Regions Bank 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

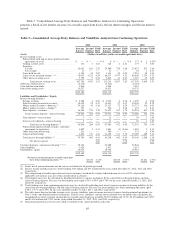

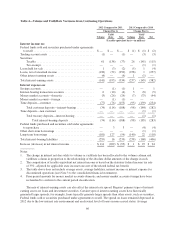

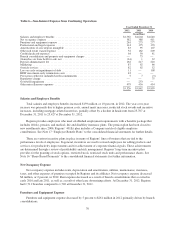

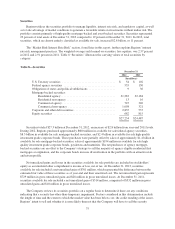

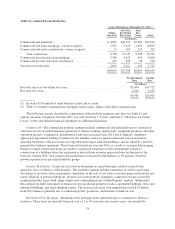

Table 5—Non-Interest Income from Continuing Operations

Year Ended December 31

2012 2011 2010

(In millions)

Service charges on deposit accounts ....................................... $ 985 $1,168 $1,174

Investment fee income .................................................. 110 64 69

Mortgage income ...................................................... 363 220 247

Trust department income ................................................ 195 199 196

Securities gains, net .................................................... 48 112 394

Insurance commissions and fees .......................................... 109 106 104

Leveraged lease termination gains ......................................... 14 8 78

Commercial credit fee income ............................................ 68 80 76

Bank-owned life insurance ............................................... 81 83 88

Net loss from affordable housing .......................................... (49) (69) (72)

Credit card / bank card income ........................................... 85 65 31

Other miscellaneous income ............................................. 91 107 104

$2,100 $2,143 $2,489

Service Charges on Deposit Accounts

Income from service charges on deposit accounts decreased 16 percent in 2012 and totaled $985 million and

$1.2 billion in 2012 and 2011, respectively. The decrease was primarily driven by policy changes negatively

impacting non-sufficient fund fees related to Regulation E, as well as a decline in interchange income as a result

of debit interchange price controls implemented in the fourth quarter of 2011. During 2012, service charges on

deposit accounts were also negatively impacted by a total of approximately $35 million in customer refunds

resulting from a change in the Company’s non-sufficient funds policy.

Interchange income, which is included in service charges on deposit accounts, was impacted by the Federal

Reserve’s rulemaking required by section 1075 of the Dodd-Frank Act. The Federal Reserve Board of Governors

announced its final rule on debit card interchange fees mandated by the Durbin Amendment to the Dodd-Frank

Act effective October 1, 2011, which contributed to the decline in service charges in 2012.

Investment Fee and Trust Department Income

Total investment fee income, which primarily relates to capital markets activities such as loan syndications,

foreign exchange and derivatives, increased 72 percent to $110 million in 2012 from $64 million in 2011, due

primarily to improved market valuations in the customer derivative portfolio. Trust department income decreased

2 percent to $195 million in 2012, driven by declines in assets under management to approximately $72.7 billion

at year-end 2012 compared to approximately $74.6 billion at year-end 2011.

Mortgage Income

Mortgage income is generated through the origination and servicing of mortgage loans for long-term

investors and sales of mortgage loans in the secondary market. Mortgage income increased $143 million or

65 percent to $363 million in 2012. The increase reflects wider margins as a result of favorable market

conditions, as well as an increase in originations driven by customers taking advantage of the opportunity to

refinance under the extended Home Affordable Refinance Program, or HARP II. Mortgage originations totaled

$8.0 billion in 2012 as compared to $6.3 billion in 2011. In 2012, refinancing encompassed 63 percent of

mortgage originations versus 54 percent in 2011.

At December 31, 2012, $26.2 billion of Regions’ servicing portfolio was serviced for third parties. At

December 31, 2011, $26.7 billion of the servicing portfolio was serviced for third parties.

68