Regions Bank 2012 Annual Report Download - page 188

Download and view the complete annual report

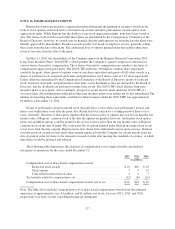

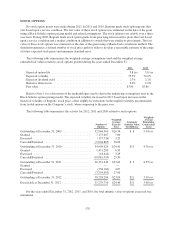

Please find page 188 of the 2012 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Regions may, from time to time, consider opportunistically retiring outstanding issued securities, including

subordinated debt, trust preferred securities and preferred shares in privately negotiated or open market

transactions for cash or common shares.

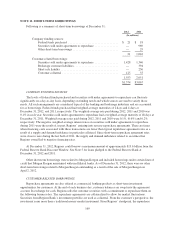

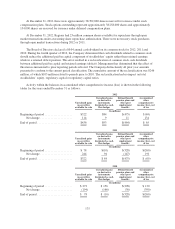

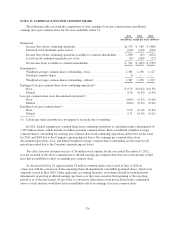

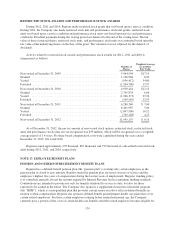

NOTE 13. REGULATORY CAPITAL REQUIREMENTS AND RESTRICTIONS

Regions and Regions Bank are required to comply with regulatory capital requirements established by

Federal banking agencies. These regulatory capital requirements involve quantitative measures of the Company’s

assets, liabilities and certain off-balance sheet items, and also qualitative judgments by the regulators. Failure to

meet minimum capital requirements can subject the Company to a series of increasingly restrictive regulatory

actions. Currently, there are two basic measures of capital adequacy: a risk-based measure and a leverage

measure.

The risk-based capital requirements are designed to make regulatory capital requirements more sensitive to

differences in credit and market risk profiles among banks and bank holding companies, to account for off-

balance sheet exposure and interest rate risk, and to minimize disincentives for holding liquid assets. Assets and

off-balance sheet items are assigned to broad risk categories, each with specified risk-weighting factors. The

resulting capital ratios represent capital as a percentage of total risk-weighted assets and off-balance sheet items.

Banking organizations that are considered to have excessive interest rate risk exposure are required to maintain

higher levels of capital.

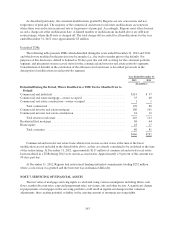

The minimum standard for the ratio of total capital to risk-weighted assets is 8 percent. At least 50 percent

of that capital level (which equates to a 4 percent minimum) must consist of common equity, undivided profits

and non-cumulative perpetual preferred stock, senior perpetual preferred stock issued to the U.S. Treasury under

the Capital Purchase Program, minority interests relating to qualifying common or noncumulative perpetual

preferred stock issued by a consolidated U.S. depository institution or foreign bank subsidiary, less goodwill,

disallowed deferred tax assets and certain other intangibles (“Tier 1 capital”). The remainder (“Tier 2 capital”)

may consist of a limited amount of other preferred stock, mandatorily convertible securities, subordinated debt,

and a limited amount of the allowance for loan losses. The sum of Tier 1 capital and Tier 2 capital is “total risk-

based capital” or total capital. However, under the Collins Amendment that was passed as a section of the Dodd-

Frank Act, trust preferred securities will be eliminated as an element of Tier 1 capital. This disallowance of trust

preferred securities will be phased in from January 1, 2013 to January 1, 2016. During the fourth quarter of 2012,

Regions redeemed its 8.875% Junior Subordinated Notes due 2048, which caused redemption of the related trust

preferred securities. The aggregate principal amount of the notes was approximately $345 million. As of

December 31, 2012, Regions had $501 million of trust preferred securities that are subject to the Collins

Amendment and $482 million of preferred securities that are exempt from the Collins Amendment. As discussed

in Note 14 “Stockholders’ Equity and Accumulated Other Comprehensive Income (Loss)”, on April 4, 2012,

$3.5 billion of Series A preferred shares issued to the U.S. Treasury were repurchased.

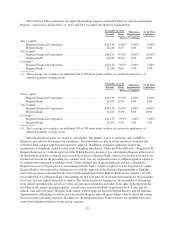

The minimum guidelines to be considered well capitalized for Total capital and Tier 1 capital are 10 percent

and 6 percent, respectively. As of December 31, 2012 and 2011, Regions and its significant subsidiaries are well

capitalized under the regulatory framework.

The Company believes that no changes in conditions or events have occurred since December 31, 2012,

which would result in changes that would cause Regions or Regions Bank to fall below the well capitalized level.

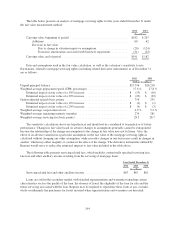

The banking regulatory agencies also have adopted regulations that supplement the risk-based guidelines to

include a minimum ratio of 3 percent of Tier 1 capital to average assets less goodwill and disallowed deferred tax

assets (the “Leverage ratio”). Depending upon the risk profile of the institution and other factors, the regulatory

agencies may require a Leverage ratio of 1 percent to 2 percent above the minimum 3 percent level.

172