Regions Bank 2012 Annual Report Download - page 88

Download and view the complete annual report

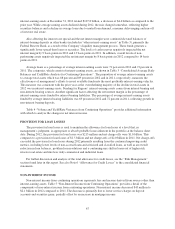

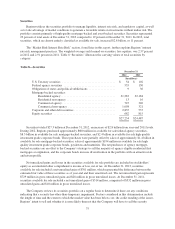

Please find page 88 of the 2012 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.agencies’ ratings, comprised of Regions Bank’s capital, asset quality, management, earnings, liquidity and

sensitivity to risk, along with certain financial ratios are used in determining deposit administrative fees. The

decrease in 2012 was related to lower asset balances, including a reduction in higher risk loans and improved

performance metrics, including asset quality metrics, all of which impact the fee calculation. For further

information, see discussion of Deposit Insurance in the Supervision and Regulation section of Item 1 of this

Form 10-K.

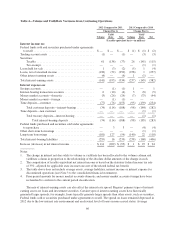

Marketing

Marketing increased $25 million in 2012 compared to 2011, primarily due to costs incurred for customer

communications in conjunction with Regions’ third quarter 2012 assumption of the servicing of the credit card

portfolio which had been purchased in the second quarter of 2011.

Outside Services

Outside services increased in 2012 by $20 million to $82 million. The increase was due primarily to

expenses incurred related to assuming the servicing of the credit card portfolio during the third quarter of 2012

that was purchased at the end of the second quarter of 2011, as well as fees related to the routine purchases of

indirect loans from a third party.

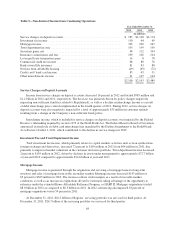

Loss on Early Extinguishment of Debt

During the fourth quarter of 2012, the Company redeemed all issued and outstanding 8.875% Trust

Preferred Securities issued by Regions Financing Trust III (“trust preferred securities”). The aggregate principal

amount of the trust preferred securities was approximately $345 million. The Company recognized an

$11 million loss on the early redemption of these securities.

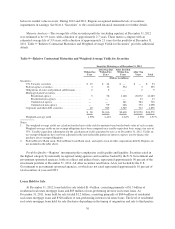

REIT Investment Early Termination Costs

On November 30, 2012, Regions entered into an agreement with a third party investor in Regions Asset

Management Company, Inc., a real estate investment trust, pursuant to which the investment was fully redeemed.

As a result, Regions incurred early termination costs of approximately $42 million.

Goodwill Impairment

As a result of the process of selling Morgan Keegan, Regions’ 2011 results include a non-cash goodwill

impairment charge of $731 million (net of $14 million income tax impact) within the investment banking/

brokerage/trust segment. Based on a relative fair value allocation, $478 million was recorded within discontinued

operations and $253 million within continuing operations. The goodwill impairment charge is a non-cash item

which does not have an adverse impact on regulatory capital. Refer to Note 9 “Intangible Assets” in the footnotes

to the consolidated financial statements for further details.

Other Miscellaneous Expenses

Other miscellaneous expenses increased $43 million in 2012 compared to 2011. The primary drivers of the

increase were mortgage repurchase expenses (see Note 7 “Servicing of Financial Assets”), amortization of

intangible assets related to the credit card portfolio purchase and bank operational losses. This item also includes

expenses for communications, postage, supplies, certain credit-related costs and business development services.

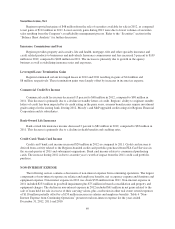

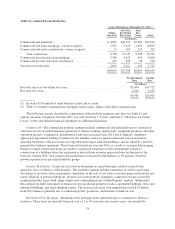

INCOME TAXES

The Company’s income tax expense from continuing operations for 2012 was $482 million compared to a

tax benefit of $28 million in 2011, resulting in an effective tax rate of 29.0 percent and (17.4) percent,

respectively. The increase in income tax expense was primarily a result of positive consolidated pre-tax earnings.

72