Regions Bank 2012 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2012 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

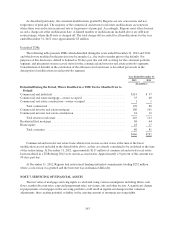

agreements are similar to deposit accounts, although they are not insured by the FDIC or guaranteed by the

United States or governmental agencies. Regions Bank does not manage the level of these investments on a daily

basis as the transactions are initiated by the customers. The level of these borrowings can fluctuate significantly

on a day-to-day basis.

Regions, through Morgan Keegan, maintained two types of liabilities for its brokerage customers that were

classified as short-term borrowings since Morgan Keegan paid its customers interest related to these liabilities.

The brokerage customer position liability represented liquid funds in the customers’ brokerage accounts. The

short-sale liability represented traditional obligations to deliver to customers securities at a predetermined date

and price. At December 31, 2012 these balances were both zero due to the April 2, 2012 sale of Morgan Keegan.

See Note 3 for additional information regarding the sale of Morgan Keegan.

Customer collateral increased to $125 million at December 31, 2012 from $55 million at December 31,

2011. These balances include cash collateral posted by customers related to derivative transactions.

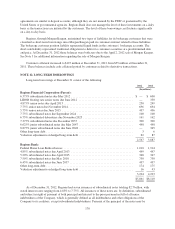

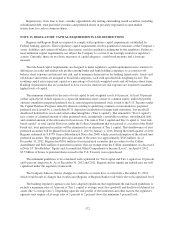

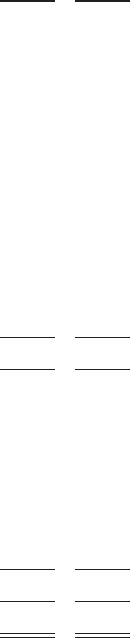

NOTE 12. LONG-TERM BORROWINGS

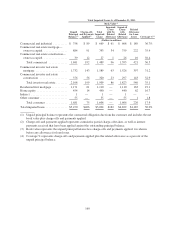

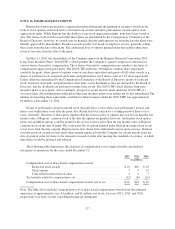

Long-term borrowings at December 31 consist of the following:

2012 2011

(In millions)

Regions Financial Corporation (Parent):

6.375% subordinated notes due May 2012 .......................................... $ — $ 600

LIBOR floating rate senior notes due June 2012 ..................................... — 350

4.875% senior notes due April 2013 ............................................... 250 249

7.75% senior notes due November 2014 ............................................ 696 694

5.75% senior notes due June 2015 ................................................ 497 496

7.75% subordinated notes due September 2024 ...................................... 100 100

6.75% subordinated debentures due November 2025 .................................. 161 162

7.375% subordinated notes due December 2037 ..................................... 300 300

6.625% junior subordinated notes due May 2047 ..................................... 498 498

8.875% junior subordinated notes due June 2048 ..................................... — 345

Other long-term debt ........................................................... 3 6

Valuation adjustments on hedged long-term debt ..................................... 62 87

2,567 3,887

Regions Bank:

Federal Home Loan Bank advances ............................................... 1,010 1,914

4.85% subordinated notes due April 2013 .......................................... 499 497

5.20% subordinated notes due April 2015 .......................................... 348 347

7.50% subordinated notes due May 2018 ........................................... 750 750

6.45% subordinated notes due June 2037 ........................................... 497 497

Other long-term debt ........................................................... 174 175

Valuation adjustments on hedged long-term debt ..................................... 16 43

3,294 4,223

$5,861 $8,110

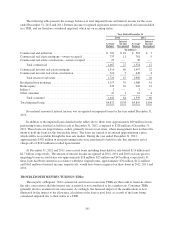

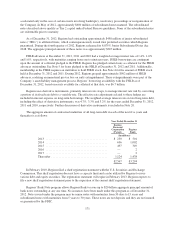

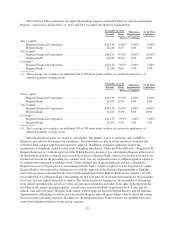

As of December 31, 2012, Regions had seven issuances of subordinated notes totaling $2.7 billion, with

stated interest rates ranging from 4.85% to 7.75%. All issuances of these notes are, by definition, subordinated

and subject in right of payment of both principal and interest to the prior payment in full of all senior

indebtedness of the Company, which is generally defined as all indebtedness and other obligations of the

Company to its creditors, except subordinated indebtedness. Payment of the principal of the notes may be

170