approximately $1.1 billion, $1.1 billion and $1.0 billion for

2002, 2003 and 2004, respectively. Two of the ships on order,

with an aggregate capacity of 4,200 berths, are committed to

the joint venture with P&O Princess. The aggregate contract

price of these two ships, excluding capitalized interest and

other ancillary costs, is approximately $0.8 billion and is

included in our projected capital costs above.

Pursuant to the joint venture agreement entered into in

November 2001 with P&O Princess, we have committed up

to $500.0 million in shareholder equity, with approximately

$5.0 million contributed to date and the balance due and

payable when called by the joint venture company. We have

agreed to assign our ship-build contracts for Serenade of the

Seas and Jewel of the Seas to the joint venture company. The

aggregate contract price of these two ships, excluding capi-

talized interest and other ancillary costs, is approximately

$0.8 billion, of which we have deposited $79.3 million as of

December 31, 2001. Also, we have obtained commitments for

export financing for up to 80% of the contract price of these

two vessels. Any payments we have made under these

contracts prior to assignment will be credited against our

shareholder equity commitment. The joint venture share-

holders intend that the joint venture company be financed

through third-party indebtedness and each joint venture share-

holder has committed to provide necessary credit support in

the form of guarantees on a pro rata basis, subject to legal or

regulatory restrictions. To the extent that third-party financing

cannot be obtained, and if approved in accordance with the

terms of the joint venture agreement, the joint venture share-

holders will provide financing on a pro rata basis on identical

terms. Subject to the terms of the joint venture agreement, the

agreement can be terminated by either party if certain

commercial benchmarks have not been achieved by January 1,

2003 or April 1, 2003.

Under the joint venture agreement, if a change of control

occurs with respect to a joint venture shareholder, the other

shareholder has a right to acquire the interest of that share-

holder at fair market value in exchange for preferred stock or a

15-year subordinated note (or a combination thereof) of the

purchasing shareholder. Notwithstanding the foregoing, the joint

venture shareholder subject to a change of control has

the right, subject to certain conditions, to put its interest in the

joint venture to the other joint venture shareholder at a

discount to fair market value in exchange for preferred stock

or a 20-year subordinated note (or a combination thereof) of

the purchasing shareholder.

LITIGATION

In April 1999, a lawsuit was filed in the United States District

Court for the Southern District of New York on behalf of

current and former crew members alleging that we failed to

pay the plaintiffs their full wages. The suit seeks payment of

(i) the wages alleged to be owed, (ii) penalty wages under

46 U.S.C. Section 10313 of U.S. law and (iii) punitive

damages. In November 1999, a purported class action suit was

filed in the same court alleging a similar cause of action. We are

not able at this time to estimate the impact of these proceedings

on us; there can be no assurance that such proceedings, if

decided adversely, would not have a material adverse effect on

our results of operations.

We are routinely involved in other claims typical within the

cruise industry. The majority of these claims is covered by

insurance. We believe the outcome of such other claims, net

of expected insurance recoveries, is not expected to have a

material adverse effect upon our financial condition or

results of operations.