Regions Bank 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254

|

|

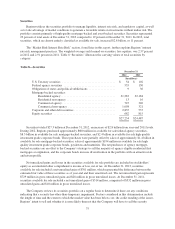

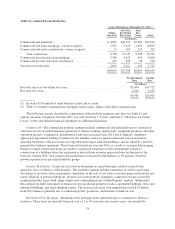

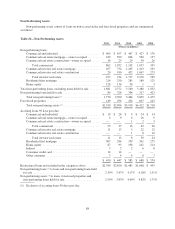

borrowers to finance their primary residence. These loans experienced a $0.8 billion decline to $13.0 billion in

2012, primarily due to consumer deleveraging. However, mortgage origination volume increased to $8.0 billion

in 2012 as compared to $6.3 billion in 2011 reflecting customers taking advantage of the opportunity to refinance

under the extended Home Affordable Refinance Program, or HARP II. A significant portion of mortgage

originations were sold in the secondary market. At the end of 2012, Regions began the process of retaining

15 year fixed-rate mortgage production on the balance sheet which should mitigate additional balance reductions

going forward. Refer to Note 6 “Allowance for Credit Losses” to the consolidated financial statements for

additional discussion.

Home Equity—Home equity lending includes both home equity loans and lines of credit. This type of

lending, which is secured by a first or second mortgage on the borrower’s residence, allows customers to borrow

against the equity in their home. Substantially all of this portfolio was originated through Regions’ branch

network. During 2012, home equity balances decreased $1.2 billion to $11.8 billion, driven by consumer

deleveraging and refinancing. Net charge-offs within the home equity portfolio remain elevated, but decreased in

2012 as compared to 2011. Most of the improvement in losses came from Florida second liens because property

values in Florida markets have either stabilized or started to increase. More information related to these

developments is included in the “Home Equity” discussion below.

Indirect— Indirect lending, which is lending initiated through third-party business partners, is largely

comprised of loans made through automotive dealerships. This portfolio class increased $488 million, or

26 percent in 2012, reflecting growth from the late 2010 re-entry into the indirect auto lending business. Regions

currently has over 1,900 dealers in its network.

Consumer Credit Card—During the second quarter of 2011, Regions completed the purchase of

approximately $1.0 billion of existing Regions-branded consumer credit card accounts from FIA Card Services.

The products are primarily open-ended variable interest rate consumer credit card loans. In the third quarter of

2012, Regions assumed the servicing of these loans from FIA Card Services.

Other Consumer—Other consumer loans include direct consumer installment loans, overdrafts and other

revolving loans. Other consumer loans totaled $1.2 billion at December 31, 2012, relatively unchanged from the

prior year.

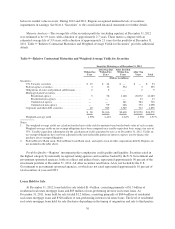

CREDIT QUALITY

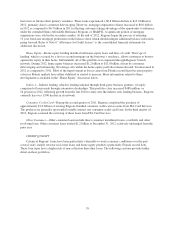

Certain of Regions’ loans have been particularly vulnerable to weak economic conditions over the past

several years, mainly investor real estate loans and home equity products (particularly Florida second lien).

These loan types have a higher risk of non-collection than other loans. The following sections provide further

detail on these portfolios.

79