Regions Bank 2012 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2012 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.options are contracts that allow the buyer to purchase or sell a financial instrument at a predetermined price and

time. Forward sale commitments are contractual obligations to sell market instruments at a future date for an

already agreed-upon price. Foreign currency contracts involve the exchange of one currency for another on a

specified date and at a specified rate. These contracts are executed on behalf of the Company’s customers and are

used to manage fluctuations in foreign exchange rates. The Company is subject to the credit risk that another

party will fail to perform.

Regions has made use of interest rate swaps to effectively convert a portion of its fixed-rate funding position

to a variable-rate position and, in some cases, to effectively convert a portion of its variable-rate loan portfolio to

fixed-rate. Regions also uses derivatives to manage interest rate and pricing risk associated with its mortgage

origination business. In the period of time that elapses between the origination and sale of mortgage loans,

changes in interest rates have the potential to cause a decline in the value of the loans in this held-for-sale

portfolio. Futures contracts and forward sale commitments are used to protect the value of the loan pipeline and

loans held for sale from changes in interest rates and pricing.

Regions manages the credit risk of these instruments in much the same way as it manages credit risk of the

loan portfolios by establishing credit limits for each counterparty and through collateral agreements for dealer

transactions. For non-dealer transactions, the need for collateral is evaluated on an individual transaction basis

and is primarily dependent on the financial strength of the counterparty. Credit risk is also reduced significantly

by entering into legally enforceable master netting agreements. When there is more than one transaction with a

counterparty and there is a legally enforceable master netting agreement in place, the exposure represents the net

of the gain and loss positions with and collateral received from and/or posted to that counterparty. The “Credit

Risk” section in this report contains more information on the management of credit risk.

Regions also uses derivatives to meet the needs of its customers. Interest rate swaps, interest rate options

and foreign exchange forwards are the most common derivatives sold to customers. Other derivatives

instruments with similar characteristics are used to hedge market risk and minimize volatility associated with this

portfolio. Instruments used to service customers are held in the trading account, with changes in value recorded

in the consolidated statements of operations.

The primary objective of Regions’ hedging strategies is to mitigate the impact of interest rate changes, from

an economic perspective, on net interest income and the net present value of its balance sheet. The overall

effectiveness of these hedging strategies is subject to market conditions, the quality of Regions’ execution, the

accuracy of its valuation assumptions, counterparty credit risk and changes in interest rates. See Note 20

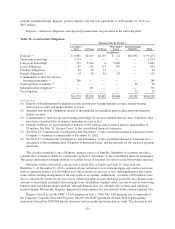

“Derivative Financial Instruments and Hedging Activities” to the consolidated financial statements for a tabular

summary of Regions’ year-end derivatives positions and further discussion.

On January 1, 2009, Regions began accounting for mortgage servicing rights at fair market value with any

changes to fair value being recorded within mortgage income. Also, in early 2009, Regions entered into

derivative and balance sheet transactions to mitigate the impact of market value fluctuations related to mortgage

servicing rights. Derivative instruments entered into in the future could be materially different from the current

risk profile of Regions’ current portfolio.

MARKET RISK—PREPAYMENT RISK

Regions, like most financial institutions, is subject to changing prepayment speeds on mortgage-related

assets under different interest rate environments. Prepayment risk is a significant risk to earnings and specifically

to net interest income. For example, mortgage loans and other financial assets may be prepaid by a debtor, so that

the debtor may refinance its obligations at lower rates. As loans and other financial assets prepay in a falling rate

environment, Regions must reinvest these funds in lower-yielding assets. Prepayments of assets carrying higher

rates reduce Regions’ interest income and overall asset yields. Conversely, in a rising rate environment, these

assets will prepay at a slower rate, resulting in opportunity cost by not having the cash flow to reinvest at higher

103