Regions Bank 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A fair value measure should reflect the assumptions that market participants would use in pricing the asset

or liability, including the assumptions about the risk inherent in a particular valuation technique, the effect of a

restriction on the sale or use of an asset and the risk of nonperformance. Fair value is measured based on a

variety of inputs the Company utilizes. Fair value may be based on quoted market prices for identical assets or

liabilities traded in active markets (Level 1 valuations). If market prices are not available, quoted prices for

identical or similar instruments in markets that are not active and model-based valuation techniques for which all

significant assumptions are observable in the market are used (Level 2 valuations). Where observable market

data is not available, the valuation is generated from model-based techniques that use significant assumptions not

observable in the market, but observable based on Company-specific data (Level 3 valuations). These

unobservable assumptions reflect the Company’s own estimates for assumptions that market participants would

use in pricing the asset or liability. Valuation techniques typically include option pricing models, discounted cash

flow models and similar techniques, but may also include the use of market prices of assets or liabilities that are

not directly comparable to the subject asset or liability.

See Note 21 “Fair Value Measurements” to the consolidated financial statements for a detailed discussion of

determining fair value.

Intangible Assets

Regions’ intangible assets consist primarily of the excess of cost over the fair value of net assets of acquired

businesses (“goodwill”) and other identifiable intangible assets (primarily core deposit intangibles). Goodwill

totaled $5.6 billion at both December 31, 2010 and 2009 and is allocated to each of Regions’ reportable segments

(each a reporting unit), at which level goodwill is tested for impairment on an annual basis or more often if

events and circumstances indicate impairment may exist (refer to Note 1 “Significant Accounting Policies” to the

consolidated financial statements for further discussion of when Regions tests goodwill for impairment). Adverse

changes in the economic environment, declining operations of the reporting unit, or other factors could result in a

decline in the estimated implied fair value of goodwill. If the estimated implied fair value is less than the

carrying amount, a loss would be recognized to reduce the carrying amount to the estimated implied fair value.

A test of goodwill for impairment consists of two steps. In Step One, the fair value of the reporting unit is

compared to its carrying amount. To the extent that the fair value of the reporting unit exceeds the carrying value,

impairment is not indicated and no further testing is required. Conversely, if the fair value of the reporting unit is

below its carrying amount, Step Two must be performed. Step Two consists of determining the implied fair value

of goodwill, which is the net difference between the after-tax valuation adjustments of assets and liabilities and

the valuation adjustment to equity (from Step One) of the reporting unit.

The fair value of the reporting unit is determined using two approaches and several key assumptions.

Regions utilizes the capital asset pricing model (CAPM) in order to derive the base discount rate. The inputs to

the CAPM include the 20-year risk-free rate, 5-year beta for a select peer set, and the market risk premium based

on published data. Once the output of the CAPM is determined, a size premium is added (also based on a

published source) as well as a company-specific risk premium, which is an estimate determined by the Company

and meant to compensate for the risk inherent in the future cash flow projections and inherent differences (such

as business model and market perception of risk) between Regions and the peer set. The table below summarizes

the discount rate used in the goodwill impairment tests of the Banking/Treasury reporting unit for the reporting

periods indicated:

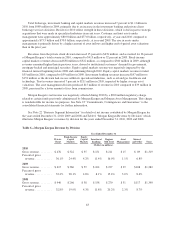

4th Quarter

2010

3rd Quarter

2010

2nd Quarter

2010

1st Quarter

2010

4th Quarter

2009

Discount Rate ............................ 15% 16% 16% 16% 18%

The decrease in discount rate from the fourth quarter 2009 test to the first quarter 2010 test was driven

primarily by a reduction in the company-specific risk premium, which was lowered as a result of updated

forecasts that reduced uncertainty from the projected cash flows.

54