Royal Caribbean Cruise Lines 2001 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2001 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Royal Caribbean Cruises Ltd. 33

Year Ended December 31, 2000 Compared to Year

Ended December 31, 1999

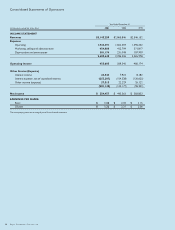

REVENUES

Revenues increased 12.6% to $2.9 billion in 2000 compared to

$2.5 billion for the same period in 1999. The increase in

revenues is due to a 16.4% increase in capacity partially offset

by a 3.3% decline in gross revenue per available passenger

cruise day. The increase in capacity is primarily associated with

the addition to the fleet of Voyager of the Seas in 1999, and

Millennium and Explorer of the Seas in 2000. The decline in

gross revenue per available passenger cruise day was due to

lower cruise ticket prices, a lower percentage of guests

electing to use our air program and lower shipboard revenue

per diems due to a higher use of concessionaires onboard the

Royal Caribbean International vessels in 2000. Concessionaires

pay us a net commission, which is recorded as revenue, in

contrast to in-house operations, where shipboard revenues

and related cost of sales are recorded on a gross basis. Net

revenue per available passenger cruise day for 2000 was

approximately the same as in 1999. Occupancy for 2000

was 104.4% compared to 104.7% in 1999.

EXPENSES

Operating expenses increased 10.4% to $1.7 billion in 2000 as

compared to $1.5 billion in 1999. The increase is primarily due

to additional costs associated with increased capacity and an

increase in fuel costs, partially offset by a decrease in air

expenses due to a lower percentage of guests electing to use

our air program, as well as lower shipboard cost of sales due to

the increased use of concessionaires as discussed previously.

Included in 1999 operating expenses are charges of

$17.3 million related to settlements with the U.S. Department

of Justice and the State of Alaska. Excluding the settlements,

operating expenses as a percentage of revenues decreased to

57.7% in 2000 from 58.1% in 1999.

Marketing, selling and administrative expenses increased

11.0% to $412.8 million in 2000 from $371.8 million in 1999.

The increase is primarily due to television advertising costs

associated with our new advertising campaigns to promote

brand awareness, as well as increased administrative staffing

levels and investment in information technology to support our

growth. Marketing, selling and administrative expenses as a

percentage of revenues decreased from 14.6% in 1999 to

14.4% in 2000.

Depreciation and amortization increased 16.7% to $231.0 million

in 2000 from $197.9 million in 1999. The increase is due

to incremental depreciation associated with the addition of

new ships, as well as shoreside capital expenditures primarily

related to information technology in support of our growth plans.

OTHER INCOME (EXPENSE)

Gross interest expense (excluding capitalized interest)

increased to $198.5 million in 2000 as compared to

$165.2 million in 1999. The increase is due primarily to higher

debt levels associated with our fleet expansion program and

higher interest rates. Capitalized interest increased $9.6 million

from $34.6 million in 1999 to $44.2 million in 2000, due to an

increase in expenditures related to ships under construction.

Included in Other income (expense) in 2000 is approximately

$10.2 million of compensation from a shipyard related to the

delivery of Millennium and $9.2 million of dividend income

from our July 2000 investment in convertible preferred stock

of First Choice Holidays PLC. (See Liquidity and Capital

Resources.) Included in Other income (expense) in 1999 is

$26.5 million of loss-of-hire insurance resulting from ships out

of service.

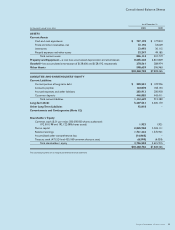

Liquidity and Capital Resources

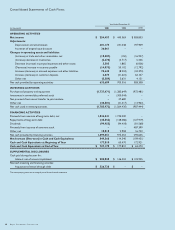

SOURCES AND USES OF CASH

Net cash provided by operating activities was $633.7 million in

2001 as compared to $703.3 million in 2000 and $583.4 million

in 1999. The change in each year was primarily due to fluctuations

in net income.

During the year ended December 31, 2001, our capital

expenditures were approximately $2.1 billion, consisting of

approximately $1.8 billion in cash payments and approximately

$0.3 billion related to the acquisition of a vessel through debt,

as compared to $1.3 billion during 2000 and $1.0 billion during

1999. The largest portion of capital expenditures related to the

deliveries of Infinity, Radiance of the Seas, Summit, and

Adventure of the Seas in 2001; Millennium and Explorer of the

Seas in 2000; and Voyager of the Seas in 1999, as well as

progress payments for ships under construction in all years.