Regions Bank 2012 Annual Report Download - page 62

Download and view the complete annual report

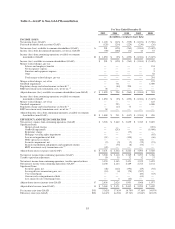

Please find page 62 of the 2012 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.payments and maturities for the next 12 months or (3) a minimum balance of $500 million. At

December 31, 2012, the Company’s borrowing capacity with the Federal Reserve Discount Window was

$19.6 billion based on available collateral. Borrowing capacity with the Federal Home Loan Bank

(“FHLB”) was $6.7 billion based on available collateral at the same date. Additionally, the Company has

$14.4 billion of unencumbered liquid securities available for pledging or repurchase agreements. The Board

of Directors has also approved a bank note program which would allow Regions Bank to issue up to

$20 billion in aggregate principal amount of bank notes outstanding at any one time. As of December 31,

2012, no issues have been made under this program. In addition, during the course of 2012 Regions received

favorable results from the four major credit rating agencies. In the first half of 2012, Standard & Poor’s

(“S&P”) upgraded the credit ratings for each of the obligations of both Regions and Regions Bank and

Dominion Bond Rating Service (“DBRS”) revised its outlook for Regions from negative to positive. In the

latter half of 2012, Moody’s upgraded the long-term ratings of Regions and Regions Bank from Ba3 to Ba1

and from Ba2 to Baa3, respectively, and Fitch Ratings (“Fitch”) revised its outlook for Regions from stable

to positive. For more information, refer to the following additional sections within this Form 10-K:

• Discussion of Short-Term Borrowings within the Balance Sheet Analysis section of MD&A

• Discussion of Long-Term Borrowings within the Balance Sheet Analysis section of MD&A

• Ratings section of MD&A

• Bank Regulatory Capital Requirements section of MD&A

• Liquidity Risk section of MD&A

• Note 11 “Short-Term Borrowings” to the consolidated financial statements

• Note 12 “Long-Term Borrowings” to the consolidated financial statements

Credit

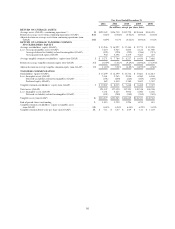

The economy has been and will be the primary factor which influences Regions’ loan portfolio.

Throughout 2012 the economy continued to work through structural headwinds including commercial and

consumer deleveraging, high unemployment, a weak housing market, and fiscal uncertainty at the local,

state and national levels. In spite of the slow and uneven pace of the economic recovery, Regions

experienced significant improvement in credit quality in both 2011 and 2012. Regions’ investor real estate

loan portfolio, which includes credit to real estate developers and investors for the financing of land or

buildings, declined 28 percent in 2012 and totaled $7.7 billion as of December 31, 2012. In addition, the

land, single-family and condominium components of the investor real estate portfolio, which have been the

Company’s most distressed loans, declined 33 percent and ended the year at $1.2 billion. The reduction in

investor real estate over the past few years has aided in a 42 percent decline in total gross inflows of non-

performing loans in 2012. In addition, commercial and investor real estate criticized and classified loans,

which are the Company’s earliest indicator of problem loans, declined 29 percent, and non-performing

assets decreased 36 percent during 2012. These favorable trends contributed to a 47 percent decline in net

charge-offs and an 86 percent decrease in the 2012 loan loss provision. The allowance for loan losses to

total loans decreased to 2.59 percent as of December 31, 2012 from 3.54 percent as of December 31, 2011

and the coverage ratio of allowance for loan losses to non-performing loans was 1.14x as of December 31,

2012, compared to 1.16x as of December 31, 2011. For more information, refer to the following additional

sections within this Form 10-K:

• 2012 Overview discussion in MD&A

• Discussion of Allowance for Credit Losses within the Critical Accounting Policies and Estimates

section of MD&A

• Loans and Allowance for Credit Losses discussion within the Balance Sheet Analysis section of

MD&A

46