Regions Bank 2010 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2010 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

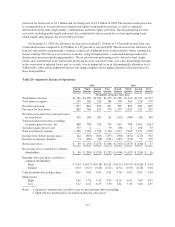

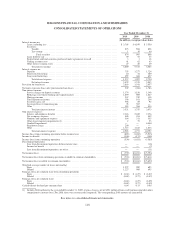

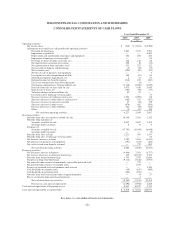

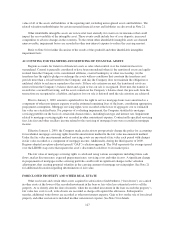

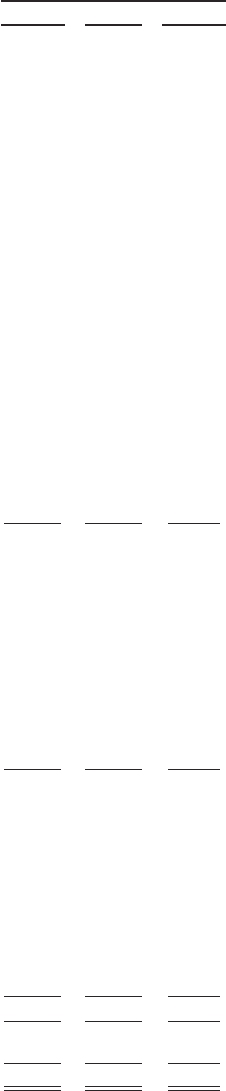

REGIONS FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

Year Ended December 31

2010 2009 2008

(In millions)

Operating activities:

Net income (loss) ................................................................. $ (539) $ (1,031) $ (5,596)

Adjustments to reconcile net cash provided by operating activities:

Provision for loan losses ....................................................... 2,863 3,541 2,057

Impairment of goodwill ........................................................ — — 6,000

Depreciation and amortization of premises and equipment ............................. 284 284 286

Impairment of mortgage servicing rights .......................................... — — 85

Provision for losses on other real estate, net ........................................ 168 142 88

Net amortization (accretion) of securities .......................................... 220 10 (15)

Net amortization of loans and other assets ......................................... 233 252 122

Net accretion of deposits and borrowings .......................................... (5) (19) (15)

Net securities gains ........................................................... (394) (69) (92)

Net loss on sale of premises and equipment ........................................ — — 3

Loss (gain) on early extinguishment of debt ........................................ 108 (61) 66

Other-than-temporary impairments, net ........................................... 2 75 23

Deferred income tax (benefit) expense ............................................ (210) 245 (407)

Excess tax benefits from share-based payments ..................................... — (4) —

Originations and purchases of loans held for sale .................................... (5,148) (7,409) (3,079)

Proceeds from sales of loans held for sale .......................................... 5,875 7,650 3,849

Gain on sale of loans, net ....................................................... (107) (96) (57)

Valuation charges on loans held for sale ........................................... 45 25 —

Loss from sale of mortgage servicing rights ........................................ — — 15

Decrease (increase) in trading account assets ....................................... 1,923 (1,989) 88

(Increase) decrease in other interest-earning assets ................................... (485) 163 (392)

Decrease (increase) in interest receivable .......................................... 47 (10) 158

(Increase) decrease in other assets ................................................ (876) 462 (584)

Increase (decrease) in other liabilities ............................................. 224 (90) (764)

Other ...................................................................... (1) (52) 168

Net cash from operating activities ............................................ 4,227 2,019 2,007

Investing activities:

Proceeds from sales of securities available for sale ....................................... 10,340 5,451 2,142

Proceeds from maturities of:

Securities available for sale ..................................................... 8,012 5,405 3,181

Securities held to maturity ...................................................... 6 17 9

Purchases of:

Securities available for sale ..................................................... (17,701) (15,646) (6,848)

Securities held to maturity ...................................................... — — (5)

Proceeds from sales of loans ........................................................ 2,233 645 1,247

Proceeds from sales of mortgage servicing rights ........................................ — — 44

Net decrease (increase) in loans ..................................................... 1,385 2,443 (6,433)

Net purchases of premises and equipment .............................................. (191) (234) (464)

Net cash received from deposits assumed .............................................. — 279 894

Net cash from investing activities ................................................ 4,084 (1,640) (6,233)

Financing activities:

Net (decrease) increase in deposits ................................................... (4,066) 7,501 (4,757)

Net increase (decrease) in short-term borrowings ........................................ 269 (12,154) 4,702

Proceeds from long-term borrowings ................................................. 3,743 2,792 11,606

Payments on long-term borrowings ................................................... (9,116) (3,246) (3,955)

Net proceeds from issuance of mandatorily convertible preferred stock ...................... — 278 —

Net proceeds from issuance of common stock .......................................... — 1,769 —

Issuance of preferred stock and common stock warrant ................................... — — 3,500

Cash dividends on common stock .................................................... (49) (105) (669)

Cash dividends on preferred stock .................................................... (184) (194) —

Proceeds from stock transactions under compensation plans ............................... — 14 27

Excess tax benefits from share-based payments ......................................... — 4 —

Net cash from financing activities ................................................ (9,403) (3,341) 10,454

Decrease in cash and cash equivalents ............................................ (1,092) (2,962) 6,228

Cash and cash equivalents at beginning of year ............................................. 8,011 10,973 4,745

Cash and cash equivalents at end of period ................................................. $ 6,919 $ 8,011 $10,973

See notes to consolidated financial statements.

121