Regions Bank 2012 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2012 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254

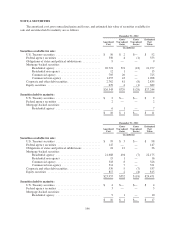

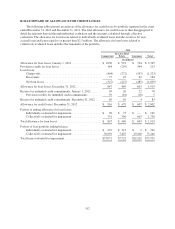

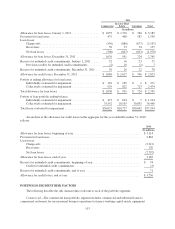

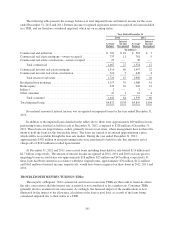

|

|

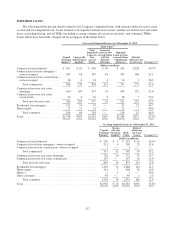

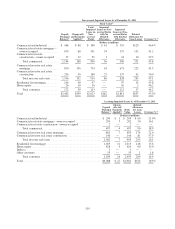

2011

Commercial

Investor Real

Estate Consumer Total

(In millions)

Allowance for loan losses, January 1, 2011 ................... $ 1,055 $ 1,370 $ 760 $ 3,185

Provision for loan losses .................................. 475 468 587 1,530

Loan losses:

Charge-offs ........................................ (550) (880) (677) (2,107)

Recoveries ........................................ 50 33 54 137

Net loan losses ..................................... (500) (847) (623) (1,970)

Allowance for loan losses, December 31, 2011 ................ 1,030 991 724 2,745

Reserve for unfunded credit commitments, January 1, 2011 ...... 32 16 23 71

Provision (credit) for unfunded credit commitments ........ (2) 10 (1) 7

Reserve for unfunded credit commitments, December 31, 2011 . . . 30 26 22 78

Allowance for credit losses, December 31, 2011 ............... $ 1,060 $ 1,017 $ 746 $ 2,823

Portion of ending allowance for loan losses:

Individually evaluated for impairment ................... $ 101 $ 169 $ 1 $ 271

Collectively evaluated for impairment ................... 929 822 723 2,474

Total allowance for loan losses ............................ $ 1,030 $ 991 $ 724 $ 2,745

Portion of loan portfolio ending balance:

Individually evaluated for impairment ................... $ 473 $ 624 $ 7 $ 1,104

Collectively evaluated for impairment ................... 35,552 10,103 30,835 76,490

Total loans evaluated for impairment ........................ $36,025 $10,727 $30,842 $77,594

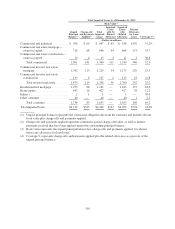

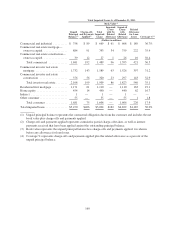

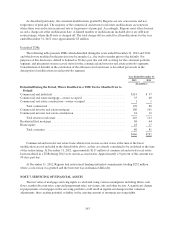

An analysis of the allowance for credit losses in the aggregate for the year ended December 31, 2010

follows:

2010

(In millions)

Allowance for loan losses, beginning of year ............................................ $3,114

Provision for loan losses ............................................................. 2,863

Loan losses:

Charge-offs ................................................................... (2,912)

Recoveries ................................................................... 120

Net loan losses ................................................................ (2,792)

Allowance for loan losses, end of year .................................................. 3,185

Reserve for unfunded credit commitments, beginning of year ............................... $ 74

Credit for unfunded credit commitments ............................................ (3)

Reserve for unfunded credit commitments, end of year .................................... 71

Allowance for credit losses, end of year ................................................ $3,256

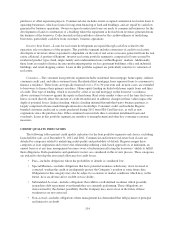

PORTFOLIO SEGMENT RISK FACTORS

The following describe the risk characteristics relevant to each of the portfolio segments.

Commercial—The commercial loan portfolio segment includes commercial and industrial loans to

commercial customers for use in normal business operations to finance working capital needs, equipment

153