Regions Bank 2012 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2012 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

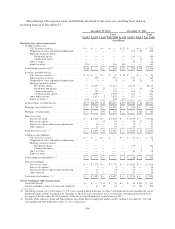

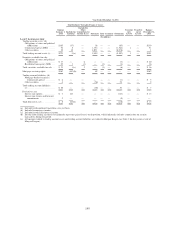

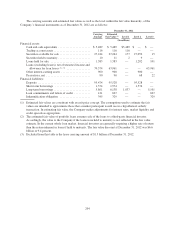

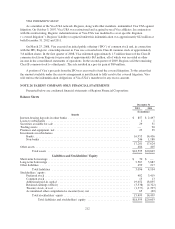

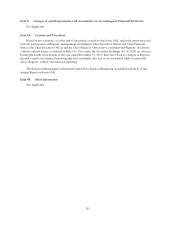

The carrying amounts and estimated fair values of the Company’s financial instruments as of December 31,

2011 are as follows:

December 31, 2011

Carrying

Amount

Estimated

Fair

Value (1)

(In millions)

Financial assets:

Cash and cash equivalents ................................................ $ 7,245 $ 7,245

Trading account assets ................................................... 1,266 1,266

Securities available for sale ............................................... 24,471 24,471

Securities held to maturity ................................................ 16 17

Loans held for sale ...................................................... 1,193 1,193

Loans (excluding leases), net of unearned income and allowance for

loan losses (2), (3) ...................................................... 73,284 65,224

Other interest-earning assets .............................................. 1,085 1,085

Derivatives, net ......................................................... 339 339

Financial liabilities:

Deposits .............................................................. 95,627 95,757

Short-term borrowings ................................................... 3,067 3,067

Long-term borrowings ................................................... 8,110 7,439

Loan commitments and letters of credit ...................................... 117 756

(1) Estimated fair values are consistent with an exit price concept. The assumptions used to estimate the fair

values are intended to approximate those that a market participant would use in a hypothetical orderly

transaction. In estimating fair value, the Company makes adjustments for interest rates, market liquidity and

credit spreads as appropriate.

(2) The estimated fair value of portfolio loans assumes sale of the loans to a third-party financial investor.

Accordingly, the value to the Company if the loans were held to maturity is not reflected in the fair value

estimate. In the current whole loan market, financial investors are generally requiring a higher rate of return

than the return inherent in loans if held to maturity. The fair value discount at December 31, 2011 was $8.1

billion or 11.0 percent.

(3) Excluded from this table is the lease carrying amount of $1.6 billion at December 31, 2011.

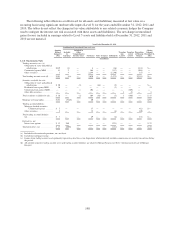

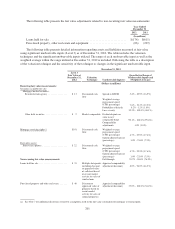

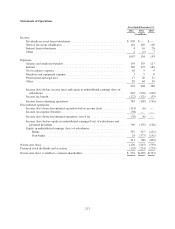

NOTE 22. BUSINESS SEGMENT INFORMATION

Each of Regions’ reportable segments is a strategic business unit that serves specific needs of Regions’

customers based on the products and services provided. The segments are based on the manner in which

management views the financial performance of the business. The Company has three reportable segments:

Business Services, Consumer Services and Wealth Management, with the remainder split between Discontinued

Operations and Other. During the third quarter of 2012, Regions reorganized its internal management structure

and, accordingly, its segment reporting structure. Historically, Regions’ primary business segment was Banking/

Treasury, representing the Company’s banking network (including the Consumer & Commercial Banking

function along with the Treasury function). Other segments included Investment Banking/Brokerage/Trust and

Insurance. During the second quarter of 2012, Regions consummated the sale of Morgan Keegan (the primary

component of Investment Banking/Brokerage/Trust). Shortly thereafter, Regions announced organizational

changes to better integrate and execute the Company’s strategic priorities across all lines of business and

geographies. As a result, Regions revised its reportable segments as described below. Prior periods’ information

has been restated to conform to the current periods’ presentation.

The Business Services segment represents the Company’s commercial banking functions including

commercial and industrial, commercial real estate and investor real estate lending. This segment also includes

equipment lease financing. Business Services customers include corporate, middle market, small business and

commercial real estate developers and investors. Corresponding deposit products related to these types of

customers are included in this segment.

205