Royal Caribbean Cruise Lines 2001 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2001 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

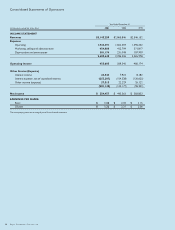

SELECTED STATISTICAL INFORMATION (UNAUDITED):

2001 2000 1999

Guests Carried 2,438,849 2,049,902 1,704,034

Guest Cruise Days 15,341,570 13,019,811 11,227,196

Occupancy Percentage 101.8% 104.4% 104.7%

PROPOSED DUAL-LISTED COMPANY MERGER WITH

P&O PRINCESS CRUISES PLC

On November 19, 2001, we entered into an agreement with

P&O Princess Cruises plc (P&O Princess), providing for the

combination of Royal Caribbean and P&O Princess as a merger

of equals under a dual-listed company structure. If the dual-listed

company merger is completed, it would involve a combination

of the two companies through a number of contracts and

certain amendments to our Articles of Incorporation and By-Laws

and to P&O Princess’ Articles and Memorandum of

Association. The two companies would retain their separate

legal identities but would operate as if they were a single

unified economic entity. The contracts governing the dual-listed

company merger would provide that the boards of directors of

the two companies would be identical and that, as far as possi-

ble, the shareholders of Royal Caribbean and P&O Princess

would be placed in substantially the same economic position as

if they held shares in a single enterprise which owned all of the

assets of both companies. The net effect of the dual-listed

company merger would be that the shareholders of Royal

Caribbean would own an economic interest equal to 49.3% of

the combined company and the shareholders of P&O Princess

would own an economic interest equal to 50.7% of the

combined company.

The obligations of Royal Caribbean and P&O Princess to effect

the dual-listed company merger are subject to the satisfaction of

various conditions, including the receipt of certain regulatory

approvals and consents and approval by the shareholders of

each of Royal Caribbean and P&O Princess. No assurance can

be given that all required approvals and consents will be

obtained, and if such approvals and consents are obtained, no

assurance can be given as to the terms, conditions and timing of

the approvals and consents. If the dual-listed company merger

is not completed by November 16, 2002, either party can

terminate the agreement if it is not in material breach of its

obligations thereunder. We have incurred, and continue to

incur, costs which have been or will be deferred in connection

with the dual-listed company merger. In the event the transaction

is not consummated, we would be required to write these costs

off, resulting in an estimated impact to earnings of approximately

$15 million. If the dual-listed company merger is completed,

these deferred costs, together with additional costs, would be

capitalized as part of the transaction.

If the merger agreement is terminated under certain circum-

stances, we would be obligated to pay P&O Princess a break

fee of $62.5 million. These circumstances include, among other

things, our board of directors withdrawing or adversely

modifying its recommendation to shareholders to approve the

dual-listed company merger, our board of directors recom-

mending an alternative acquisition transaction to shareholders,

and our shareholders failing to approve the dual-listed

company merger if another acquisition proposal with respect

to Royal Caribbean exists at that time. Similarly, P&O Princess

would be obligated to pay us a break fee of $62.5 million upon

the occurrence of reciprocal circumstances.

In December 2001, Carnival Corporation (Carnival) announced

a competing pre-conditional offer to acquire all of the

outstanding shares of P&O Princess. In connection with its pre-

conditional offer, Carnival solicited proxies from P&O Princess’

shareholders in favor of an adjournment of the P&O

Princess’ special meeting prior to a shareholder vote to

approve the dual-listed company merger. On February 14,

2002, Royal Caribbean and P&O Princess convened special

meetings of their respective shareholders to approve the dual-

listed company merger. Prior to voting to approve the merger,

the shareholders of each company voted to adjourn their

respective meetings until an unspecified future date. We do not

know at this time the date on which the meetings will be

reconvened.

JOINT VENTURE WITH P&O PRINCESS

On November 19, 2001, we entered into a joint venture

agreement with P&O Princess to target customers in southern

Europe. The joint venture company is owned 50% by P&O

Princess and 50% by us. Each party has committed up to

$500.0 million in shareholder equity, with approximately

$5.0 million contributed by each party to date and the balance

due and payable when called by the joint venture company. Each

party has agreed to assign two identified ship-build contracts to

the joint venture company, which will be held in trust for the joint

venture company pending such assignments. Any payments we

have made under these contracts prior to assignment will be

credited against our shareholder equity commitment. Subject to

the terms of the agreement, the joint venture agreement can be

terminated by either party if certain commercial benchmarks

have not been achieved by January 1, 2003 or April 1, 2003. The

joint venture agreement does not require the approval of the

shareholders of Royal Caribbean or P&O Princess. (See Future

Commitments.)

Royal Caribbean Cruises Ltd. 29

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)