Royal Caribbean Cruise Lines 2001 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2001 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

28 Royal Caribbean Cruises Ltd.

As used in this document, the terms “Royal Caribbean,” “we,”

“our” and “us” refer to Royal Caribbean Cruises Ltd., the term

“Celebrity” refers to Celebrity Cruise Lines Inc. and the terms

“Royal Caribbean International” and “Celebrity Cruises” refer to

our two cruise brands. In accordance with industry practice, the

term “berths” is determined based on double occupancy per cabin

even though some cabins can accommodate three or four guests.

Certain statements under this caption “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations,” in our letter to shareholders and elsewhere in

this document constitute forward-looking statements under the

Private Securities Litigation Reform Act of 1995. Forward-

looking statements do not guarantee future performance and

may involve risks, uncertainties and other factors which could

cause our actual results, performance or achievements to differ

materially from the future results, performance or achievements

expressed or implied in those forward-looking statements.

Examples of these risks, uncertainties and other factors include,

but are not limited to:

• general economic and business conditions,

• cruise industry competition,

• changes in vacation industry capacity, including cruise capacity,

• the impact of tax laws and regulations affecting our business

or our principal shareholders,

• the impact of changes in other laws and regulations affecting

our business,

• the impact of pending or threatened litigation,

• the delivery of scheduled new vessels,

• emergency ship repairs,

• incidents involving cruise vessels at sea,

• reduced consumer demand for cruises as a result of any

number of reasons, including armed conflict, political insta-

bility, or the unavailability of air service,

• changes in interest rates or oil prices, and

• weather.

The above examples may not be exhaustive and new risks emerge

from time to time. We undertake no obligation to publicly update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise.

General

SUMMARY

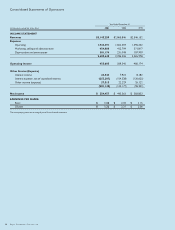

We reported net income and earnings per share for the year

ended December 31, 2001 as shown in the table below. Net

income decreased 42.9% to $254.5 million or $1.32 per share

on a diluted basis in 2001 compared to $445.4 million or

$2.31 per share in 2000. The decrease in net income is primarily

the result of lost revenues and additional costs associated with

events related to September 11, 2001, and ships out of service.

Additionally, net income was impacted by a decline in net

revenues per available passenger cruise day due to a general

softness in the U.S. economy and a significant growth of our

fleet capacity. The increase in capacity is associated with the

addition of Millennium and Explorer of the Seas in 2000 and

Infinity, Radiance of the Seas, Summit, and Adventure of the Seas

in 2001.

Net income for 2001 was adversely impacted by approximately

$47.7 million due to lost revenues and extra costs directly

associated with passengers not being able to reach their depar-

ture ports during the weeks following the terrorist attacks

of September 11, 2001 and costs associated with business deci-

sions taken in the aftermath of the attacks. Also, net income

was negatively impacted by approximately $30.7 million from

the cancellation of nine weeks of sailings due to ship incidents,

partially offset by $14.0 million related to insurance claims from

prior years. Net income for 1999 was adversely impacted by

$17.3 million of non-recurring settlement-related charges and

by $12.8 million, net of insurance recoveries, for ships out of

service. Accordingly, on a comparable basis, before the impact

of September 11, 2001, ships out of service, insurance claims

and the settlement charges, earnings were $318.9 million or

$1.65 per share in 2001 versus $445.4 million or $2.31 per

share in 2000 and $414.0 million or $2.22 per share in 1999.

There were no significant events or circumstances in 2000 for

which an adjustment was appropriate to make 2000 net income

comparable to adjusted 2001 and 1999 earnings.

(in thousands, Year Ended December 31,

except per share data) 2001 2000 1999

Revenues $3,145,250 $2,865,846 $2,546,152

Operating Income 455,605 569,540 480,174

Net Income 254,457 445,363 383,853

Basic Earnings

Per Share $ 1.32 $ 2.34 $ 2.15

Diluted Earnings

Per Share $ 1.32 $ 2.31 $ 2.06