Regions Bank 2012 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2012 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Regions elected to exit the Federal Deposit Insurance Corporation’s (“FDIC”) Transaction Account

Guarantee (“TAG”) program on July 1, 2010. The TAG program was a component of the Temporary Liquidity

Guarantee Program, whereby the FDIC guaranteed all funds held at participating institutions beyond the

$250,000 deposit insurance limit in qualifying transaction accounts. Regions’ decision to exit the program did

not have a significant impact on liquidity. When the Dodd-Frank Act was enacted in July 2010, it permanently

increased the FDIC coverage limit to $250,000. Also as a result of the Dodd-Frank Act, effective as of

December 31, 2010, unlimited coverage for non-interest bearing demand transaction accounts was provided until

the expiration date of the program, which was January 1, 2013. In early 2013, non-interest bearing transaction

accounts have declined, but the overall impact to deposit balances and liquidity has not been significant and is

within expectations.

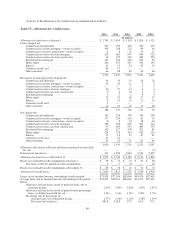

Within customer deposits, non-interest-bearing demand deposits increased $1.8 billion to $30.0 billion,

driven primarily by an increase in non-interest bearing deposits from commercial and small businesses. Non-

interest-bearing deposits accounted for approximately 31 percent of total deposits at year-end 2012 compared to

29 percent at year-end 2011. Savings balances increased $601 million to $5.8 billion, generally reflecting

continued consumer savings trends, spurred by economic uncertainty. Interest-bearing transaction accounts

increased $1.7 billion to $21.1 billion due to Regions’ focus on shifting the mix of deposits. Interest-bearing

transaction deposits accounted for approximately 22 percent of total deposits at year-end 2012 compared to 20

percent at year-end 2011.

Domestic money market products, which exclude foreign money market accounts, are one of Regions’ most

significant funding sources. These balances increased 8 percent in 2012 to $24.9 billion or 26 percent of total

deposits, compared to 24 percent of total deposits in 2011 another reflection of the shifting in the mix of deposits.

Included in customer time deposits are certificates of deposit and individual retirement accounts. The

balance of customer time deposits decreased 31 percent in 2012 to $13.4 billion compared to $19.4 billion in

2011. The decrease was primarily due to maturities with minimal reinvestment by customers as a result of the

continued decline in rates offered on these products. Customer time deposits accounted for 14 percent of total

deposits in 2012 compared to 20 percent in 2011.

Consistent with 2011, total treasury deposits, which are used mainly for overnight funding purposes,

remained at low levels in 2012 as the Company continued to utilize customer-based funding and other sources.

The Company’s choice of overnight funding sources is dependent on the Company’s particular funding needs

and the relative attractiveness of each source.

The sensitivity of Regions’ deposit rates to changes in market interest rates is reflected in Regions’ average

interest rate paid on interest-bearing deposits. The rate paid on interest-bearing deposits decreased to 0.43 percent

in 2012 from 0.69 percent in 2011, driven by the expiration of time deposits, the positive mix shift to lower cost

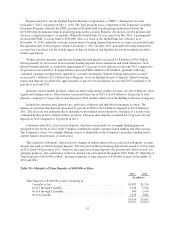

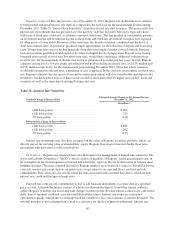

customer products, and continuation of the low interest rate environment throughout 2012. Table 25 “Maturity of

Time Deposits of $100,000 or More” presents maturities of time deposits of $100,000 or more at December 31,

2012 and 2011.

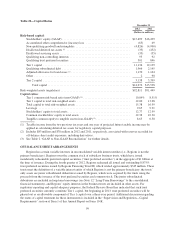

Table 25—Maturity of Time Deposits of $100,000 or More

2012 2011

(In millions)

Time deposits of $100,000 or more, maturing in:

3 months or less ................................................. $1,002 $1,216

Over 3 through 6 months .......................................... 1,168 1,504

Over 6 through 12 months ......................................... 900 1,910

Over 12 months ................................................. 1,949 3,061

$5,019 $7,691

93