Royal Caribbean Cruise Lines 2001 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2001 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

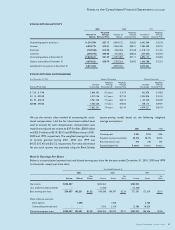

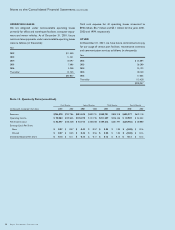

Notes to the Consolidated Financial Statements

42 Royal Caribbean Cruises Ltd.

Note 1. General

DESCRIPTION OF BUSINESS

We are a global cruise company. We operate two cruise

brands, Royal Caribbean International and Celebrity Cruises,

with 15 cruise ships and 8 cruise ships, respectively, at

December 31, 2001. Our ships operate on a selection of

worldwide itineraries that call on approximately 200 destinations.

BASIS FOR PREPARATION OF CONSOLIDATED

FINANCIAL STATEMENTS

The consolidated financial statements are prepared in

accordance with U.S. generally accepted accounting principles

and are presented in U.S. dollars. Estimates are required for

the preparation of financial statements in accordance with

generally accepted accounting principles. Actual results could

differ from these estimates. All significant intercompany

accounts and transactions are eliminated in consolidation.

Note 2. Summary of Significant Accounting Policies

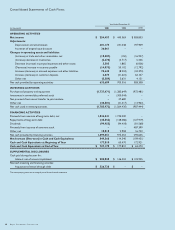

CRUISE REVENUES AND EXPENSES

Deposits received on sales of guest cruises represent unearned

revenue and are initially recorded as customer deposit liabilities

on our balance sheet. Customer deposits are subsequently

recognized as cruise revenues, together with revenues from

shipboard activities and all associated direct costs of a voyage,

upon completion of voyages with durations of ten days or less

and on a pro rata basis for voyages in excess of ten days. Minor

amounts of revenues and expenses from pro rata voyages are

estimated.

CASH AND CASH EQUIVALENTS

Cash and cash equivalents include cash and marketable securities

with original maturities of less than 90 days.

INVENTORIES

Inventories consist of provisions, supplies and fuel carried at

the lower of cost (weighted-average) or market.

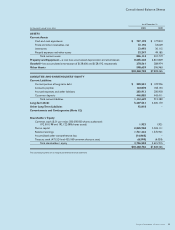

PROPERTY AND EQUIPMENT

Property and equipment are stated at cost less accumulated

depreciation and amortization. We capitalize interest as part of

the cost of construction. Significant vessel improvement costs

are capitalized as additions to the vessel, while costs of repairs

and maintenance are charged to expense as incurred. We

review long-lived assets for impairment whenever events or

changes in circumstances indicate, based on estimated future

cash flows, that the carrying amount of these assets may not be

fully recoverable.

Depreciation of property and equipment, which includes

amortization of vessels under capital leases, is computed using

the straight-line method over useful lives of primarily 30 years

for vessels and three to ten years for other property and

equipment. (See Note 4 – Property and Equipment.)

GOODWILL

Goodwill represents the excess of cost over the fair value of

net assets acquired and is being amortized over 40 years using

the straight-line method. We review goodwill and other intan-

gible assets for impairment whenever events or changes in

circumstances indicate that the carrying amount of these assets

may not be fully recoverable.

ADVERTISING COSTS

Advertising costs are expensed as incurred except those costs

which result in tangible assets, such as brochures, are treated

as prepaid expenses and charged to expense as consumed.

Advertising expenses consist of media advertising as well as

brochure, production and direct mail costs. Media advertising

was $103.4 million, $98.9 million and $93.1 million, and

brochure, production and direct mail costs were $77.5 million,

$79.2 million and $57.4 million for the years 2001, 2000 and

1999, respectively.

DRYDOCKING

Drydocking costs are accrued evenly over the period to the

next scheduled drydocking and are included in accrued

expenses and other liabilities.

FINANCIAL INSTRUMENTS

We enter into various forward, swap and option contracts to

manage our interest rate exposure and to limit our exposure

to fluctuations in foreign currency exchange rates and bunker

fuel prices.

On January 1, 2001, we adopted Statement of Financial

Accounting Standards No. 133, “Accounting for Derivative

Instruments and Hedging Activities,” as amended, which

requires that all derivative instruments be recorded on the

balance sheet at their fair value. On an ongoing basis, we assess

whether derivatives used in hedging transactions are “highly

effective” in offsetting changes in fair value or cash flow of

hedged items and therefore qualify as either a fair value or cash

flow hedge. A derivative instrument that hedges the exposure

to changes in the fair value of a recognized asset or a liability, or

a firm commitment is designated as a fair value hedge. A

derivative instrument that hedges a forecasted transaction or

the variability of cash flows related to a recognized liability is

designated as a cash flow hedge.