Royal Caribbean Cruise Lines 2001 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2001 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Royal Caribbean Cruises Ltd. 35

In June 2001, we deferred our options to purchase two addi-

tional Radiance-class vessels with delivery dates in the third

quarters of 2005 and 2006. The options have an aggregate

contract price of $804.6 million. Our right to cancel the

options was extended to on or before July 26, 2002.

Pursuant to the joint venture agreement entered into in

November 2001 with P&O Princess, we have committed up

to $500.0 million in shareholder equity, with approximately

$5.0 million contributed to date and the balance due and

payable when called by the joint venture company. We have

agreed to assign our ship-build contracts for Serenade of the Seas

and Jewel of the Seas to the joint venture company. The aggregate

contract price of these two ships, excluding capitalized interest

and other ancillary costs, is approximately $0.8 billion, of which

we have deposited $79.3 million as of December 31, 2001.

Also, we have obtained commitments for export financing for

up to 80% of the contract price of these two vessels. Any

payments we have made under these contracts prior to assign-

ment will be credited against our shareholder equity commitment.

The joint venture shareholders intend that the joint venture

company be financed through third-party indebtedness and

each joint venture shareholder has committed to provide

necessary credit support in the form of guarantees on a pro rata

basis, subject to legal or regulatory restrictions. To the extent

that third-party financing cannot be obtained, and if approved in

accordance with the terms of the joint venture agreement, the

joint venture shareholders will provide financing on a pro rata

basis on identical terms. Subject to the terms of the joint

venture agreement, the agreement can be terminated by either

party if certain commercial benchmarks have not been achieved

by January 1, 2003 or April 1, 2003.

Under the joint venture agreement, if a change of control

occurs with respect to a joint venture shareholder, the other

shareholder has a right to acquire the interest of that shareholder

at fair market value in exchange for preferred stock or a 15-year

subordinated note (or a combination thereof) of the purchasing

shareholder. Notwithstanding the foregoing, the joint venture

shareholder subject to a change of control has the right, subject

to certain conditions, to put its interest in the joint venture to

the other joint venture shareholder at a discount to fair market

value in exchange for preferred stock or a 20-year subordinated

note (or a combination thereof) of the purchasing shareholder.

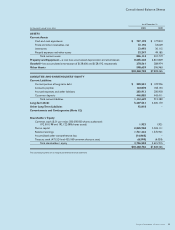

We have $5.6 billion of long-term debt of which $238.6 million

is due during the 12-month period ending December 31, 2002.

The vast majority of our property and equipment consists of

vessels. We own all but two ships, which were financed with

capital leases. These capital lease obligations are included as a

component of long-term debt. (See Note 6 – Long-Term Debt.)

We are obligated under noncancelable operating leases

primarily for office and warehouse facilities, computer equip-

ment and motor vehicles. As of December 31, 2001, future

minimum lease payments under noncancelable operating leases

aggregated to $87.9 million, due primarily through 2016. We

have future commitments to pay for our usage of certain port

facilities, maintenance contracts and communication services

aggregating $228.2 million, due through 2014. (See Note 12 –

Commitments and Contingencies.)

As a normal part of our business, depending on market condi-

tions, pricing and our overall growth strategy, we continuously

consider opportunities to enter into contracts for the building

of additional ships. We may also consider the sale of ships. We

continuously consider potential acquisitions and strategic

alliances. If any of these were to occur, they would be financed

through the incurrence of additional indebtedness, the

issuance of additional shares of equity securities or through

cash flows from operations.

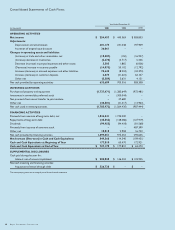

FUNDING SOURCES

As of December 31, 2001, our liquidity was $1.4 billion

consisting of approximately $0.7 billion in cash and cash equiv-

alents and approximately $0.7 billion available under our

$1.0 billion unsecured revolving credit facility. Our $1.0 billion

revolving credit facility expires June 2003. Any amounts

outstanding at that time will be payable immediately if the facil-

ity is not renewed. We intend to renew or replace this facility

prior to its expiration date. The margin and facility fee under

our $1.0 billion unsecured revolving credit facility and the

$625.0 million unsecured term loan vary with our credit rating

and were increased 0.20% and 0.25%, respectively, as a result

of the lowering of our credit rating by Standard & Poors to

BB+ and Moody’s to Ba2 in the fourth quarter of 2001 and

currently are at their highest contractual levels. In addition, we

have obtained commitments for export financing for up to