Regions Bank 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012 ANNUAL REPORT TO SHAREHOLDERS

moving forward

Table of contents

-

Page 1

2012 ANNUAL REPORT TO SHAREHOLDERS moving forward -

Page 2

... - diluted Earnings (loss) per common share - diluted $ 1,050 991 0.76 0.71 $ (25) (429) (0.02) (0.34) $ (692) (763) (0.56) (0.62) BALANCE SHEET SUMMARY At year-end Loans net of unearned income Assets Deposits Long-term debt Stockholders' equity Average balances - Continuing Operations Loans net of... -

Page 3

..., and I will address those in more detail shortly, but first, let's review the achievements of the past year. Most importantly, 2012 marked a return to sustainable profitability for Regions. Your company earned $1.1 billion from continuing operations in 2012, or $0.76 per diluted share. Notably, our... -

Page 4

... ratio was 10.8%. We divested Morgan Keegan. In April 2012, we completed the sale of our brokerage and investment banking company, Morgan Keegan, to Raymond James Financial, Inc., for approximately $1.2 billion. This move gave us the ability to better focus on the fundamentals of our core business... -

Page 5

REGIONS 2012 ANNUAL REPORT These weren't our only achievements in 2012. We also received upgrades in our credit ratings, invested in new risk-management resources and made further improvements in our loan portfolio. None of these achievements could have occurred without the dedication and ... -

Page 6

moving forward By arranging a strategically important community development loan for the Karns Volunteer Fire Department in Knoxville, Tenn., Regions had a positive impact on this community and the lives of our neighbors. -

Page 7

... revenues - stood at 62.7%, which was in line with our peer group. Among the banks in our peer group, we have the second lowest expense-to-assets ratio at 2.79%. 3.36% 3.22% 3.25% 3.47% 3.51% Funding Costs - A Competitive Opportunity Another key to our performance in 2012 was our ability to improve... -

Page 8

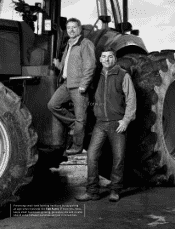

moving forward Preserving small-town farming traditions by supporting an agriculture business like T&D Farms in Inverness, Miss., keeps small businesses growing, generates jobs and creates shared value between ourselves and our communities. -

Page 9

REGIONS 2012 ANNUAL REPORT remote deposit capture product in 2013 is expected to provide increased efï¬ciency and convenience to our customers who prefer mobile banking. 2009 2010 2011 2012 30% 33% 38% 40% In the wake of the ï¬nancial crisis, we have reafï¬rmed our commitment to these values ... -

Page 10

moving forward Our relationship with Oakhurst Medical Centers is another example of how we all beneï¬t from shared value. Through a loan ï¬nanced with Regions, Oakhurst was able to expand its current facilities and provide low-income communities with additional access to quality healthcare. -

Page 11

... markets. At mid-year 2012, Regions held a 9.4% share of the weighted average deposits in our core markets, placing us a close third in market share among all banks. We hold the leading market share in Alabama, Tennessee and Mississippi, and rank fourth or better in Florida, Louisiana and Arkansas... -

Page 12

... in 2012. This service gives unbanked and underbanked customers the ability to cash checks, transfer funds, reload prepaid debit cards and expedite bill payment. More than 350,000 of our customers currently use the Now Banking service, half of whom are new to the bank. In addition, we have invested... -

Page 13

... Lusco Senior Executive Vice President Chief Risk Ofï¬cer Executive Council and Operating Committee William D. Ritter Senior Executive Vice President Head of Wealth Management Group Operating Committee John B. Owen Senior Executive Vice President Head of Business Lines Executive Council and... -

Page 14

...and Chief Executive Ofï¬cer Alabama Power Company John R. Roberts Eric C. Fast Chief Executive Ofï¬cer Crane Co. Managing Partner (Retired) Mid-South Region, Arthur Andersen LLP Lee J. Styslinger III O.B. Grayson Hall Jr. President and Chief Executive Ofï¬cer Regions Financial Corporation Chief... -

Page 15

... File Number 001-34034 REGIONS FINANCIAL CORPORATION (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) (Address of principal executive offices) 63-0589368 (I.R.S. Employer Identification No.) 1900 Fifth Avenue North... -

Page 16

... Accounting and Financial Disclosure ...Item 9A. Controls and Procedures ...Item 9B. Other Information ...PART III Item 10. Directors, Executive Officers and Corporate Governance ...Item 11. Executive Compensation ...Item 12. Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 17

...business model or products and services. Possible stresses in the financial and real estate markets, including possible deterioration in property values. Regions' ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital... -

Page 18

...and services by Regions' customers and potential customers. Regions' ability to keep pace with technological changes. Regions' ability to effectively manage credit risk, interest rate risk, market risk, operational risk, legal risk, liquidity risk, reputational risk, counterparty risk, international... -

Page 19

... company headquartered in Birmingham, Alabama, which operates in the South, Midwest and Texas. Regions provides traditional commercial, retail and mortgage banking services, as well as other financial services in the fields of asset management, wealth management, securities brokerage, insurance... -

Page 20

... operations in Alabama, Arkansas, Indiana, Georgia, Louisiana, Missouri, Mississippi, Tennessee and Texas, Regions Insurance, Inc. offers insurance coverage for various lines of personal and commercial insurance, such as property, casualty, life, health and accident insurance. Regions Insurance... -

Page 21

...the Alabama Banking Department. The Federal Reserve and the Alabama Banking Department regularly examine the operations of Regions Bank and are given authority to approve or disapprove mergers, acquisitions, consolidations, the establishment of branches and similar corporate actions. The federal and... -

Page 22

... Capital Analysis and Review. In November 2011, the Federal Reserve published a final rule which requires U.S. bank holding companies with total consolidated assets of $50 billion or more (such as Regions) to submit annual capital plans, along with related stress test requirements, to the Federal... -

Page 23

...and management information systems, among other elements. The plan must be submitted annually for review to the Federal Reserve and the FDIC. In addition, the FDIC has issued a final rule that requires insured depository institutions with $50 billion or more in total assets, such as Regions Bank, to... -

Page 24

... total consolidated assets of $50 billion or more. The rule became effective for bank holding companies on July 20, 2012, and, under the program, Regions is required to pay assessments on a semiannual basis to cover expenses associated with the Office of Financial Research, the FSOC, and the FDIC... -

Page 25

... to the Dodd-Frank Act, trust preferred securities will be phased-out of the definition of Tier 1 capital of bank holding companies having consolidated assets exceeding $500 million, such as Regions, over a three-year period beginning in January 2013. Currently the minimum guideline to be considered... -

Page 26

... of the bank's asset size, level of complexity, risk profile or scope of operations. Regions Bank is currently not required to comply with Basel II. In July 2008, the U.S. bank regulatory agencies issued a proposed rule that would provide banking organizations that do not use the advanced approaches... -

Page 27

... $250 billion in consolidated assets or on-balance sheet foreign exposures greater than $10 billion. • • • • • The capital conservation buffer is designed to absorb losses during periods of economic stress. Banking institutions with a ratio of CET1 to risk-weighted assets above the... -

Page 28

... currently available under the rules for certain highly rated banking organizations. Regions' leverage ratio at December 31, 2012 as defined under Basel I was 9.65 percent. The guidelines also provide that bank holding companies experiencing internal growth or making acquisitions will be expected... -

Page 29

...by the federal bank regulatory agencies pursuant to the Federal Deposit Insurance Act, as amended (the "FDIA"), establish general standards relating to internal controls and information systems, internal audit systems, loan documentation, credit underwriting, interest rate exposure, asset growth and... -

Page 30

...these regulations, the term "tangible equity" includes core capital elements counted as Tier 1 capital for purposes of the risk-based capital standards plus the amount of outstanding cumulative perpetual preferred stock (including related surplus), minus all intangible assets with certain exceptions... -

Page 31

.... Moreover, the Federal Reserve and the FDIC have issued policy statements stating that bank holding companies and insured banks should generally pay dividends only out of current operating earnings. Payment of Dividends by Regions Bank. Under the Federal Reserve's Regulation H, Regions Bank may not... -

Page 32

... on market terms. The Federal Reserve has indicated that it expects to request comment on a proposed rule in 2013 regarding the Dodd-Frank revisions to Sections 23A and 23B. Deposit Insurance Regions Bank accepts deposits, and those deposits have the benefit of FDIC insurance up to the applicable... -

Page 33

...3% of an institution's Tier 1 capital) of long-term, unsecured debt held that was issued by another insured depository institution, excluding debt guaranteed under the FDIC's Temporary Liquidity Guarantee Program (TLGP). The New Assessment Rule also changed the deposit insurance assessment base from... -

Page 34

... Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operation" of this Annual Report on Form 10-K. FICO Assessments. In addition, the Deposit Insurance Funds Act of 1996 authorized the Financing Corporation ("FICO") to impose assessments on DIF applicable deposits in... -

Page 35

... banks with compensation plans that encourage risky behavior should be charged higher deposit assessment rates than such banks would otherwise be charged. The comment period ended in February 2010. As of February 2013, a final rule has not been adopted. In June 2010, the Federal Reserve issued... -

Page 36

... direct banks and other financial institutions not to share information about transactions and experiences with affiliated companies for the purpose of marketing products or services. Community Reinvestment Act Regions Bank is subject to the provisions of the CRA. Under the terms of the CRA, Regions... -

Page 37

... such as savings and loan associations, credit unions, consumer finance companies, brokerage firms, insurance companies, investment companies, mutual funds, mortgage companies and financial service operations of major commercial and retail corporations. Regions expects competition to intensify among... -

Page 38

... clients include entities active in the real estate and financial services industries. Furthermore, financial services companies with a substantial lending business, like ours, are dependent upon the ability of their borrowers to make debt service payments on loans. If economic conditions worsen or... -

Page 39

... states of Alabama, Arkansas, Georgia, Florida, Louisiana, Mississippi and Tennessee. As a result, local economic conditions in the Southeastern United States can significantly affect the demand for the products offered by Regions Bank (including real estate, commercial and construction loans), the... -

Page 40

...charge-offs in future periods, which could materially adversely affect our business, financial condition or results of operations. Continued weakness in the commercial real estate markets could adversely affect our performance. Facing continuing pressure from reduced asset values, high vacancy rates... -

Page 41

... originated as amortizing loans). This type of lending, which is secured by a first or second mortgage on the borrower's residence, allows customers to borrow against the equity in their home. Real estate market values at the time of origination directly affect the amount of credit extended, and, in... -

Page 42

...," "Market Risk - Interest Rate Risk" and "Securities" sections of Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operation" of this Annual Report on Form 10-K. Obligations currently rated below investment grade as well as possible future reductions in our credit... -

Page 43

... liquid investments earned a lower return than other assets, such as loans. Regions' liquidity policy requires that we maintain a minimum cash requirement that is the greater of the next two years of corporate dividend payments and debt service and maturities less the next one year of bank dividends... -

Page 44

...routinely execute transactions with counterparties in the financial services industry, including brokers and dealers, commercial banks, investment banks, mutual and hedge funds, and other institutional clients. Furthermore, although we do not hold any European sovereign debt, we may do business with... -

Page 45

...marketing these products and services to our customers. As a result, our ability to effectively compete to retain or acquire new business may be impaired, and our business, financial condition or results of operations, may be adversely affected. Our customers may pursue alternatives to bank deposits... -

Page 46

... to our physical infrastructure or operating systems that support our businesses and customers. Information security risks for large financial institutions such as Regions have generally increased in recent years in part because of the proliferation of new technologies, the use of the Internet and... -

Page 47

...Third parties provide key components of our business operations such as data processing, recording and monitoring transactions, online banking interfaces and services, Internet connections and network access. While we have selected these third party vendors carefully, we do not control their actions... -

Page 48

... for expected credit losses. This proposal, if adopted as proposed, will likely have a negative impact, potentially material, on Regions' reported earnings and capital and could also have an impact on Regions Bank's lending to the extent that higher reserves are required at the inception of a loan... -

Page 49

... business operations and financial condition of Regions and Regions Bank (including permissible types, amounts and terms of loans and investments, the amount of reserves against deposits, restrictions on dividends, establishment of branch offices, and the maximum interest rate that may be charged... -

Page 50

... under the "Bank Regulatory Capital Requirements" section and associated Capital Ratios table of Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operation" of this Annual Report on Form 10-K. Recent legislation regarding the financial services industry may have... -

Page 51

... Capital Analysis and Review" in the "Supervision and Regulation" section of Item 1. of this Annual Report on Form 10-K, the Federal Reserve conducts an annual stress analysis of Regions to evaluate our ability to absorb losses in various economic and financial scenarios. This stress analysis uses... -

Page 52

..., among others, bank holding companies with total consolidated assets of $50 billion or more, such as Regions. Any such assessments may adversely affect our business, financial condition or results of operations. Risks Related to Our Capital Stock The market price of shares of our capital stock will... -

Page 53

...; Expectations of or actual equity dilution; Whether we declare or fail to declare dividends on our capital stock from time to time; The ratings given to our securities by credit-rating agencies; Changes in the credit, mortgage and real estate markets, including the markets for mortgage-related... -

Page 54

...ability to pay dividends on shares of our capital stock. Pursuant to rules adopted in November 2011, the Federal Reserve has required bank holding companies with $50 billion or more of total consolidated assets, such as Regions, to submit annual capital plans to the Federal Reserve for review before... -

Page 55

...the discount window of the Federal Reserve. Additionally, some of our long-term debt securities are currently rated below investment grade by certain of the credit ratings agencies. Any such ratings may affect our cost of funding and limit our access to the capital markets. We cannot assure you that... -

Page 56

... "Business" of this Annual Report on Form 10-K for a list of the states in which Regions Bank's branches are located. Item 3. Legal Proceedings Information required by this item is set forth in Note 23 "Commitments, Contingencies and Guarantees" in the Notes to the Consolidated Financial Statements... -

Page 57

... Report on Form 10-K. As of February 15, 2013, there were 67,117 holders of record of Regions' common stock (including participants in the Computershare Investment Plan for Regions Financial Corporation). Restrictions on the ability of Regions Bank to transfer funds to Regions at December 31, 2012... -

Page 58

... interest payments but the related deferral period has not yet commenced or a deferral period is continuing. On November 1, 2012, Regions completed the sale of 20 million depositary shares each representing a 1/40th ownership interest in a share of its 6.375% Non-Cumulative Perpetual Preferred Stock... -

Page 59

... 91.68 71.54 $20.36 93.61 64.39 $ 33.96 108.59 80.17 The information required by Item 6. is set forth in Table 1 "Financial Highlights" of "Management's Discussion and Analysis of Financial Condition and Results of Operations", which is included in Item 7. of this Annual Report on Form 10-K. 43 -

Page 60

... MD&A and consolidated financial statements, as well as the other sections of this Annual Report on Form 10-K. Capital Regulatory Capital-Regions and Regions Bank are required to comply with applicable capital adequacy standards established by the Federal Reserve. Currently, the minimum guidelines... -

Page 61

..." to the consolidated financial statements Note 14 "Stockholders' Equity and Accumulated Other Comprehensive Income (Loss)" to the consolidated financials Liquidity At the end of 2012, Regions Bank had over $3.5 billion in cash on deposit with the Federal Reserve, the loan-to-deposit ratio was 78... -

Page 62

...state and national levels. In spite of the slow and uneven pace of the economic recovery, Regions experienced significant improvement in credit quality in both 2011 and 2012. Regions' investor real estate loan portfolio, which includes credit to real estate developers and investors for the financing... -

Page 63

... fees from service charges on deposit accounts, mortgage servicing and secondary marketing, trust and asset management activities, insurance activities, capital markets and other customer services, which Regions provides. Results of operations are also affected by the provision for loan losses and... -

Page 64

..., commercial real estate and investor real estate lending. This segment also includes equipment lease financing. Business Services customers include corporate, middle market, small business and commercial real estate developers and investors. Corresponding deposit products related to these types of... -

Page 65

...and services such as trust activities, commercial insurance and credit related products, and investment management. Wealth Management customers include individuals and institutional clients who desire services that include investment advice, assistance in managing assets, and estate planning. Wealth... -

Page 66

... Operations ...Loans, net of unearned income ...Assets ...Deposits ...Long-term debt ...Stockholders' equity ...SELECTED RATIOS Allowance for loan losses as a percentage of loans, net of unearned income ...Tier 1 capital ...Tier 1 common risk-based ratio (non-GAAP) (1) ...Total risk-based capital... -

Page 67

... OVERVIEW Regions reported net income available to common shareholders of $991 million or $0.71 per diluted common share in 2012. Credit-related costs, primarily the loan loss provision, declined significantly in 2012 as a result of improvements in the credit environment. Average low-cost deposits... -

Page 68

...the Board of Directors utilize these non-GAAP financial measures as follows Preparation of Regions' operating budgets Monthly financial performance reporting Monthly close-out reporting of consolidated results (management only) Presentations to investors of Company performance The efficiency ratio... -

Page 69

... by the risk-weighted assets to determine the Tier 1 common equity ratio. The amounts disclosed as risk-weighted assets are calculated consistent with banking regulatory requirements. Regions currently calculates its risk-based capital ratios under guidelines adopted by the Federal Reserve based... -

Page 70

... (GAAP) to Tier 1 capital (regulatory) and to Tier 1 common equity (non-GAAP) and calculations of related ratios, and 13) a reconciliation of stockholders' equity (GAAP) to Basel III Tier 1 common equity (non-GAAP) and calculation of the related ratio based on Regions' current understanding of the... -

Page 71

... available to common shareholders (non-GAAP) ...EFFICIENCY AND FEE INCOME RATIOS Non-interest expense from continuing operations (GAAP) ...Significant Items: Merger-related charges ...Goodwill impairment ...Regulatory charge ...Mortgage servicing rights impairment ...Loss on extinguishment of debt... -

Page 72

... tax liability related to intangibles (GAAP) ...Tangible assets (non-GAAP) ...End of period shares outstanding ...Tangible common stockholders' equity to tangible assets (non-GAAP) ...Tangible common book value per share (non-GAAP) ...K L J/K J/L $ J For Year Ended December 31 2011 2010 2009 (In... -

Page 73

...-BASED RATIO Stockholders' equity (GAAP) ...Accumulated other comprehensive (income) loss ...Non-qualifying goodwill and intangibles ...Disallowed deferred tax assets (4) ...Disallowed servicing assets ...Qualifying non-controlling interests ...Qualifying trust preferred securities ...Tier 1 capital... -

Page 74

...for all accounts would result in an increase to estimated losses of approximately $85 million. For residential real estate mortgages, home equity lending and other consumer-related loans, individual products are reviewed on a group basis or in loan pools (e.g., residential real estate mortgage pools... -

Page 75

... Significant Accounting Policies" to the consolidated financial statements for further discussion of when Regions tests goodwill for impairment). As further discussed in Note 22 "Business Segment Information", Regions reorganized its management reporting structure during the third quarter of 2012 59 -

Page 76

...model and market perception of risk) between Regions and the peer set. The table below summarizes the discount rate used in the goodwill impairment test of each reporting unit for the third and fourth quarters of 2012: Business Services Consumer Services Wealth Management Discount Rate: 4th Quarter... -

Page 77

... Accounting Policies" to the consolidated financial statements for discussions of the exit price concept and the determination of fair values of financial assets and liabilities. Throughout 2009 and 2010 in the former Banking/Treasury reporting unit, the credit quality of Regions' loan portfolio... -

Page 78

...value of the related mortgage servicing rights. As a result, Regions stratifies its mortgage servicing portfolio on the basis of certain risk characteristics, including loan type and contractual note rate, and values its mortgage servicing rights using discounted cash flow modeling techniques. These... -

Page 79

... "Discontinued Operations" of the consolidated financial statements for additional information. Regions reported net income from continuing operations available to common shareholders of $1,050 million, or $0.76 per diluted common share in 2012. Regions' net loss from discontinued operations was $59... -

Page 80

... year-end level. The Company's loan pricing is also influenced by the 30-day London Interbank Offering Rate ("LIBOR"), which, on average was 24 basis points 2012. With short-term interest rates remaining low, deposit costs improved considerably from 0.49 percent in 2011 to 0.30 percent in 2012... -

Page 81

... for the years ended December 31, 2012, 2011 and 2010, respectively. (3) The computation of taxable-equivalent net interest income is based on the stautory federal income tax rate of 35%, adjusted for applicable state income taxes net of the related federal tax benefit. (4) Total deposit costs may... -

Page 82

... accounts ...Money market accounts-domestic ...Money market accounts-foreign ...Time deposits-customer ...Total customer deposits-interest-bearing ...Time deposits-non customer ...Total treasury deposits-interest-bearing ...Total interest-bearing deposits ...Federal funds purchased and securities... -

Page 83

...investor real estate and into less risky commercial and industrial loans. For further discussion and analysis of the total allowance for credit losses, see the "Risk Management" section found later in this report. See also Note 6 "Allowance for Credit Losses" to the consolidated financial statements... -

Page 84

... Year Ended December 31 2012 2011 2010 (In millions) Service charges on deposit accounts ...Investment fee income ...Mortgage income ...Trust department income ...Securities gains, net ...Insurance commissions and fees ...Leveraged lease termination gains ...Commercial credit fee income ...Bank... -

Page 85

... Company's asset/liability management process. Refer to the "Securities" section in the "Balance Sheet Analysis" for further discussion. Insurance Commissions and Fees Regions provides property and casualty, life and health, mortgage, title and other specialty insurance and credit related products... -

Page 86

... 2012 2011 2010 (In millions) Salaries and employee benefits ...Net occupancy expense ...Furniture and equipment expense ...Professional and legal expenses ...Amortization of core deposit intangible ...Other real estate owned expense ...Credit/checkcard expenses ...Branch consolidation and property... -

Page 87

... an entire year's worth of impact from the credit card portfolio purchase at the end of the second quarter of 2011. Branch Consolidation and Property and Equipment Charges Non-interest expense in 2011 included $75 million of branch consolidation charges related to lower of cost or market adjustments... -

Page 88

... increased $43 million in 2012 compared to 2011. The primary drivers of the increase were mortgage repurchase expenses (see Note 7 "Servicing of Financial Assets"), amortization of intangible assets related to the credit card portfolio purchase and bank operational losses. This item also includes... -

Page 89

... expire unutilized. • • • The Company completed the sale of Morgan Keegan and related affiliates to Raymond James on April 2, 2012. The Company has reflected the transaction as if Raymond James purchased the assets of the entities for tax purposes and in January 2013, income tax elections... -

Page 90

...in 2012, Regions completed the sale of Morgan Keegan. Also included in trading account assets are securities held in rabbi trusts related to deferred compensation plans. Trading account assets are carried at fair value with changes in fair value reflected in the consolidated statements of operations... -

Page 91

... billion from year-end 2011 levels. During 2012, Regions purchased approximately $600 million in available for sale federal agency securities, $8.3 billion in available for sale mortgage-backed securities, and $2.4 billion in available for sale high quality investment grade corporate bonds. These... -

Page 92

... 2011, Regions recognized minimal levels of securities impairments in earnings. See Note 4 "Securities" to the consolidated financial statements for further details. Maturity Analysis-The average life of the securities portfolio (excluding equities) at December 31, 2012 was estimated to be 3.9 years... -

Page 93

... investor real estate loans (commercial real estate mortgage and construction loans) and consumer loans (residential first mortgage, home equity, indirect, consumer credit card and other consumer loans). Regions manages loan growth with a focus on risk management and risk-adjusted return on capital... -

Page 94

...2011 year-end. See Note 5 "Loans" and Note 6 "Allowance for Credit Losses" to the consolidated financial statements for additional discussion. Commercial-The commercial portfolio segment includes commercial and industrial loans to commercial customers for use in normal business operations to finance... -

Page 95

... home equity loans and lines of credit. This type of lending, which is secured by a first or second mortgage on the borrower's residence, allows customers to borrow against the equity in their home. Substantially all of this portfolio was originated through Regions' branch network. During 2012, home... -

Page 96

... State represents the state in which the underlying collateral is located. HOME EQUITY The home equity portfolio totaled $11.8 billion at December 31, 2012 as compared to $13.0 billion at December 31, 2011. Substantially all of this portfolio was originated through Regions' branch network. Losses... -

Page 97

..., 2011. Losses in Florida-based credits remained at elevated levels, but the related net charge-off percentage did decrease to 3.25 percent for the year ended December 31, 2012 from 4.44 percent for the year ended December 31, 2011. Home equity losses have decreased during 2012 due to improvement in... -

Page 98

... delinquency and loss rates than home equity lines of credit with a second lien. In the current environment, second liens in areas experiencing declines in home prices since origination, such as Florida, perform similar to an unsecured portfolio. Regions is unable to track payment status on first... -

Page 99

... part of Regions' formal underwriting process. Refreshed FICO scores are obtained by the Company quarterly for all revolving accounts and home equity lines of credit and semi-annually for all other consumer loans. Regions considers FICO scores less than 620 to be indicative of higher credit risk and... -

Page 100

..., management expects that net loan charge-offs in 2013 will continue to improve compared to 2012. Economic trends such as real estate valuations, interest rates and unemployment will impact the future levels of net charge-offs and provision and may result in volatility from quarter to quarter during... -

Page 101

... for Credit Losses 2012 2011 2010 (In millions) 2009 2008 Allowance for loan losses at January 1 ...Loans charged-off: Commercial and industrial ...Commercial real estate mortgage-owner occupied ...Commercial real estate construction-owner occupied ...Commercial investor real estate mortgage... -

Page 102

...-owner occupied ...342 Commercial real estate construction-owner occupied ...8 Total commercial . . Commercial investor real estate mortgage ...Commercial investor real estate construction ...Total investor real estate ...Residential first mortgage ...Home equity ...Indirect ...Consumer credit card... -

Page 103

... 31, 2012 December 31, 2011 Allowance Allowance Loan for Loan Loan for Loan Balance Losses Balance Losses (In millions) Accruing, excluding 90 days past due and still accruing: Commercial ...Investor real estate ...Residential first mortgage ...Home equity ...Other consumer ...Non-accrual status or... -

Page 104

... assets consist of loans on non-accrual status and foreclosed properties and are summarized as follows: Table 20-Non-Performing Assets 2012 2011 2010 2009 (Dollars in millions) 2008 Non-performing loans: Commercial and industrial ...Commercial real estate mortgage-owner occupied ...Commercial real... -

Page 105

... assets are expected to improve in 2013 compared to 2012. Economic trends such as real estate valuations, interest rates and unemployment, as well as the level of disposition activity, will impact the future level of non-performing assets. Circumstances related to individually large credits... -

Page 106

...: Table 21-Analysis of Non-Accrual Loans Non-Accrual Loans, Excluding Loans Held for Sale Year Ended December 31, 2012 Investor Commercial Real Estate Consumer (1) Total (In millions) Balance at beginning of year ...Additions ...Net payments/other activity ...Return to accrual ...Charge-offs on non... -

Page 107

... and the purchased credit card intangibles. See Note 9 "Intangible Assets" to the consolidated financial statements for further information. Foreclosed Properties Other real estate and certain other assets acquired in foreclosure are reported at the lower of the investment in the loan or fair... -

Page 108

... serves customers through providing centralized, high-quality banking services and alternative product delivery channels such as internet banking. Deposits are Regions' primary source of funds, providing funding for 88 percent of average interest-earning assets from continuing operations in 2012 and... -

Page 109

Regions elected to exit the Federal Deposit Insurance Corporation's ("FDIC") Transaction Account Guarantee ("TAG") program on July 1, 2010. The TAG program was a component of the Temporary Liquidity Guarantee Program, whereby the FDIC guaranteed all funds held at participating institutions beyond ... -

Page 110

... 31, 2011, federal funds purchased, securities sold under agreements to repurchase, and other short-term borrowings were outstanding. Other short-term borrowings were related to Morgan Keegan and included borrowings under lines of credit that Morgan Keegan maintained with unaffiliated banks. As... -

Page 111

...insured by the FDIC or guaranteed by the United States or governmental agencies. Regions Bank does not manage the level of these investments on a daily basis as the transactions are initiated by the customers. The level of these borrowings can fluctuate significantly on a day-to-day basis. Long-Term... -

Page 112

... and 2011. Table 27-Credit Ratings As of December 31, 2012 Standard & Poor's Moody's Fitch DBRS Regions Financial Corporation Senior notes ...Subordinated notes ...Junior subordinated notes ...Regions Bank Short-term debt ...Long-term bank deposits ...Long-term debt ...Subordinated debt ...Outlook... -

Page 113

... stock purchases through open market transactions during 2012 or 2011. Regions' ratio of stockholders' equity to total assets was 12.77 percent at December 31, 2012 and 12.99 percent December 31, 2011. Regions' ratio of tangible common stockholders' equity (stockholders' equity less preferred stock... -

Page 114

... is expected to be phased in beginning in 2013. The Federal Reserve has announced a delay in the implementation date of the final rules; however, when implemented there will be a phase in period of up to 6 years. The Company's estimated Tier 1 common ratio as of December 31, 2012, based on Regions... -

Page 115

... to the consolidated financial statements), and Regions' equity interests in the business trusts are included in other assets. For regulatory reporting and capital adequacy purposes, the Federal Reserve Board has indicated that such trust preferred securities currently constitute Tier 1 capital, but... -

Page 116

... affordable housing projects, which are funded through a combination of debt and equity. Regions' maximum exposure to loss as of December 31, 2012 was $774 million, which included $197 million in unfunded commitments to the partnerships. Additionally, Regions has short-term construction loans or... -

Page 117

...receives reports from the Company's management quarterly. Additionally, Regions' Internal Audit Division performs ongoing, independent reviews of the risk management process which are reported to the Audit Committee of the Board of Directors. Some of the more significant processes used to manage and... -

Page 118

... to decline materially from the recent implied market-forward outlook, Regions' loan and securities portfolios would expect to be subject to higher levels of prepayment. Deposit costs, having benefited from several years of very low short-term rates, would likely experience additional reduction from... -

Page 119

... of its variable-rate loan portfolio to fixed-rate. Regions also uses derivatives to manage interest rate and pricing risk associated with its mortgage origination business. In the period of time that elapses between the origination and sale of mortgage loans, changes in interest rates have the... -

Page 120

...a stock purchase agreement to sell Morgan Keegan & Company, Inc. and related affiliates to Raymond James Financial, Inc. The transaction closed on April 2, 2012. Refer to Note 3 "Discontinued Operations," to the consolidated financial statements for further details. Regions' capital markets business... -

Page 121

... 31, 2012, commercial loans and investor real estate mortgage and construction loans with an aggregate balance of $10.6 billion were due to mature in one year or less, although Regions may renew some of these lending arrangements if the risk profile is acceptable. Additionally, securities of $38... -

Page 122

... 31, 2012, based on assets available for collateral at that date, was $19.6 billion. Regions periodically accesses funding markets through sales of securities with agreements to repurchase. Repurchase agreements are also offered through a commercial banking sweep product as a short-term investment... -

Page 123

...the trust preferred securities pursuant to the terms of such securities. Regions may, from time to time, consider opportunistically retiring outstanding issued securities, including subordinated debt, trust preferred securities and preferred shares in privately negotiated or open market transactions... -

Page 124

... and accountability for adherence to underwriting policies and accurate risk ratings lies in the lines of business. For consumer and small business portfolios, the risk management process focuses on managing customers who become delinquent in their payments and managing performance of the credit... -

Page 125

...loans to small and mid-sized commercial and large corporate customers with business operations in Regions' geographic footprint. Loans in this portfolio are generally underwritten individually and are usually secured with the assets of the company and/or the personal guarantee of the business owners... -

Page 126

... are originated through Regions' branch network. Loans of this type are generally smaller in size than commercial or investor real estate loans and are geographically dispersed throughout Regions' market areas, with some guaranteed by government agencies or private mortgage insurers. Losses on the... -

Page 127

... the risk rating process, which provides the basis for the allowance for loan losses for the commercial and investor real estate portfolio segments. In some cases, the credit support provided by the guarantor is integral to the risk rating. In concluding that the risk rating is appropriate, Regions... -

Page 128

... CFO meet quarterly with the SEC Filings Review Committee, which includes senior representatives from accounting, legal, risk management, audit, treasury, the lines of business, and administration. The SEC Filings Review Committee reviews certain reports to be filed with the SEC, including Forms 10... -

Page 129

... agency mortgage-backed securities classified as available for sale. Credit card / bank card income increased $34 million in 2011 as compared to 2010. Credit card income is derived from activity related to the Regions-branded credit card amounts purchased from FIA Card Services in the second quarter... -

Page 130

... in the second quarter of 2011. The bank regulatory agencies' ratings, comprised of Regions Bank's capital, asset quality, management, earnings, liquidity and sensitivity to risk, along with certain financial ratios are used in determining deposit administrative fees. During 2010, Regions prepaid... -

Page 131

... of Operations 2012 2011 Fourth Third Second First Fourth Third Second First Quarter Quarter Quarter Quarter Quarter (3) Quarter Quarter Quarter (In millions, except per share data) Total interest income ...$ 948 Total interest expense ...130 Net interest income ...Provision for loan losses ...Net... -

Page 132

... public accounting firm has issued an audit report on the effectiveness of the Company's internal control over financial reporting. This report appears on the following page. REGIONS FINANCIAL CORPORATION by /S/ O. B. GRAYSON HALL, JR. O. B. Grayson Hall, Jr. President and Chief Executive Officer... -

Page 133

...of December 31, 2012 and 2011, and the related consolidated statements of operations, other comprehensive income (loss), changes in stockholders' equity, and cash flows for each of the three years in the period ended December 31, 2012 of Regions Financial Corporation and our report dated February 21... -

Page 134

... with the standards of the Public Company Accounting Oversight Board (United States), Regions Financial Corporation's internal control over financial reporting as of December 31, 2012, based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring... -

Page 135

REGIONS FINANCIAL CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS December 31 2012 2011 (In millions, except share data) Assets Cash and due from banks ...Interest-bearing deposits in other banks ...Federal funds sold and securities purchased under agreements to resell ...Trading account ... -

Page 136

... FINANCIAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS Year Ended December 31 2012 2011 2010 (In millions, except per share data) Interest income on: Loans, including fees ...Securities: Taxable ...Tax-exempt ...Total securities ...Loans held for sale ...Trading account assets... -

Page 137

REGIONS FINANCIAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) Year Ended December 31 2012 2011 2010 (In millions) Net income (loss) ...Other comprehensive income (loss), net of tax:* Unrealized gains (losses) on securities available for sale: Unrealized ... -

Page 138

REGIONS FINANCIAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY Accumulated Preferred Common Additional Retained Treasury Other Stock Stock Paid-In Earnings Stock, Comprehensive Shares Amount Shares Amount Capital (Deficit) At Cost Income (Loss) Total (In ... -

Page 139

REGIONS FINANCIAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY-Continued Accumulated Preferred Common Additional Retained Treasury Other Stock Stock Paid-In Earnings Stock, Comprehensive Shares Amount Shares Amount Capital (Deficit) At Cost Income (Loss) ... -

Page 140

REGIONS FINANCIAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS Year Ended December 31 2012 2011 2010 (In millions) Operating activities: Net income (loss) ...Adjustments to reconcile net cash provided by operating activities: Provision for loan losses ...Impairment of goodwill... -

Page 141

...OF SIGNIFICANT ACCOUNTING POLICIES Regions Financial Corporation ("Regions" or "the Company") provides a full range of banking and bankrelated services to individual and corporate customers through its subsidiaries and branch offices located primarily in Alabama, Arkansas, Florida, Georgia, Illinois... -

Page 142

...as collateralized financing transactions. It is Regions' policy to take possession of securities purchased under resell agreements. TRADING ACCOUNT ASSETS Trading account assets, which are primarily held for the purpose of selling at a profit, consist of debt and marketable equity securities and are... -

Page 143

... to current fair value with the entire offset recorded in the statement of operations. Refer to Note 4 for further detail and information on loans. LOANS HELD FOR SALE At December 31, 2012 and 2011, loans held for sale included commercial loans, investor real estate loans and residential real estate... -

Page 144

... later than 120 days past due for home equity second liens or at 180 days past due for residential and home equity first liens. When a commercial or investor real estate loan is placed on non-accrual status, uncollected interest accrued in the current year is reversed and charged to interest income... -

Page 145

... the third quarter of 2011, for commercial and investor real estate accruing TDRs and non-accruing TDRs less than $2.5 million, the allowance for loan losses is based on a discounted cash flow analysis performed at the note level, where projected cash flows reflect credit losses based on statistical... -

Page 146

... for unfunded commitments, Regions uses a process consistent with that used in developing the allowance for loan losses. In the second quarter of 2012, the Company refined the methodology for estimation of the reserve for unfunded credit commitments. Before the change, the Company based the reserve... -

Page 147

... of Allowance For Credit Losses" section above for Regions' allowance for loan losses methodology as related to TDRs. Because Regions' past practice was to base the allowance for loan losses for commercial and investor real estate loans on loss content based on risk rating and product type, either... -

Page 148

... the consolidated statements of operations. Improvements that extend the useful life of the asset are capitalized to the carrying value and depreciated. See Note 8 for detail of premises and equipment. Regions enters into lease transactions for the right to use assets. These leases vary in term and... -

Page 149

... expected future cash flows, the long-term target equity ratios, and the discount rate. Regions utilizes the capital asset pricing model ("CAPM") in order to derive the base discount rate. The inputs to the CAPM include the 20-year risk-free rate, 5-year beta for a select peer set, and the market... -

Page 150

...Note 7 for further information on servicing of financial assets. FORECLOSED PROPERTY AND OTHER REAL ESTATE Other real estate and certain other assets acquired in satisfaction of indebtedness ("foreclosure") are carried in other assets at the lower of the recorded investment in the loan or fair value... -

Page 151

... are sales of securities at a specified price at a future date. Forward sale commitments subject Regions to market risk associated with changes in interest rates, as well as the credit risk that the counterparty will fail to perform. Derivative financial instruments that qualify for hedge accounting... -

Page 152

...used to mitigate economic and accounting volatility related to customer derivative transactions. Derivative contracts that were related to Morgan Keegan activities are included in discontinued operations. Regions enters into interest rate lock commitments, which are commitments to originate mortgage... -

Page 153

... valuation purposes. The risk-free rate is based on the U.S. Treasury yield curve in effect at the time of grant and the weighted-average expected life of the grant. Regions issues new common shares to settle stock options. Beginning in 2009, Regions issued restricted stock units payable solely in... -

Page 154

... loan agreements or securities contracts. Credit-related fees, including letter of credit fees, finance charges and fees related to credit cards are recognized in non-interest income when earned. Regions recognizes commission revenue and exchange and clearance fees on a trade-date basis. Other types... -

Page 155

... A portion of Regions' trading account assets and the majority of trading liabilities and securities available for sale are valued using third-party pricing services. To validate pricing related to investment securities held in the trading account assets and liabilities portfolios, pricing received... -

Page 156

... fair value. The following is a description of the valuation methodologies used for certain assets that are recorded at fair value. Foreclosed property and other real estate is carried in other assets at the lower of the recorded investment in the loan or fair value less estimated costs to sell the... -

Page 157

..., which is updated at least annually, is applied to the appraisal amount for certain commercial and investor real estate properties when the recorded investment in the loan is transferred into foreclosed property. Internally adjusted valuations are considered Level 3 measurements as management uses... -

Page 158

... or annual period beginning on or after December 15, 2011. Regions periodically accesses funding markets through sales of securities with agreements to repurchase. Repurchase agreements are also offered through a commercial banking sweep product as a short-term investment opportunity for customers... -

Page 159

... years beginning after December 15, 2011. Regions adopted this guidance beginning with the first quarter 2012 financial reporting. The amended guidance did not have a material impact upon adoption. FUTURE APPLICATION OF ACCOUNTING STANDARDS In December 2011, the FASB issued new accounting guidance... -

Page 160

.... These long-term loans are classified as investor real estate mortgage loans on the consolidated balance sheets. A summary of Regions' equity method investments and related loans and letters of credit, representing Regions' maximum exposure to loss as of December 31 is as follows: 2011 2012 (In... -

Page 161

... indemnification at the close of the transaction. See Note 23 for related disclosure. The following table represents the condensed results of operations for discontinued operations for the years ended December 31: Year Ended December 31 2012 2011 2010 (In millions, except per share data) Interest... -

Page 162

... available for sale: U.S. Treasury securities ...Federal agency securities ...Obligations of states and political subdivisions ...Mortgage-backed securities: Residential agency ...Residential non-agency ...Commercial agency ...Commercial non-agency ...Corporate and other debt securities ...Equity... -

Page 163

... sold during the second quarter of 2012 as discussed in Note 3. Equity securities in the tables above included the following amortized cost related to Federal Reserve Bank stock and Federal Home Loan Bank ("FHLB") stock. Shares in the Federal Reserve Bank and FHLB are accounted for at amortized cost... -

Page 164

..., which may be at maturity. Credit-related impairment charges were immaterial for the years ended December 31, 2012, 2011, and 2010. Cash proceeds from sale, gross realized gains and gross realized losses from continuing operations on sales of available for sale securities are shown in the table... -

Page 165

...were secured by customer assets held in custody at Morgan Keegan. There were no such sales of loans during 2011. The loan portfolio is diversified geographically, primarily within Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Missouri, North Carolina... -

Page 166

... credit risk, environmental and other hazard risks, and market risks associated with the sale or rental of completed properties. The portion of the home equity portfolio where the collateral is comprised of second liens in Florida was $2.4 billion and $2.8 billion at December 31, 2012 and 2011... -

Page 167

... home equity portfolio was segmented at a more granular level during the first quarter of 2012. Loss rates for home equity products are now developed based on lien position, status as a troubled debt restructuring ("TDR"), geography, past due status, and refreshed FICO scores for non-past due loans... -

Page 168

... for loan losses related to collectively evaluated loans includes the remainder of the portfolio. 2012 Investor Real Commercial Estate Consumer (In millions) Total Allowance for loan losses, January 1, 2012 ...$ 1,030 Provision (credit) for loan losses ...144 Loan losses: Charge-offs ...(404... -

Page 169

... SEGMENT RISK FACTORS The following describe the risk characteristics relevant to each of the portfolio segments. Commercial-The commercial loan portfolio segment includes commercial and industrial loans to commercial customers for use in normal business operations to finance working capital needs... -

Page 170

... lending includes both home equity loans and lines of credit. This type of lending, which is secured by a first or second mortgage on the borrower's residence, allows customers to borrow against the equity in their home. Real estate market values as of the time the loan or line is secured directly... -

Page 171

... by accrual status. December 31, 2012 Special Substandard Mention Accrual Non-accrual (In millions) Pass Total Commercial and industrial ...$25,225 Commercial real estate mortgage-owner-occupied ...8,976 Commercial real estate construction-owner-occupied ...278 Total commercial ...$34,479... -

Page 172

...aging analysis of days past due (DPD) for each portfolio segment and class: December 31, 2012 Accrual Loans 30-59 DPD 60-89 DPD 90+ DPD Total 30+ DPD Total Accrual Non-accrual (In millions) Total Commercial and industrial ...Commercial real estate mortgage- owner-occupied ...Commercial real estate... -

Page 173

... Charge-offs Nonwith No accrual Status Related Principal and Payments accrual Related with Related Allowance for (1) (2) Balance Applied Status Allowance Allowance Loan Losses Coverage %(4) (Dollars in millions) Commercial and industrial ...$ 467 Commercial real estate mortgage- owner-occupied... -

Page 174

... Impaired Loans Loans Related Unpaid Charge-offs Total with No with Allowance Principal and Payments Impaired Related Related for Loan Balance(1) Applied(2) Loans Allowance Allowance Losses Coverage %(4) (Dollars in millions) Commercial and industrial ...$ 766 Commercial real estate mortgage- owner... -

Page 175

... Charge-offs Nonwith No accrual Status Related Principal and Payments accrual Related with Related Allowance for Balance(1) Applied(2) Status Allowance Allowance Loan Losses Coverage %(4) (Dollars in millions) Commercial and industrial ...$ 468 Commercial real estate mortgage- owner-occupied... -

Page 176

... Impaired Loans Loans Related Unpaid Charge-offs Total with No with Allowance Principal and Payments Impaired Related Related for Loan Balance(1) Applied(2) Loans Allowance Allowance Losses Coverage %(4) (Dollars in millions) Commercial and industrial ...$ 758 Commercial real estate mortgage- owner... -

Page 177

... recognized on these loans in 2012, 2011 and 2010. TROUBLED DEBT RESTRUCTURINGS (TDRs) The majority of Regions' 2012 commercial and investor real estate TDRs are the result of renewals where the only concession is that the interest rate at renewal is not considered to be a market rate. Consumer TDRs... -

Page 178

... Year Ended December 31, 2012 Financial Impact of Modifications Considered TDRs Number Increase in of Recorded Allowance at Obligors Investment Modification (Dollars in millions) Commercial and industrial ...Commercial real estate mortgage-owner-occupied ...Commercial real estate construction-owner... -

Page 179

... on non-accrual status for the commercial and investor real estate portfolio segments. Consideration of defaults in the calculation of the allowance for loan losses is described previously in the description of modifications in each portfolio segment. Year Ended December 31 2012 2011 (In millions... -

Page 180

... and other ancillary income resulting from the servicing of mortgage loans: Year Ended December 31 2012 2011 2010 (In millions) Servicing related fees and other ancillary income ... $83 $85 $81 Loans are sold in the secondary market with standard representations and warranties regarding certain... -

Page 181

...on the consolidated statements of operations. The table below presents an analysis of Regions' repurchase liability related to mortgage loans sold with representations and warranty provisions for the years ended December 31: 2012 2011 (In millions) Beginning balance ...Additions ...Losses ...Ending... -

Page 182

... in estimating the fair value of each reporting unit. As of Fourth Quarter 2012 Business Services Consumer Services Wealth Management Discount rate used in income approach ...Public company method market multiplier(1) ...Transaction method market multiplier(2) ... 14% 1.2x 1.3x 13% 1.0x 1.3x 13... -

Page 183

... expected useful lives. A summary of Regions' other intangible assets as of December 31, 2012 and 2011 is presented as follows: 2012 2011 (In millions) Net Book Value ...Current Year Amortization ... $169 27 $190 20 These other intangible assets resulted from purchased credit card relationships... -

Page 184

... losses of credit card accounts and/or balances, increased competition or adverse changes in the economy. To the extent other identifiable intangible assets are deemed unrecoverable, impairment losses are recorded in other non-interest expense to reduce the carrying amount. Regions' 2012 annual... -

Page 185

...the sale of Morgan Keegan on April 2, 2012. CUSTOMER-RELATED BORROWINGS Repurchase agreements are also offered as commercial banking products as short-term investment opportunities for customers. At the end of each business day, customer balances are swept into the agreement account. In exchange for... -

Page 186

... are similar to deposit accounts, although they are not insured by the FDIC or guaranteed by the United States or governmental agencies. Regions Bank does not manage the level of these investments on a daily basis as the transactions are initiated by the customers. The level of these borrowings... -

Page 187

... by Regions to issue various debt and equity securities. The registration statement will expire in February 2013. Regions expects to file a new shelf registration statement prior to the expiration of the current shelf registration statement. Regions' Bank Note program allows Regions Bank to issue up... -

Page 188

... retiring outstanding issued securities, including subordinated debt, trust preferred securities and preferred shares in privately negotiated or open market transactions for cash or common shares. NOTE 13. REGULATORY CAPITAL REQUIREMENTS AND RESTRICTIONS Regions and Regions Bank are required... -

Page 189

...adjusted quarterly average assets. December 31, 2011 Minimum Amount Ratio Requirement (Dollars in millions) To Be Well Capitalized Tier 1 capital: Regions Financial Corporation ...$12,139 13.28% Regions Bank ...11,623 12.86 Total capital: Regions Financial Corporation ...$15,538 16.99% Regions Bank... -

Page 190

... sale of 3.5 million shares of its Fixed Rate Cumulative Perpetual Preferred Stock, Series A, to the U.S. Treasury as part of the Capital Purchase Program ("CPP"). Under this agreement, Regions was required to pay the U.S. Treasury on a quarterly basis a 5 percent dividend, or $175 million annually... -

Page 191

...an existing share repurchase authorization. There were no treasury stock purchases through open market transactions during 2012 or 2011. The Board of Directors declared a $0.04 annual cash dividend on its common stock for 2012, 2011 and 2010. During the fourth quarter of 2012, the Company determined... -

Page 192

... earnings (loss) per common share for the years ended December 31: 2012 2011 2010 (In millions, except per share amounts) Numerator: Income (loss) from continuing operations ...Preferred stock dividends and accretion ...Income (loss) from continuing operations available to common shareholders... -

Page 193

... employee service, generally within three years from the date of the grant. The contractual lives of options granted under these plans range from seven to ten years from the date of the grant. On May 13, 2010, the shareholders of the Company approved the Regions Financial Corporation 2010 Long-Term... -

Page 194

... on the date of the grant using a Black-Scholes option pricing model and related assumptions. The stock options vest ratably over a threeyear term. During 2009, Regions made stock option grants from prior long-term incentive plans that vest based upon a service condition and a market condition in... -

Page 195

... certain senior executive officers defined benefits in relation to their compensation. Regions also sponsors defined-benefit postretirement health care plans that cover certain retired employees. For these certain employees retiring before normal retirement age, the Company currently pays a portion... -

Page 196

... health care benefits in amounts determined at the discretion of management. Postretirement life insurance is also provided to a grandfathered group of employees and retirees. Actuarially determined pension expense is charged to current operations using the projected unit credit method. All defined... -

Page 197

...The weighted-average assumptions used to determine net periodic benefit cost for the years ended December 31 are as follows: Pension 2012 2011 2010 Other Postretirement Benefits 2012 2011 2010 Discount rate ...Expected long-term rate of return on plan assets ...Rate of annual compensation increase... -

Page 198

... documents. Other types of investments may include hedge funds, real estate funds, and private equity funds that follow several different strategies. Plan assets are highly diversified with respect to asset class, security and manager. Investment risk is controlled with plan assets rebalancing to... -

Page 199

... of Regions' defined-benefit pension plans' and other postretirement plans' financial assets as of December 31: Level 1 Level 2 2012 Level 3 Fair Value Level 1 Level 2 (In millions) 2011 Level 3 Fair Value Cash and cash equivalents(1) ...Fixed income securities: U.S. Treasury and federal agency... -

Page 200

... debt securities is applicable to corporate bonds. Mutual funds are valued based on quoted market prices of identical assets on active exchanges; these valuations are Level 1 measurements. Collective trust funds, international hedge funds, real estate funds, private equity funds and other assets... -

Page 201

... Inputs Year Ended December 31, 2011 (Level 3 measurements only) Real estate funds Private equity funds (In millions) Other assets Beginning balance, January 1, 2011 ...Actual return on plan assets: Net appreciation (depreciation) in fair value of investments ...Purchases, sales, issuances... -

Page 202

... operations for the years ended December 31: 2012 2011 (In millions) 2010 Professional and legal expenses ...Amortization of core deposit intangible ...Other real estate owned expense ...Credit/checkcard expenses ...Deposit administrative fee ...Loss on early extinguishment of debt ...Branch... -

Page 203

... operations for financial reporting purposes differs from the amount computed by applying the statutory federal income tax rate of 35 percent for the years ended December 31, as shown in the following table: 2012 2011 2010 (Dollars in millions) Tax on income (loss) from continuing operations... -

Page 204

... the Company's net deferred tax asset at December 31 are listed below: 2012 2011 (In millions) Deferred tax assets: Allowance for loan losses ...Accrued expenses ...Net operating loss carryfowards, if applicable, net of federal tax effect ...Federal tax credit carryforwards ...Employee benefits and... -

Page 205

... to disclosures in prior periods. During 2012, the Company reached an agreement with the Internal Revenue Service ("IRS") that effectively settled the IRS examinations for the tax years 2007, 2008 and 2009. The Revenue Agent's Report was issued in 2010, which included proposed adjustments that... -

Page 206

... and 2010, income tax expense (benefit) includes interest expense, interest income and penalties related to income taxes, before the impact of any applicable federal and state deductions, of zero, ($2) million and $2 million, respectively. As of December 31, 2012 and December 31, 2011, the Company... -

Page 207

... rate swaps. Regions issues long-term fixed-rate debt for various funding needs. Regions enters into receive LIBOR/pay fixed forward starting swaps to hedge risks of changes in the projected quarterly interest payments attributable to changes in the benchmark interest rate ("LIBOR") during the time... -

Page 208

... the years ended December 31, 2012 and 2011, respectively, related to the amortization of cash flow hedges of loan and debt instruments. Regions expects to reclassify out of other comprehensive income (loss) and into earnings approximately $56 million in pre-tax income due to the receipt or payment... -

Page 209

... customers. The portfolio is used to generate trading profit and to help clients manage market risk. The Company is subject to the credit risk that a counterparty will fail to perform. The Company is also subject to market risk, which is evaluated by the Company and monitored by the asset/liability... -

Page 210

... current status of the prepayment/performance risk on bought and sold credit derivatives on recently issued internal risk ratings consistent with the risk management practices of unfunded commitments. Regions' maximum potential amount of future payments under these contracts as of December 31, 2012... -

Page 211

... 2 measurements. There were no such transfers during the years ended December 31, 2012, 2011 or 2010. Trading account assets and securities available for sale may be periodically transferred to or from Level 3 valuation based on management's conclusion regarding the best method of pricing for an... -

Page 212

... 13 Commercial agency ...- 725 - Commercial non-agency ...- 1,098 - Other debt securities ...- 2,833 2 Equity securities (2) ...125 - - Total securities available for sale ...$ 177 $26,495 $ 15 Mortgage loans held for sale ...$ - Mortgage servicing rights ...$ - Derivative assets Interest rate swaps... -

Page 213

... 31, 2012 amounts as they were included with the sale of Morgan Keegan. Assets and liabilities in all levels could result in volatile and material price fluctuations. Realized and unrealized gains and losses on Level 3 assets represent only a portion of the risk to market fluctuations in Regions... -

Page 214

... (Loss) Closing Transfers Transfers Disposition Balance into out of of Morgan December 31, Purchases Sales Issuances Settlements Level 3 Level 3 Keegan 2012 (In millions) Level 3 Instruments Only Trading account assets: (c) Obligations of states and political subdivisions ...Commercial agency MBS... -

Page 215

... assets primarily represents gains/(losses) on disposition, which inherently includes commissions on security transactions during the period. (e) All amounts related to trading account assets and trading account liabilities are related to Morgan Keegan (see Note 3 for discussion of sale of Morgan... -

Page 216

... assets primarily represents gains/(losses) on disposition, which inherently includes commissions on security transactions during the period. (d) All amounts related to trading account assets and trading account liabilities are related to Morgan Keegan (see Note 3 for discussion of sale of Morgan... -

Page 217

... adjustments related to non-recurring fair value measurements: Year Ended December 31 2012 2011 (In millions) Loans held for sale ...Foreclosed property, other real estate and equipment ... $(174) (66) $(611) (229) The following table presents detailed information regarding assets and liabilities... -

Page 218

...Management establishes this discount or comparability adjustment based on recent sales of loans secured by similar property types. As liquidity in the market increases or decreases, the comparability adjustment and the resulting asset valuation are impacted. Foreclosed property and other real estate... -

Page 219

...the consolidated statements of operations. These changes in fair value are mostly offset by economic hedging activities. An immaterial portion of these amounts was attributable to changes in instrument-specific credit risk. Mortgage loans held for sale, at fair value Year Ended December 31 2012 2011... -

Page 220

... account assets ...Securities available for sale ...Securities held to maturity ...Loans held for sale ...Loans (excluding leases), net of unearned income and allowance for loan losses (2), (3) ...Other interest-earning assets ...Derivatives, net ...Financial liabilities: Deposits ...Short-term... -

Page 221

..., commercial real estate and investor real estate lending. This segment also includes equipment lease financing. Business Services customers include corporate, middle market, small business and commercial real estate developers and investors. Corresponding deposit products related to these types of... -

Page 222

... closed the sale of Morgan Keegan and related entities on April 2, 2012. Other includes the Company's Treasury function, the securities portfolio, wholesale funding activities, interest rate risk management activities and other corporate functions that are not related to a strategic business unit... -

Page 223

... financial information for each reportable segment for the years ended December 31: Business Services Consumer Services Year Ended December 31, 2012 Wealth Continuing Management Other Operations (In millions) Discontinued Operations Consolidated Net interest income ...$ 2,046 Provision for loan... -

Page 224

...extend credit-To accommodate the financial needs of its customers, Regions makes commitments under various terms to lend funds to consumers, businesses and other entities. These commitments include (among others) credit card and other revolving credit agreements, term loan commitments and short-term... -

Page 225

... below. Beginning in December 2007, Regions and certain of its affiliates have been named in class-action lawsuits filed in federal and state courts on behalf of investors who purchased shares of certain Regions Morgan Keegan Select Funds (the "Funds") and shareholders of Regions. These cases have... -

Page 226

... July 2009, the Securities and Exchange Commission ("SEC") filed a complaint in U.S. District Court for the Northern District of Georgia against Morgan Keegan alleging violations of the federal securities laws in connection with auction rate securities ("ARS") that Morgan Keegan underwrote, marketed... -

Page 227

... Regions' business, consolidated financial position, results of operations or cash flows for any particular reporting period of occurrence. GUARANTEES INDEMNIFICATION OBLIGATION As discussed in Note 3, on April 2, 2012 ("Closing Date"), Regions closed the sale of Morgan Keegan and related affiliates... -

Page 228

... COMPANY ONLY FINANCIAL STATEMENTS Presented below are condensed financial statements of Regions Financial Corporation: Balance Sheets December 31 2012 2011 (In millions) Assets Interest-bearing deposits in other banks ...Loans to subsidiaries ...Securities available for sale ...Trading assets... -

Page 229

Statements of Operations Year Ended December 31 2012 2011 2010 (In millions) Income: Dividends received from subsidiaries ...Service fees from subsidiaries ...Interest from subsidiaries ...Other ...Expenses: Salaries and employee benefits ...Interest ...Net occupancy expense ...Furniture and ... -

Page 230

... of securities available for sale ...Purchases of securities available for sale ...Proceeds from disposition of business, net of cash transferred ...Net cash from investing activities ...Financing activities: Net increase in short-term borrowings ...Proceeds from long-term borrowings ...Payments on... -

Page 231

... the Chief Financial Officer have concluded that Regions' disclosure controls and procedures (as defined in Rule 13a-15(e) under the Securities Exchange Act of 1934) are effective. During the fourth fiscal quarter of the year ended December 31, 2012, there have been no changes in Regions' internal... -

Page 232

... Group, registrant and Regions Bank. Senior Executive Vice President, General Counsel and Corporate Secretary, registrant and Regions Bank. Previously a founding partner of Maynard Cooper & Gale PC in Birmingham, Alabama. Senior Executive Vice President and Chief Risk Officer, registrant and Regions... -

Page 233

...Mississippi state president and as area executive for West Florida. Director, Regions Investment Services, Inc. Senior Executive Vice President, Chief Credit Officer and Head of Credit Operations, registrant and Regions Bank. Previously served in senior management roles in credit and risk management... -

Page 234

... Jr... 51 Senior Executive Vice President, Chief Financial Officer for Business Operations and Support, registrant and Regions Bank. Previously held senior level finance leadership positions at Bank of America. Director, Regions Insurance Group, Inc., Manager, RFC Financial Services Holding LLC and... -

Page 235

...have been adjusted to reflect the applicable exchange ratio. See Note 16 "Share Based Payments" to the consolidated financial statements included in Regions' Annual Report on Form 10-K for the year ended December 31, 2012. Does not include 133,506 shares issuable pursuant to outstanding rights under... -

Page 236

... financial statements of Regions and its subsidiaries are included in Item 8. of this Form 10-K: Reports of Independent Registered Public Accounting Firm; ...Consolidated Balance Sheets-December 31, 2012 and 2011; ...Consolidated Statements of Operations-Years ended December 31, 2012, 2011 and 2010... -

Page 237

...10-Q Quarterly Report filed by registrant on August 4, 2010. Form of stock option grant agreement under Regions Financial Corporation 2010 Long Term Incentive Plan, incorporated by reference to Exhibit 10.5 to Form 10-K Annual Report filed by registrant on February 24, 2011. Form of 2009-2010 Annual... -

Page 238

... Plan and Regions Financial Corporation 2006 Long Term Incentive Plan, incorporated by reference to Exhibit 10.5 to Form 10-Q Quarterly Report filed by registrant on May 11, 2009. Form of performance-based restricted stock agreement and award notice applicable to the nonemployee members of the Board... -

Page 239

... Exhibit Number Description of Exhibits 10.31* Form of TARP restricted stock award agreement under the Regions Financial Corporation 2006 Long Term Incentive Plan with John C. Carson, incorporated by reference to Exhibit 10.20 to Form 10-K Annual Report filed by registrant on February 24, 2011... -

Page 240

... on March 1, 2007. Amendment Number 2 to AmSouth Bancorporation Deferred Compensation Plan, incorporated by reference to Exhibit 10.36 to Form 10-K Annual Report filed by registrant on February 25, 2009. Form of Change-in-Control Agreement for executive officers O. B. Grayson Hall, Jr., David... -

Page 241

... Grayson Hall, Jr. Regions Financial Corporation Use of Corporate Aircraft Policy. Regions Financial Corporation Amended and Restated Management Incentive Plan, incorporated by reference to Exhibit 10.1 to Form 8-K Current report filed by registrant on May 25, 2012. Form of Morgan Keegan & Company... -

Page 242

... plan or agreement. Copies of exhibits not included herein may be obtained free of charge, electronically through Regions' website at www.regions.com or through the SEC's website at www.sec.gov or upon request to: Investor Relations Regions Financial Corporation 1900 Fifth Avenue North Birmingham... -

Page 243

... authorized. REGIONS FINANCIAL CORPORATION By: /S/ O. B. GRAYSON HALL, JR. O. B. Grayson Hall, Jr. President and Chief Executive Officer Date: February 21, 2013 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf... -

Page 244

... III Director February 21, 2013 * Fournier J. Gale, III, by signing his name hereto, does sign this document on behalf of each of the persons indicated above pursuant to powers of attorney executed by such persons and filed with the Securities and Exchange Commission. By: /S/ FOURNIER J. GALE... -

Page 245