Regions Bank 2010 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2010 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

determine the adequacy of the allowance or the availability of new information could cause the allowance for

credit losses to be adjusted in future periods.

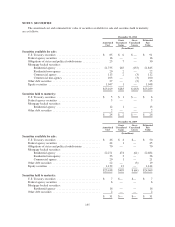

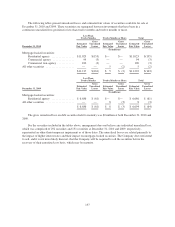

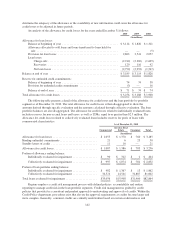

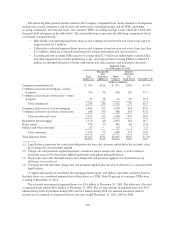

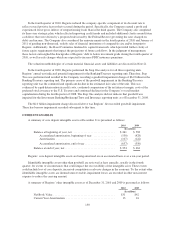

An analysis of the allowance for credit losses for the years ended December 31 follows:

2010 2009 2008

(In millions)

Allowance for loan losses:

Balance at beginning of year ....................................... $3,114 $ 1,826 $ 1,321

Allowance allocated to sold loans and loans transferred to loans held for

sale ......................................................... — — (5)

Provision for loan losses .......................................... 2,863 3,541 2,057

Loan losses:

Charge-offs ................................................. (2,912) (2,369) (1,639)

Recoveries ................................................. 120 116 92

Net loan losses .............................................. (2,792) (2,253) (1,547)

Balance at end of year ................................................ $3,185 $ 3,114 $ 1,826

Reserve for unfunded credit commitments:

Balance at beginning of year ....................................... 74 74 58

Provision for unfunded credit commitments ........................... (3) — 16

Balance at end of year ............................................ $ 71 $ 74 $ 74

Total allowance for credit losses ........................................ $3,256 $ 3,188 $ 1,900

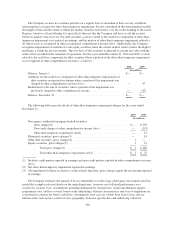

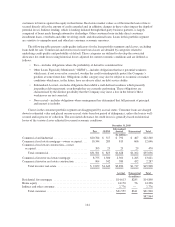

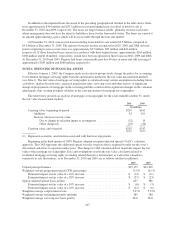

The following table presents a detail of the allowance for credit losses and the loan portfolio by portfolio

segment as of December 31, 2010. The total allowance for credit losses is then disaggregated to show the

amounts derived through specific evaluation and the amounts calculated through collective evaluation. The loan

portfolio balances are also disaggregated. The allowance for credit losses related to individually evaluated loans

includes reserves for non-accrual loans and leases, as well as TDRs, equal to or greater than $2.5 million. The

allowance for credit losses related to collectively evaluated loans includes reserves for pools of loans with

common risk characteristics.

As of December 31, 2010

Commercial

Investor Real

Estate Consumer Total

(In millions)

Allowance for loan losses ............................... $ 1,055 $ 1,370 $ 760 $ 3,185

Binding unfunded commitments .......................... 21 6 23 50

Standby letters of credit ................................ 11 10 — 21

Allowance for credit losses .............................. $ 1,087 $ 1,386 $ 783 $ 3,256

Portion of allowance ending balance:

Individually evaluated for impairment ................. $ 90 $ 312 $ 2 $ 404

Collectively evaluated for impairment ................. $ 997 $ 1,074 $ 781 $ 2,852

Portion of loan portfolio ending balance:

Individually evaluated for impairment ................. $ 482 $ 1,367 $ 13 $ 1,862

Collectively evaluated for impairment ................. 34,574 14,541 31,887 81,002

Total loans evaluated for impairment ...................... $35,056 $15,908 $31,900 $82,864

Regions employs a credit risk management process with defined policies, accountability and routine

reporting to manage credit risk in the loan portfolio segments. Credit risk management is guided by credit

policies that provide for a consistent and prudent approach to underwriting and approvals of credits. Within the

Credit Policy department, procedures exist that elevate the approval requirements as credits become larger and

more complex. Generally, consumer credits are centrally underwritten based on custom credit matrices and

142