Regions Bank 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Interest rate risk at Morgan Keegan arises from the exposure of holding interest-sensitive financial

instruments such as government, corporate and municipal bonds, and certain preferred equities. Morgan Keegan

manages its exposure to interest rate risk by setting and monitoring limits and, where feasible, entering into

offsetting positions in securities with similar interest rate risk characteristics. Securities inventories recorded in

trading account assets on the consolidated balance sheets, are marked to market, and, accordingly, there are no

unrecorded gains or losses in value. While a significant portion of the securities inventories have contractual

maturities in excess of five years, these inventories, on average, turn over in excess of twelve times per year.

Accordingly, the exposure to interest rate risk inherent in Morgan Keegan’s securities inventories is less than that

of similar financial instruments held by firms in other industries. Morgan Keegan’s equity securities inventories

are exposed to risk of loss in the event of unfavorable price movements. Also, Morgan Keegan is subject to credit

risk arising from non-performance by trading counterparties, customers and issuers of debt securities owned.

This risk is managed by imposing and monitoring position limits, monitoring trading counterparties, reviewing

security concentrations, holding and marking to market collateral, and conducting business through clearing

organizations that guarantee performance. Morgan Keegan regularly participates in the trading of some

derivative securities for its customers; however, this activity does not involve Morgan Keegan acquiring a

significant position or commitment in these products and this trading is not a significant portion of Morgan

Keegan’s business.

Morgan Keegan has been an underwriter and dealer in auction rate securities. See Note 23 “Commitments,

Contingencies and Guarantees” to the consolidated financial statements for more details regarding regulatory

action related to Morgan Keegan auction rate securities. As of December 31, 2010, customers of Morgan Keegan

owned approximately $54 million of auction rate securities, and Morgan Keegan held approximately $161

million of auction rate securities on the balance sheet.

To manage trading risks arising from interest rate and equity price risks, Regions uses a Value at Risk

(“VAR”) model along with other risk management methods to measure the potential fair value the Company

could lose on its trading positions given a specified statistical confidence level and time-to-liquidate time

horizon. The end-of-period VAR was approximately $805 thousand at December 31, 2010 and $1 million at

December 31, 2009. Maximum daily VAR utilization during 2010 was $2 million and average daily VAR during

the same period was $3 million.

LIQUIDITY RISK

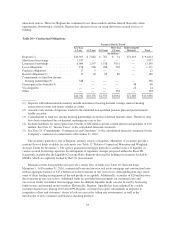

Liquidity is an important factor in the financial condition of Regions and affects Regions’ ability to meet the

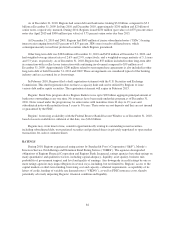

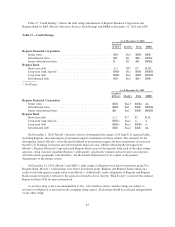

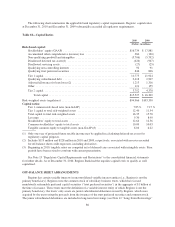

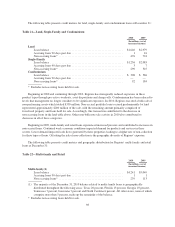

borrowing needs and deposit withdrawal requirements of its customers. Table 20 “Contractual Obligations”

summarizes Regions’ contractual cash obligations at December 31, 2010. Regions intends to fund obligations

primarily through cash generated from normal operations. In addition to these obligations, Regions has

obligations related to potential litigation contingencies (see Note 23 “Commitments, Contingencies and

Guarantees” to the consolidated financial statements for additional discussion of the Company’s funding

requirements).

Assets, consisting principally of loans and securities, are funded by customer deposits, purchased funds,

borrowed funds and stockholders’ equity. Regions’ goal in liquidity management is to satisfy the cash flow

requirements of depositors and borrowers, while at the same time meeting its cash flow needs. The challenges of

the current market environment demonstrate the importance of having and using diversified sources of liquidity

to satisfy the Company’s funding requirements.

In order to ensure an appropriate level of liquidity is maintained, Regions performs specific procedures

including scenario analyses and stress testing at the bank, holding company and affiliate levels. Regions’ policy

is to maintain a sufficient level of funding to meet projected cash needs, including all debt service, dividends, and

maturities, for the subsequent two years at the parent company and acceptable periods for the bank and other

affiliates. The Company’s funding and contingency planning does not currently include any reliance on

92