Regions Bank 2010 Annual Report Download - page 96

Download and view the complete annual report

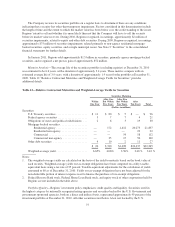

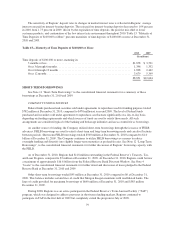

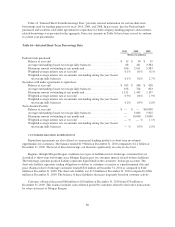

Please find page 96 of the 2010 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As of December 31, 2010, Regions had senior debt and bank notes totaling $3.8 billion, compared to $5.3

billion at December 31, 2009. In June 2010 and December 2010, approximately $250 million and $2 billion of

senior notes, respectively, matured. During 2010, Regions issued $250 million (par value) of 4.875 percent senior

notes due April 2013 and $500 million (par value) of 5.75 percent senior notes due June 2015.

At December 31, 2010 and 2009, Regions had $843 million of junior subordinated notes (“JSNs”) bearing

interest rates ranging from 6.625 percent to 8.875 percent. JSNs were issued to affiliated trusts, which

contemporaneously issued trust preferred securities which Regions guaranteed.

Other long-term debt was $383 million at December 31, 2010 and $454 million at December 31, 2009, and

had weighted-average interest rates of 2.6% and 2.9%, respectively, and a weighted-average maturity of 5.1 years

and 5.3 years, respectively. As of December 31, 2010, Regions has $55 million included in other long-term debt

in connection with a seller-lessee transaction with continuing involvement compared to $59 million as of

December 31, 2009. Approximately $200 million related to term repurchase agreements is also included in other

long-term debt at both December 31, 2010 and 2009. These arrangements are considered typical of the banking

industry and are accounted for as borrowings.

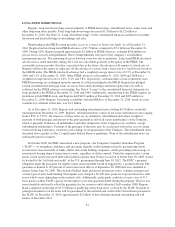

In February 2010, Regions filed a shelf registration statement with the U.S. Securities and Exchange

Commission. This shelf registration does not have a capacity limit and can be utilized by Regions to issue

various debt and/or equity securities. The registration statement will expire in February 2013.

Regions’ Bank Note program allows Regions Bank to issue up to $20 billion aggregate principal amount of

bank notes outstanding at any one time. No issuances have been made under this program as of December 31,

2010. Notes issued under the program may be senior notes with maturities from 30 days to 15 years and

subordinated notes with maturities from 5 years to 30 years. These notes are not deposits and they are not insured

or guaranteed by the FDIC.

Regions’ borrowing availability with the Federal Reserve Bank Discount Window as of December 31, 2010,

based on assets available for collateral at that date, was $16.6 billion.

Regions may, from time to time, consider opportunistically retiring its outstanding issued securities,

including subordinated debt, trust preferred securities and preferred shares in privately negotiated or open market

transactions for cash or common shares.

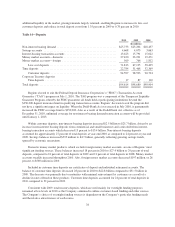

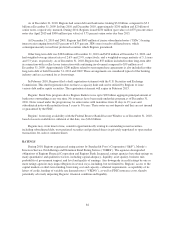

RATINGS

During 2010, Regions experienced rating actions by Standard & Poor’s Corporation (“S&P”), Moody’s

Investors Service, Fitch Ratings and Dominion Bond Rating Service (“DBRS”). The agencies downgraded

obligations of Regions Financial Corporation and Regions Bank. In general, ratings agencies base their ratings on

many quantitative and qualitative factors, including capital adequacy, liquidity, asset quality, business mix,

probability of government support,and level and quality of earnings. Any downgrade in credit ratings by one or

more ratings agencies may impact Regions in several ways, including, but not limited to, Regions’ access to the

capital markets or short-term funding, borrowing cost and capacity, collateral requirements, acceptability of its

letters of credit, funding of variable rate demand notes (“VRDNs”), as well as FDIC insurance costs, thereby

potentially adversely impacting Regions’ financial condition and liquidity.

82